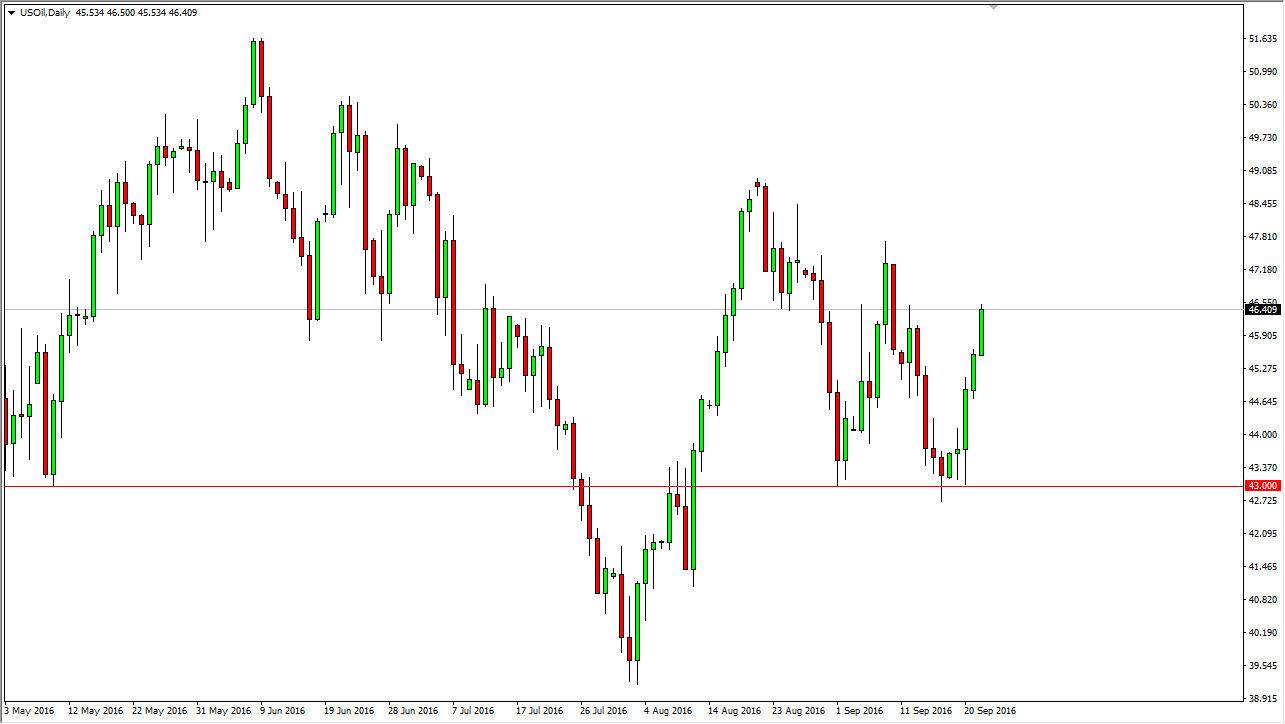

WTI Crude Oil

The WTI Crude Oil market broke higher during the course of the session on Thursday, as we continue to see bullish pressure enter this market. With this being the case, I think that we are getting a little bit “long in the tooth” when it comes to the move higher. With this, I think that it’s only a matter of time before the sellers get involved though, so having said that I think that it’s only matter of time before we get an exhaustive candle that we can take advantage of. With this, the market could very well fall the way down to the $43 level. I believe that there are massive amounts of resistance all the way to at least to the $49 level. I believe that sooner or later we will get the candle that I can search selling and therefore I will as the highs continue to get lower and lower.

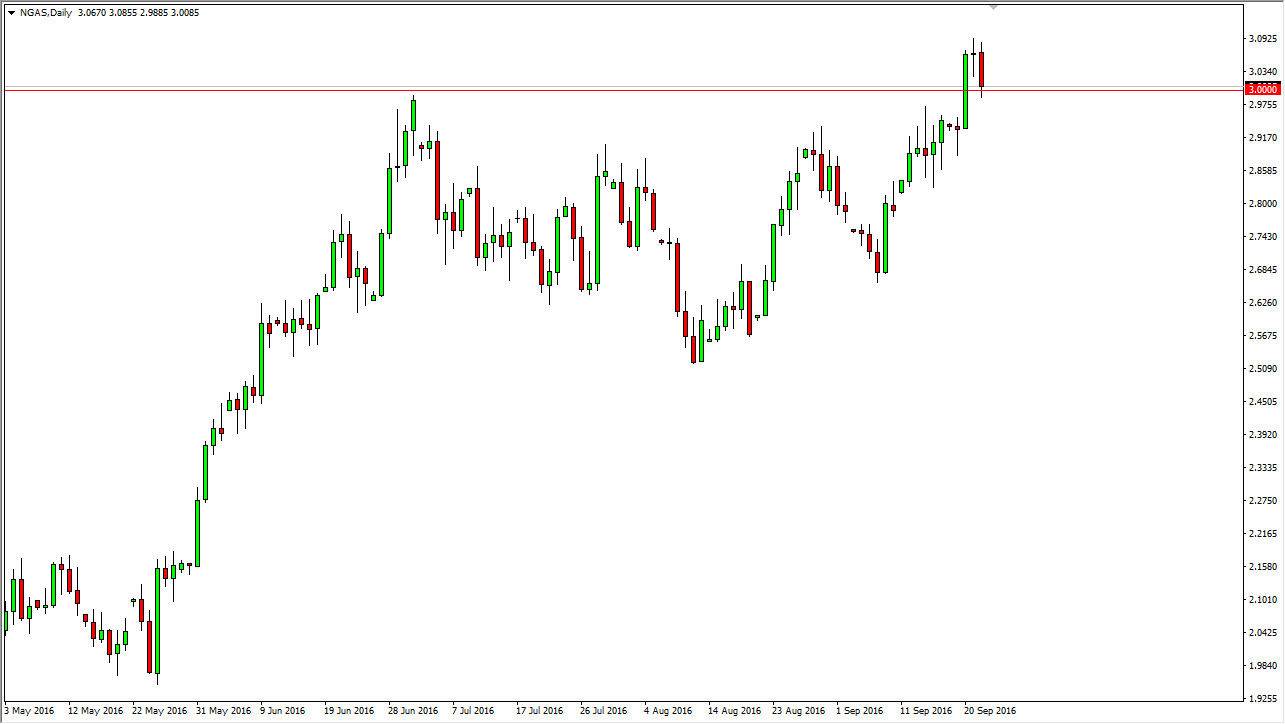

Natural Gas

The natural gas markets fell during the course of the session on Thursday, testing the $3 level. This is an area that obviously has a large psychological importance, and on top of that was an area that had previously been resistive. The fact that we are broken above there tells me that we continue to go higher over the longer term. With this being the case, I believe the fact that we bounced off of that area shows that the buyers are very willing to get involved in this market so I expect this market to go higher from here. You may have to go to shorter-term charts in order to start buying, but ultimately it looks like you will get your opportunity, at least for the time being, and as a result I remain bullish. I believe that there is plenty of support all the way down to at least the $2.90 level below.