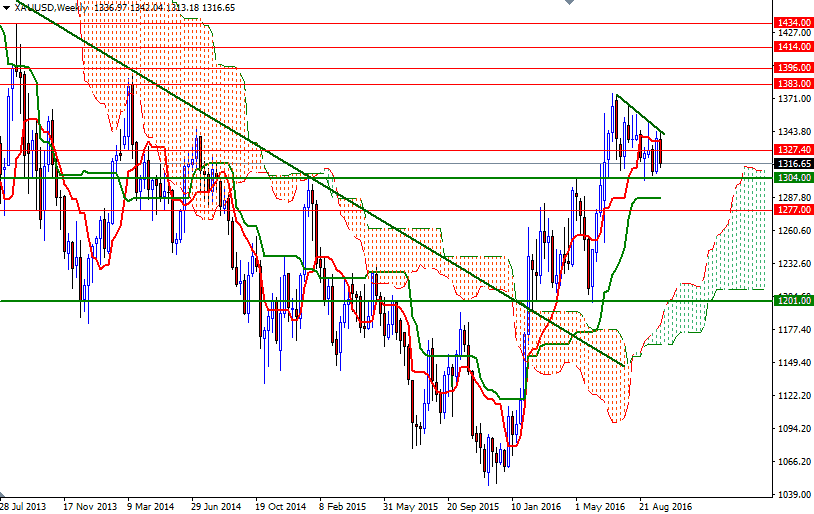

Gold prices settled at $1316.55 an ounce on Friday, suffering a loss of 1.52% on the week but scoring a gain of 0.54% over the month. At the beginning of September the XAU/USD pair tried to breakout through the $1555/3 zone on the back of softer-than-expected U.S. data but buying dried up after prices reached this area which had been troublesome for the bulls in mid-August. Consequently, the market returned to the $1306.30-1304 support. The U.S. Federal Reserve decided to wait but signaled it could tighten policy in the months ahead. Fed chief Yellen said "Our decision does not reflect a lack of confidence in the economy... We’re generally pleased with how the economy is doing... The economy has a little more room to run than might have previously been thought."

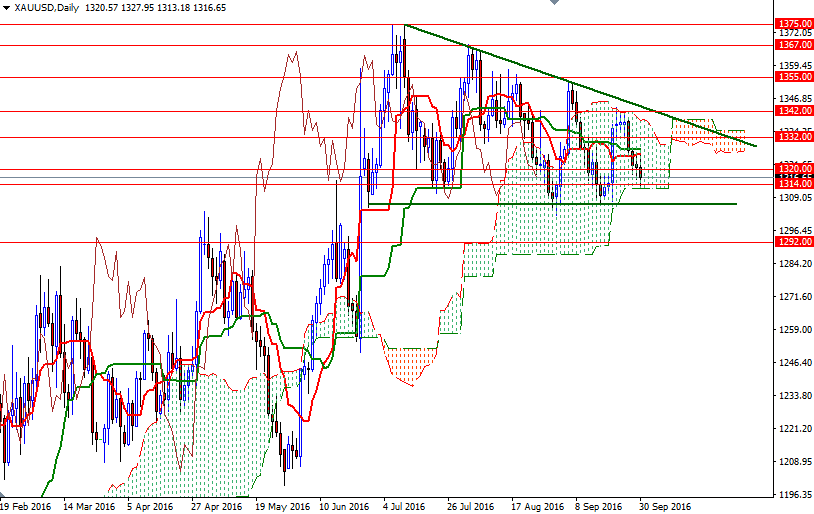

Meanwhile, the European Central Bank cut its growth and inflation forecasts but, like the Bank of Japan, didn't increase its stimulus program. The ongoing strength in the global equity markets is also another thing to pay attention, as it eases need for disaster insurance. For the last couple of months, on several occasions, I repeated that the market was going to spend some time consolidating. It is quite likely we will continue to chop around within the triangle (shown on the daily chart) but it seems that we are coming closer to the point where the market will witness a break out.

Despite the positive long-term outlook, we have negatively aligned Tenkan-Sen (nine-period moving average, red line) and Kijun-Sen (twenty six-period moving average, green line) lines on the daily and 4-hourly charts. Therefore, I can't eliminate the possibility of a bearish price action in the short term. With these in mind, I think XAU/USD will need to convincingly break either above 1342 or below 1300 in order to gain momentum. Falling through 1300 would put us back on track with such a scenario eying subsequent targets at 1292, 1287.40 and 1277. If the support at around 1277 is broken, the market will aim for 1272/69 afterwards. On the other hand, if the bulls take the reins and push prices beyond the Ichimoku cloud on the 4-hourly and daily time frames, they may have a chance to tackle the key resistance at 1355. Anchoring somewhere beyond this strategic barrier could signal a run up to 1367.