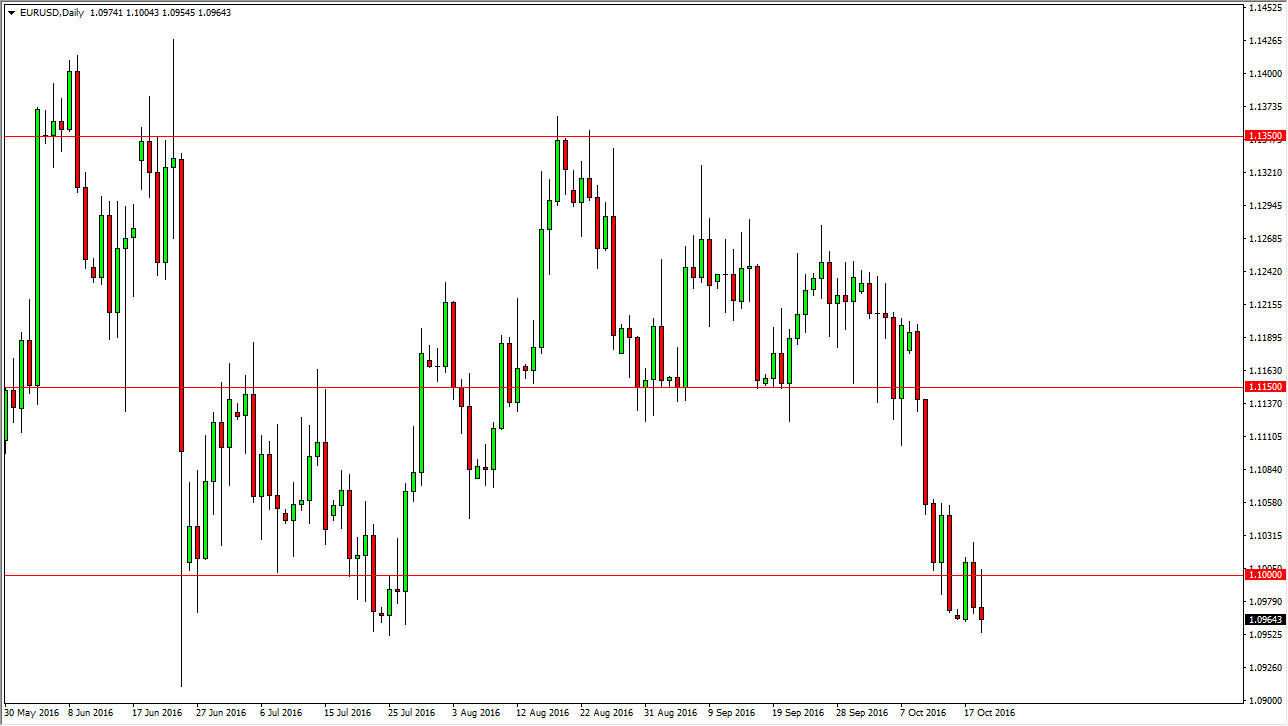

EUR/USD

The Euro initially rallied against the US dollar during the day on Wednesday again, but just as we had happened on Tuesday, the sellers came back into the marketplace and pushed lower. At the end of the day, we had formed a shooting star and it is sitting on pretty significant support. With this being the case, I believe that a break down below the bottom of the shooting star probably sends this market looking to the 1.09 level below, and then eventually even lower than that. I have no interest in buying this market, is clearly showing that there is a lot of downward pressure at this point in time and I believe that short-term rallies offer value in the US dollar that you can take advantage of by shorting this pair.

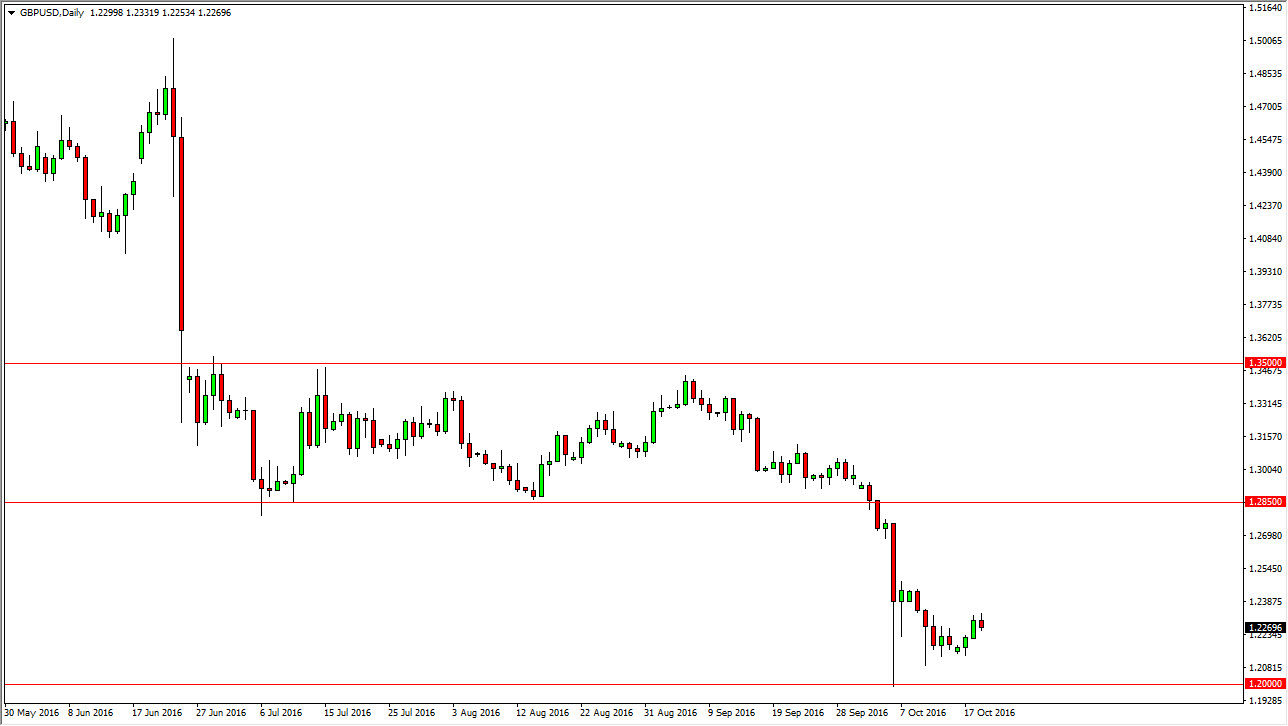

GBP/USD

The British pound had a fairly back-and-forth type of session on Wednesday, but at the end of the day really didn’t do much. I believe that this market still has plenty of downward pressure upon it, but at this level, we may be a bit oversold in the market may need to grind for a moment. If that’s the case, it’s likely that there will be a lot of back-and-forth type of action. I still believe in the downtrend, it’s just that you are probably going to have to sell short-term rallies and show signs of exhaustion for very short-term moves if you are involved at all. I believe that the 1.2850 level above is essentially the “ceiling” in this market, and as long as we stay below there I don’t see any real opportunities to go long. I do think that eventually we break down below the 1.20 level, and when we do that should send this market into even lower levels as it will be a very significant support level being broken.