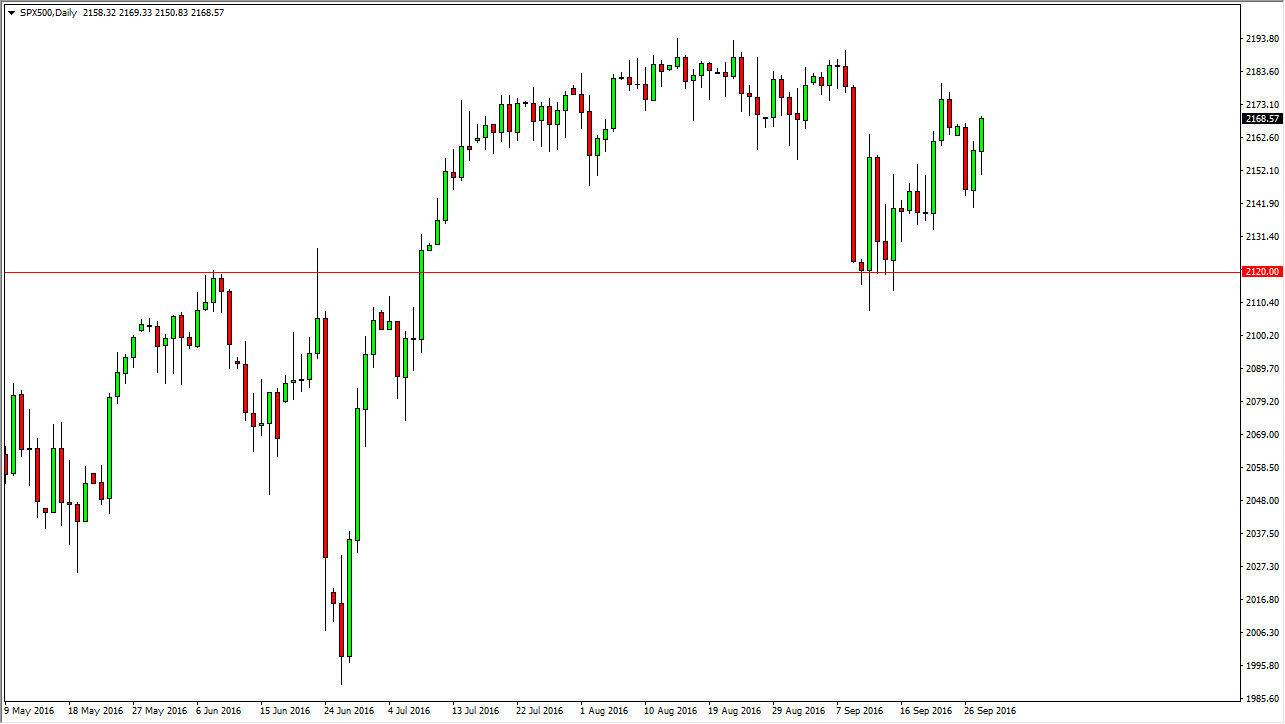

S&P 500

The S&P 500 had a very volatile session during the day on Wednesday, as we initially fell and then shot higher. Because of this, I think we’re going to test the resistance area above so I think short-term pullbacks are buying opportunities. With that being the case, I would anticipate that we are going to reach towards the 2200 level above. That was where we had seen quite a bit of resistance, and as a result I believe that we are trying to build up enough momentum to finally go above there. I believe that the “floor” is near the 2120 handle, so as long as we pullback I am more than willing to start buying this market. I have no interest in selling this market, especially considering that the interest-rate situation in the United States should continue to be very negative.

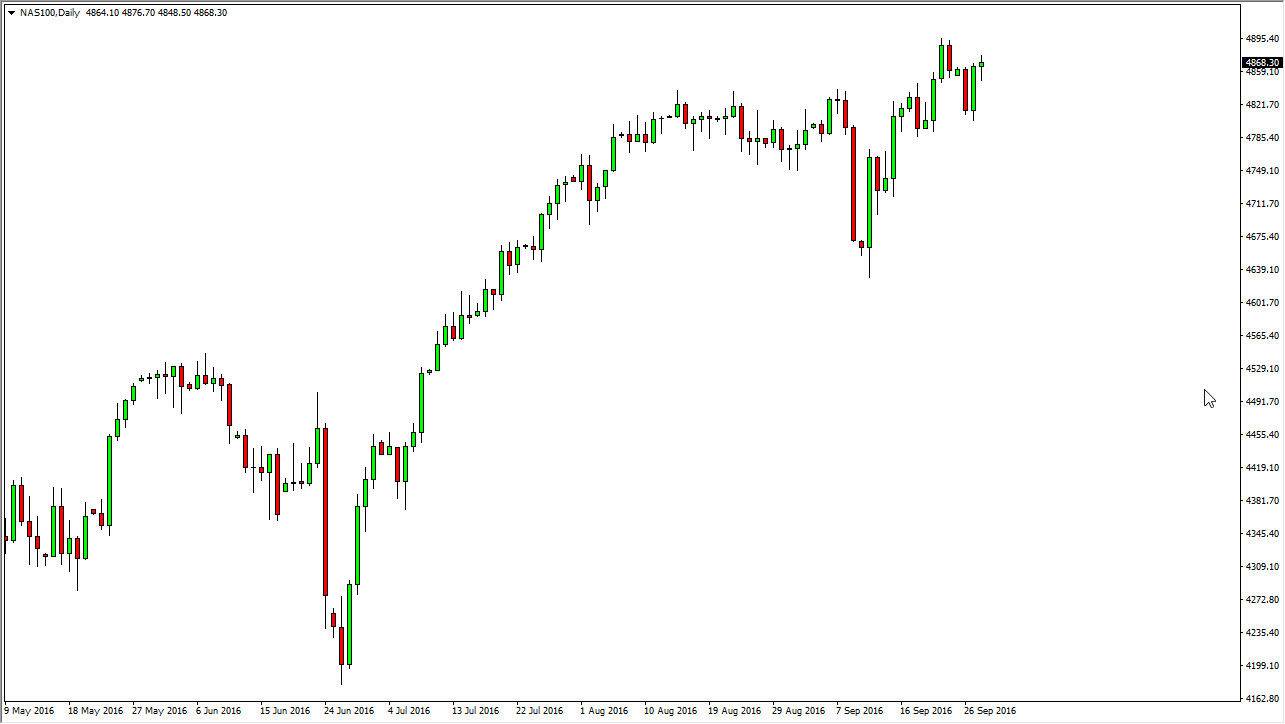

NASDAQ 100

The NASDAQ 100 went back and forth during the course of the session as well, but as you can see we are trying to find enough momentum to go higher, as the 5000 level is by far my longer-term target anyway. I believe that pullbacks at this point in time should continue to be buying opportunities, as the interest-rate environment of course is very attractive for stocks. On top of that, the NASDAQ 100 has outperformed the other indices that I follow so I think that we are going to continue to see quite a bit of “hot money” flow into this market going forward.

The 4800 level below is massively supportive, so I think that even if we fall from here, we will continue to find buyers near that area as well. Ultimately, I think we probably even break above the 5000 level, but it is going to take some time to do so. With this, I am bullish but I recognize that we may have to take several attempts to break out for the longer-term move.