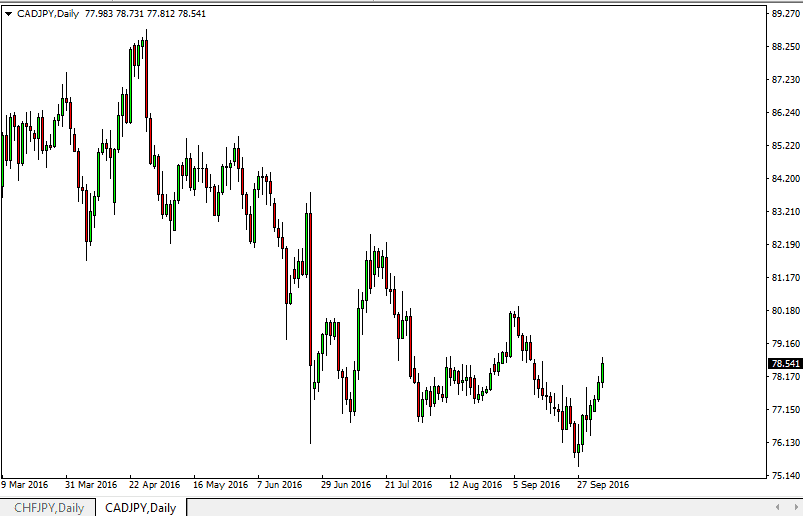

Today’s CAD/JPY signal

Risk 0.33%

Trade can be taken anytime.

Trade 1 – long

Buy CAD/JPY above 78.75

Stop loss at 77.90

Take full profit at 80

Trade 2 – short

Sell CAD/JPY below 77.75

Set stop loss at 78.80

Collect half profits at 77, move stop loss to breakeven

CAD/JPY Analysis

The CAD/JPY Paris highly correlated to the petroleum markets. Because of this, I tend to follow this market quite a bit and also recognize that you need to pay attention to both the WTI Crude Oil market, and is currency pair. With this being the case, I believe that oil will be what you need to pay attention to figure out which direction the market will eventually move. The pair tends to fall with oil prices as Canada is a major exporter of crude oil, while Japan imports 100% of its petroleum. If the crude oil market rises and this pair does as well, the long position can be taken. On the other hand, if the oil markets fall and this pair does as well, selling is likely the way to go.