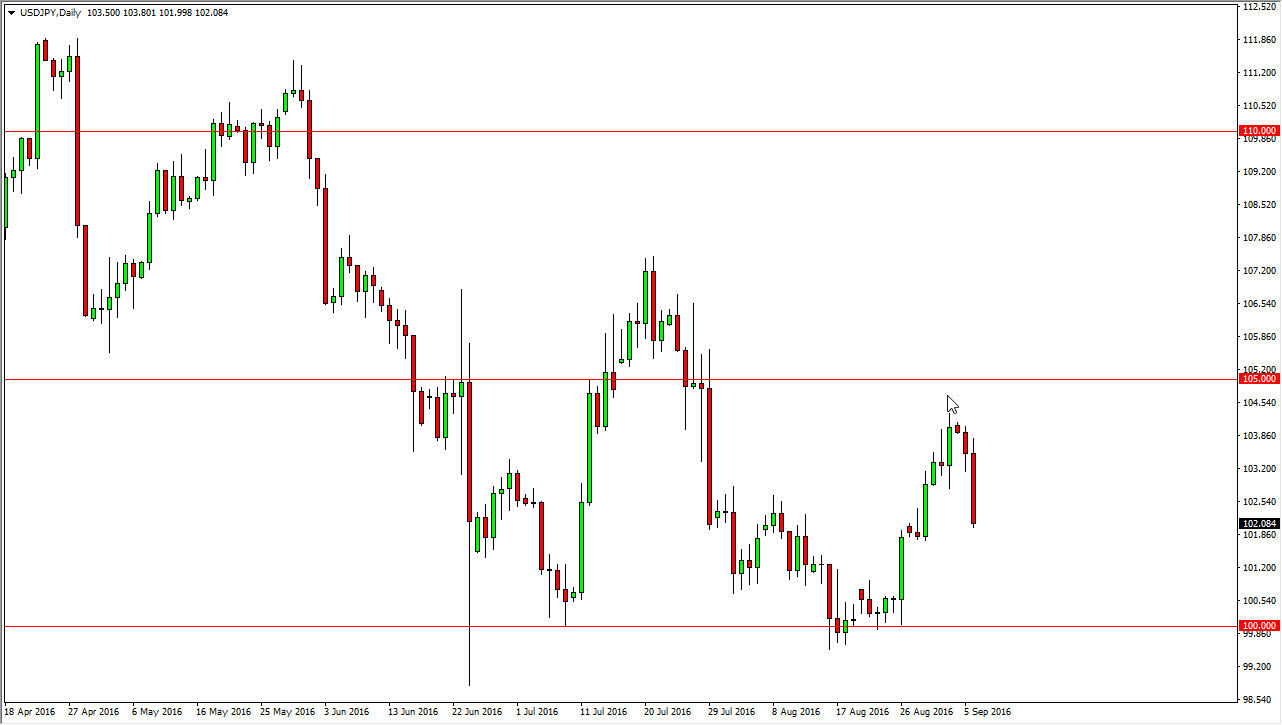

USD/JPY

The US dollar initially tried to rally against the Japanese yen during the day on Tuesday, but then turned right back around to crash into the 102 level. This of course is a very bearish candle, and at this point in time it’s very likely that there will continue to be some selling pressure. However, I believe that the Bank of Japan will get involved one way or another, and as a result I’m waiting to see whether or not we get a supportive candle in order to start buying. Short-term traders could be tempted to sell still, and I would not be surprise at all to see that happen. However, I believe that given enough time the buyers step back in as 100 will more than likely continue to be the “line in the sand” so to speak when it comes to the Bank of Japan.

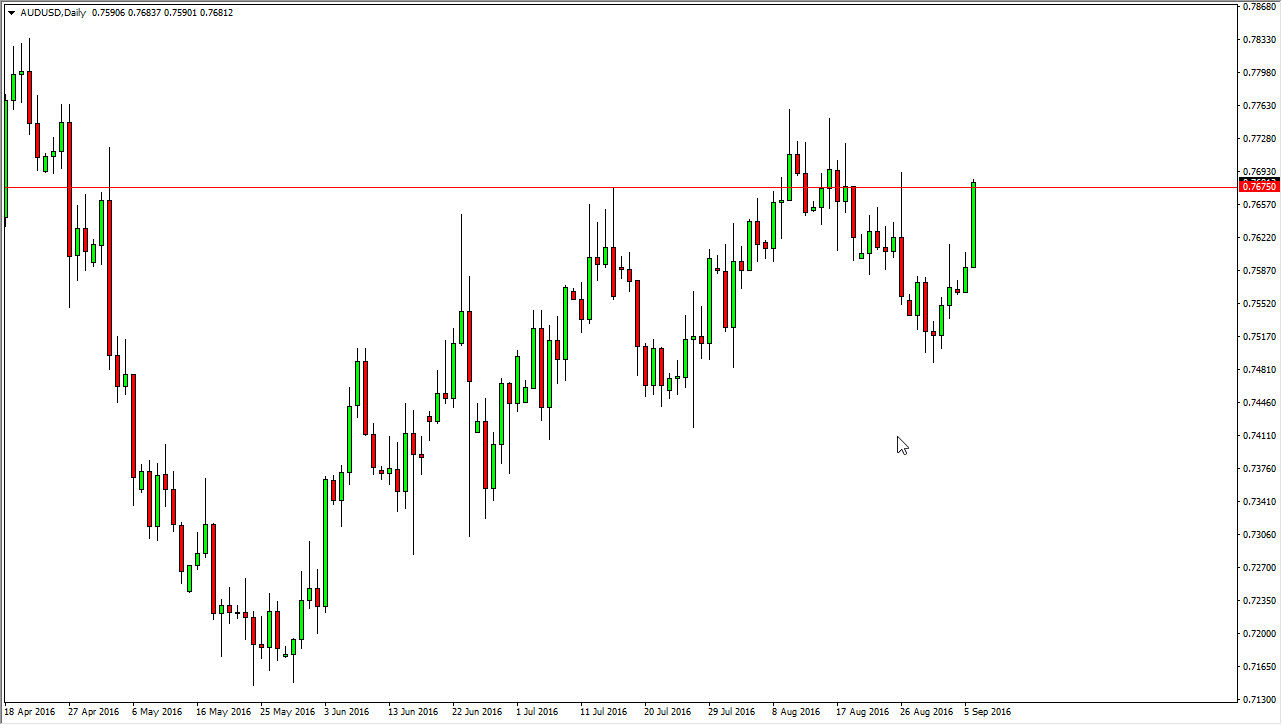

AUD/USD

The Australian dollar rose quite rapidly during the session on Tuesday, but as you can see struggled a little bit once we got towards the 0.7675 handle. However, we are closing towards the top of the candle, and with the Reserve Bank of Australia offering quite a bit of volatility due to the interest-rate statement today, it’s likely that we will get some type of move. If we pullback from here, I believe that there is more than a significant chance that we could start buying yet again. A supportive candle after a move below would be a nice buying opportunity.

On the other hand, we could break above the resistance barrier just above, and if we do I think at that point in time this pair continues to go much higher. I have no interest in shorting this market, unless of course the Reserve Bank of Australia suddenly decides to cut interest rates, which it is not expected to do today.