The difference between success and failure in Forex trading is very likely to depend upon which currency pairs you choose to trade each week, and not on the exact trading methods you might use to determine trade entries and exits. Each week I to analyze fundamentals, sentiment and technical positions in order to determine which currency pairs are most likely to produce the easiest and most profitable trading opportunities over the next week. In some cases it will be trading the trend. In other cases it will be trading support and resistance levels during more ranging markets.

Big Picture 30th October 2016

Last week I predicted that the best trades for this week were likely to be short EUR/USD and long USD/CAD. The EUR/USD trade made a small loss of -0.91% while the USD/CAD trade made a profit of 0.43%, producing a small averaged loss of -0.24%.

The market seems harder to forecast this week, as the bullish USD trend began to break down at the end of the week.

I suggest that the best trade this week is likely to be long USD/CAD as the USD still has long-term strength and is holding up best against the CAD.

Fundamental Analysis & Market Sentiment

Fundamental analysis is of some use right now. Slightly better-than-expected U.S. economic data has been boosting the greenback over recent weeks, as well as the continuing strong lead of Hillary Clinton in the Presidential election opinion polls. There is also an expectation of a rate hike in December and at least one further rate hike during 2017. There is no other major global currency whose central bank is expected to raise rates any time soon.

Sentiment is probably going to be of more use, at least concerning the USD, as we move into the final week of the U.S. election campaign. The news that the F.B.I. was re-opening its investigation into Hillary Clinton caused the Dollar to fall against a basket of currencies. Any news pointing in opposite direction or showing her poll lead holding up strongly can be expected to boost the Greenback. There is a release due this week of FOMC minutes but this can be expected to be low key.

Technical Analysis

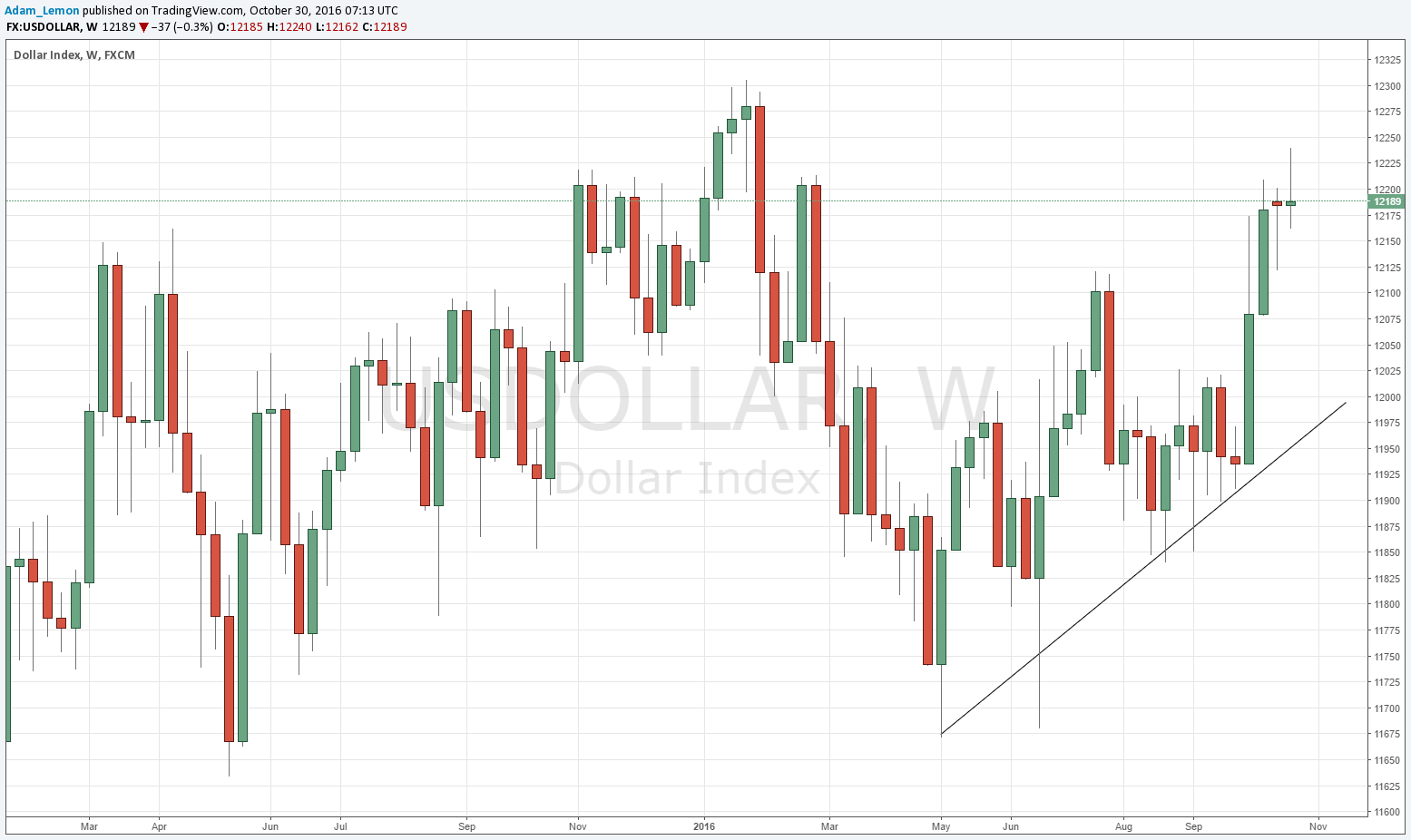

USDX

The U.S. Dollar has established a bullish trend, being above its historical prices from both 13 and 26 weeks ago. I wrote last week that the index might run into some resistance at 12200 and this seems to be what happened as we printed a somewhat bearish semi-pin candle. The price might fall from here but both the long and short-term trends are up.

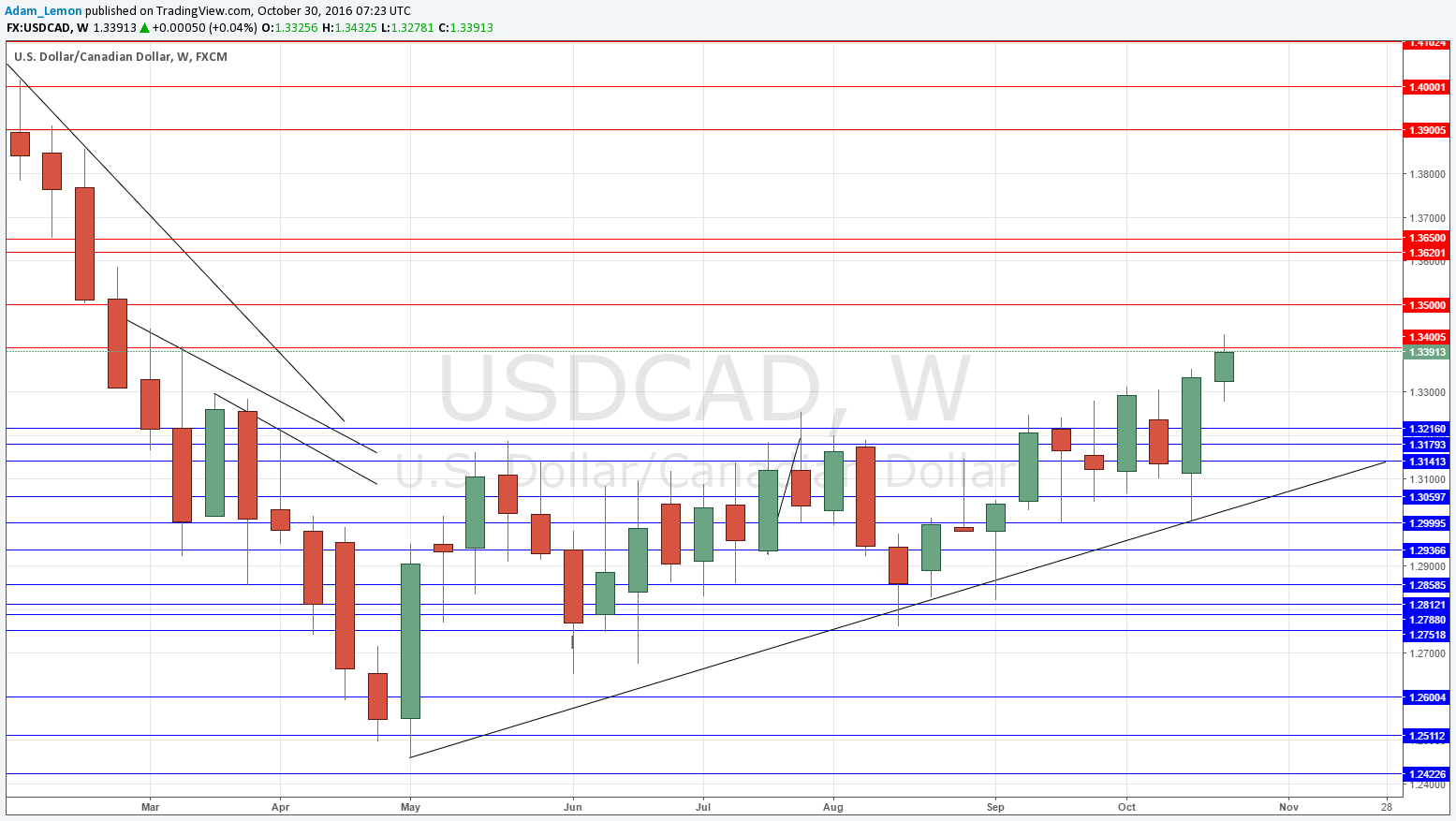

USD/CAD

The price has been coiling bullishly for many weeks now, but finally two weeks ago we got a high close above the long-term range, formed by a very bullish outside candle that closed near its high price. There has now been another small although certainly bullish candle, although the price ended the week still held by resistance at 1.3400. Overall, it looks like the most clearly bullish currency pair.

Conclusion

Bullish on the USD, bearish on the Canadian Dollar.