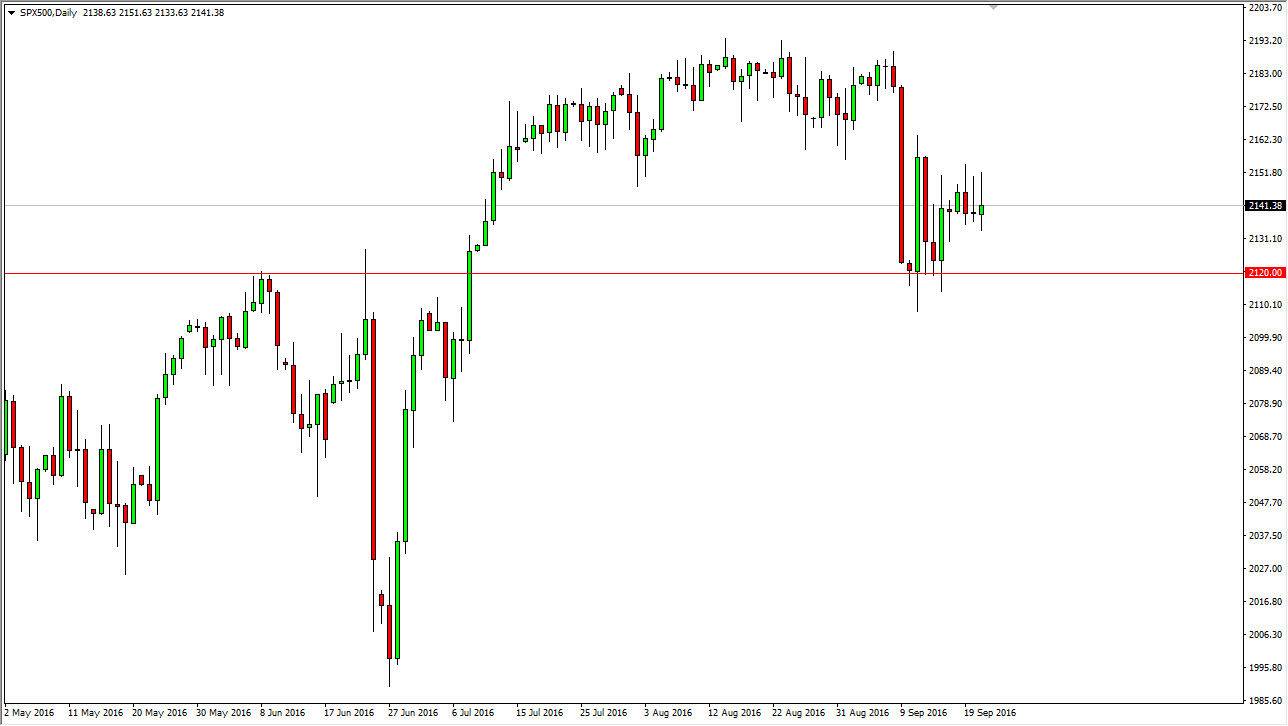

S&P 500

The S&P 500 initially tried to rally during the course the day but as you can see we ended up forming a be shooting star, however I should admit that this is before the FOMC Statement. With that being the case, I think that the market longer-term still continues to go higher, and a pullback from here will more than likely find buyers below. This is because we have seen such a large move higher, and quite frankly the markets already expect the Federal Reserve to do almost nothing. With this being the case, any type of pullback will more than likely be looked at as value that you can take advantage of because quite frankly the Federal Reserve is probably only looking at one interest-rate hike anytime soon, and it certainly is in coming now. With this, the low interest-rate environment should continue to be a propellant for markets to go higher.

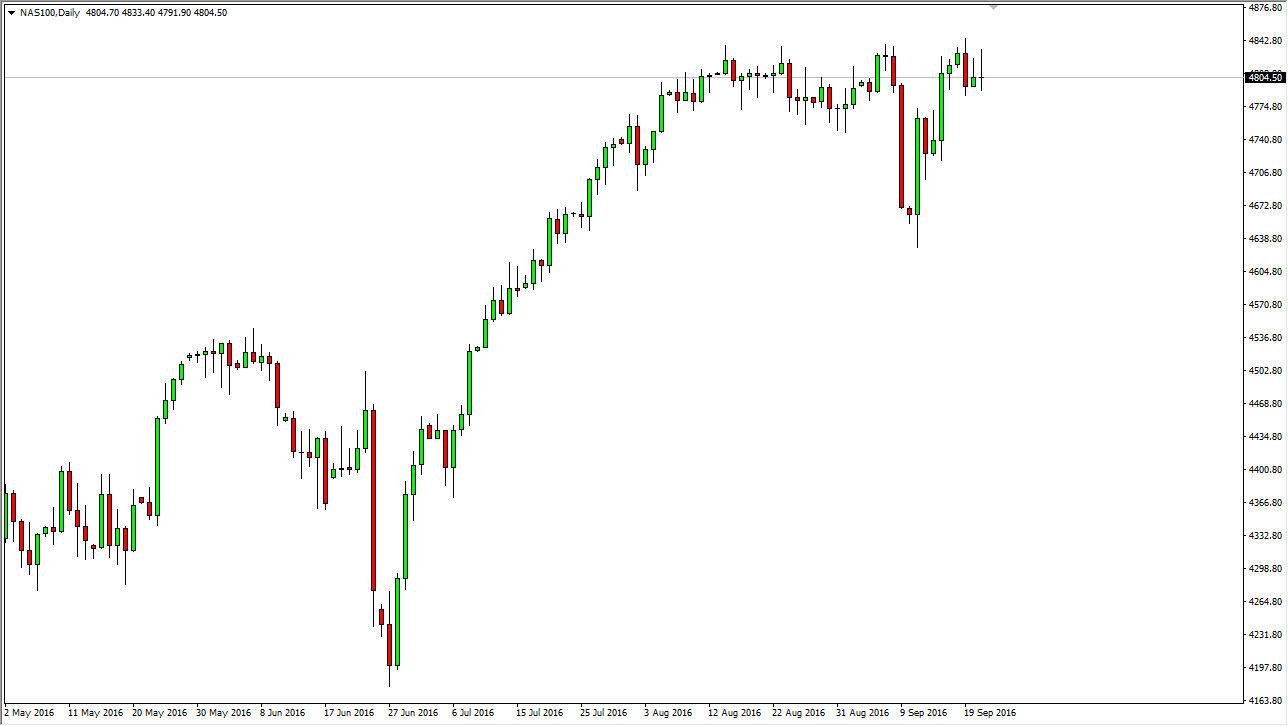

NASDAQ 100

The NASDAQ 100 initially tried to rally as well, and also ended up forming a bit of a shooting star. We are pressing up against the 4840 level though, so we can break above there think that the market will continue to go towards the 5000 level. A break down below the bottom of the shooting star courses negative, but quite frankly I’m looking for some type of supportive candle below in order to take advantage of the knee-jerk reaction. If we get that, then I’m willing to buy supportive candles as this would allow people to take advantage of the value the would inherently be there. Quite frankly, I don’t think that there are going to be falling for any real length of time, and at that point in time you have to be looking for advantages and what is obviously a very strong longer-term trend. A break above the 4040 level should send this market looking for the 5000 handle yet again.