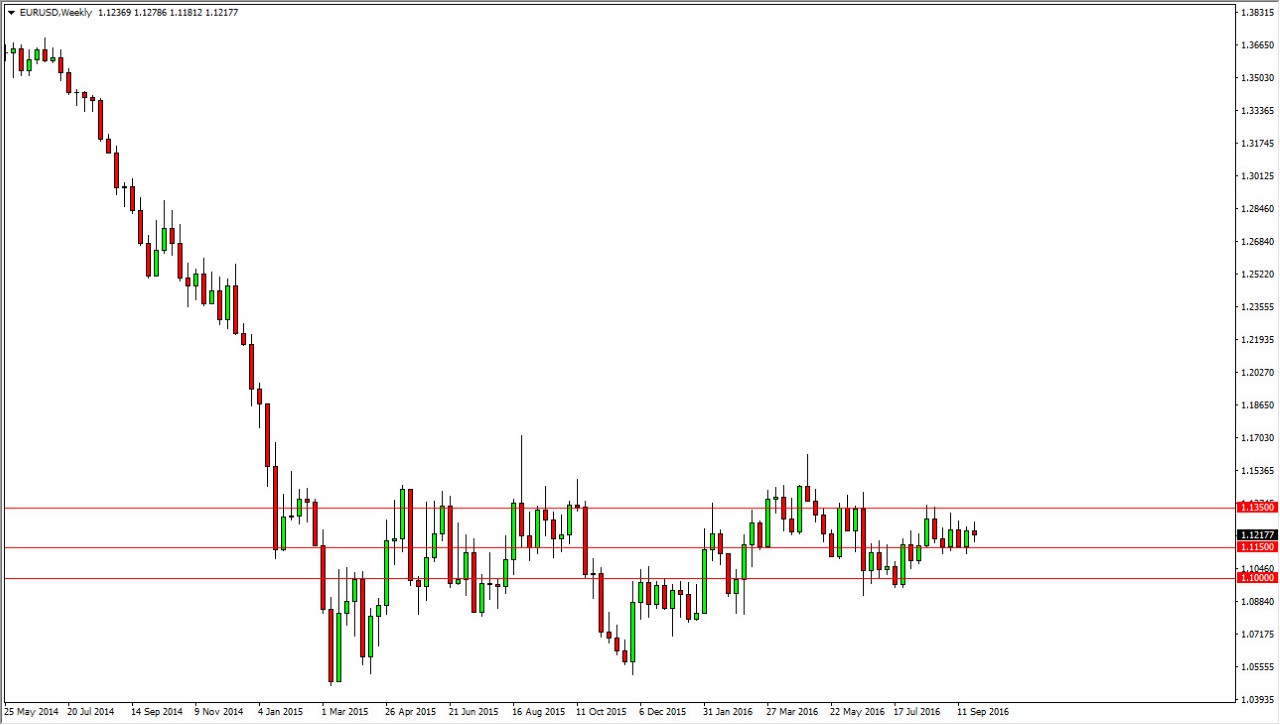

Over the last couple of weeks, the EUR/USD pair has done almost nothing. I think that will probably continue to be the way going forward, and the only thing that I would say about this pair for the month of October is the need to pay attention to the 3 lines I have drawn on this chart. The 1.10 level at the very bottom I believe is essentially the “floor” in this market. If we were to somehow break down below that level, that would indeed be very negative and show a real pickup in bearish momentum. However, I believe that we will not break down below there.

I also have the 1.1150 level marked on the chart, and that has essentially been a bit of a magnet for price. If you look at the last several months, you can see that we have spent most of our time bouncing around that level. I think that will probably continue to be the case, because quite frankly there’s nothing to move this pair. We know that the European Central Bank is nowhere near raising interest rates, and it is assumed that the Federal Reserve has perhaps one interest-rate hike ahead of it this year. In other words, I think we’re going to see a bit of a “status quo” when it comes to the Forex markets and therefore I feel that this area will be one that the markets are very comfortable dealing with.

The 1.1350 level above is essentially what I consider to be the “ceiling” of this market. Because of this, I find it very difficult to imagine that this market will break above there, so therefore anything above that level would indeed be significant. I don’t think that’s going to happen though, I think this is going to be a very slow month for this pair, as although volumes have picked up, we just don’t have anywhere to go with the moment.