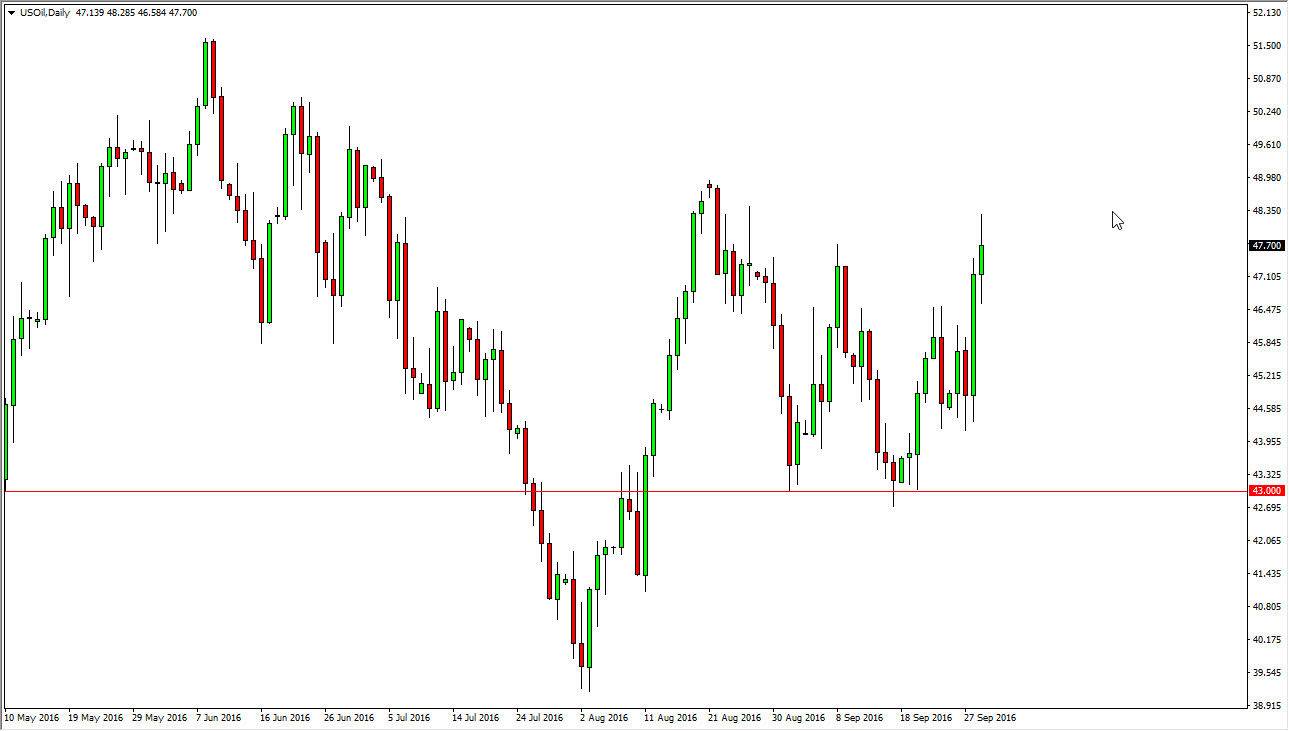

WTI Crude Oil

The WTI Crude Oil market went back and forth during the course of the session on Thursday, ultimately settling on a slightly positive candle. However, the one thing that I notice is that we are starting to run out of steam here a little bit, so with that being the case it’s probably a situation where we will see the market turning back around fairly soon, reaching down towards the $45 level. I do think that it’s possible that we continue to break out to the upside but there is a lot of noise above, and quite frankly I’m not comfortable going long until we get above the $50 handle, something that I don’t think we’re going to do right away. With this, I’m waiting to see an exhaustive candle or break down below the Thursday session in order to start selling again.

Natural Gas

Natural gas markets fell during the day on Thursday, as we continue to bounce between the $2.90 level, and the $3 level above. Ultimately, I do think that the buyers will continue to come into this market and push higher and higher. Once we break above the $3.00 level for any real length of time, I think at that point in time you continue to go higher at that point in time. With this being the case, the market should still see quite a bit of support below, and as a result I feel it is only a matter time before we get the bounce that’s needed. If we broke down below the $2.850 level, I feel that the market will continue to go much lower. I do think overall though, there seems to be quite a bit of bullish pressure as natural gas producers have pulled away from the fields due to low pricing.