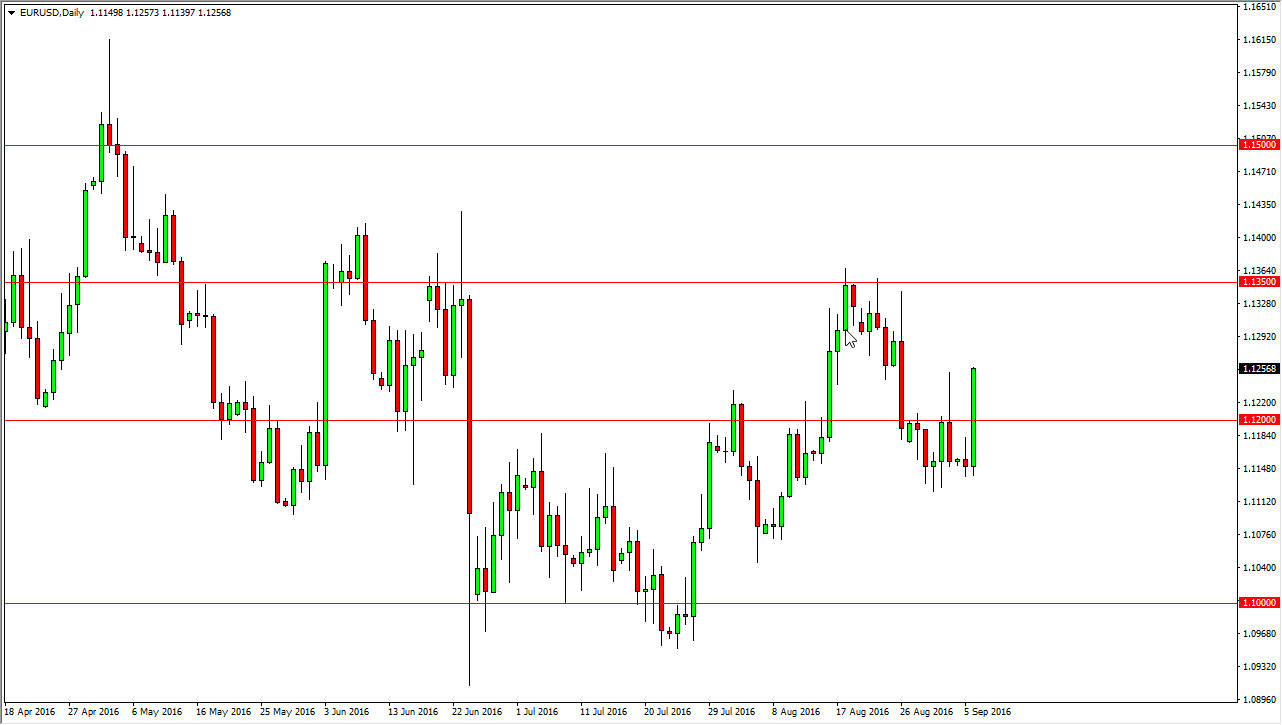

EUR/USD

The Euro exploded to the upside during the session on Tuesday as people continue to believe that the Federal Reserve will not be able to raise interest rates. Because of this, we ended up going above the 1.12 level for the session, and closing very strongly. If we pullback from here, it’s likely that the markets will more than likely have plenty of support below, extending all the way down to the 1.1150 level. With this being the case, the market looks very likely to have buyers returning again and again. On top of that, it makes quite a bit of sense that we go higher based upon the fact that we closed so strongly during the day. With this, I believe we are reaching towards the 1.1350 level above.

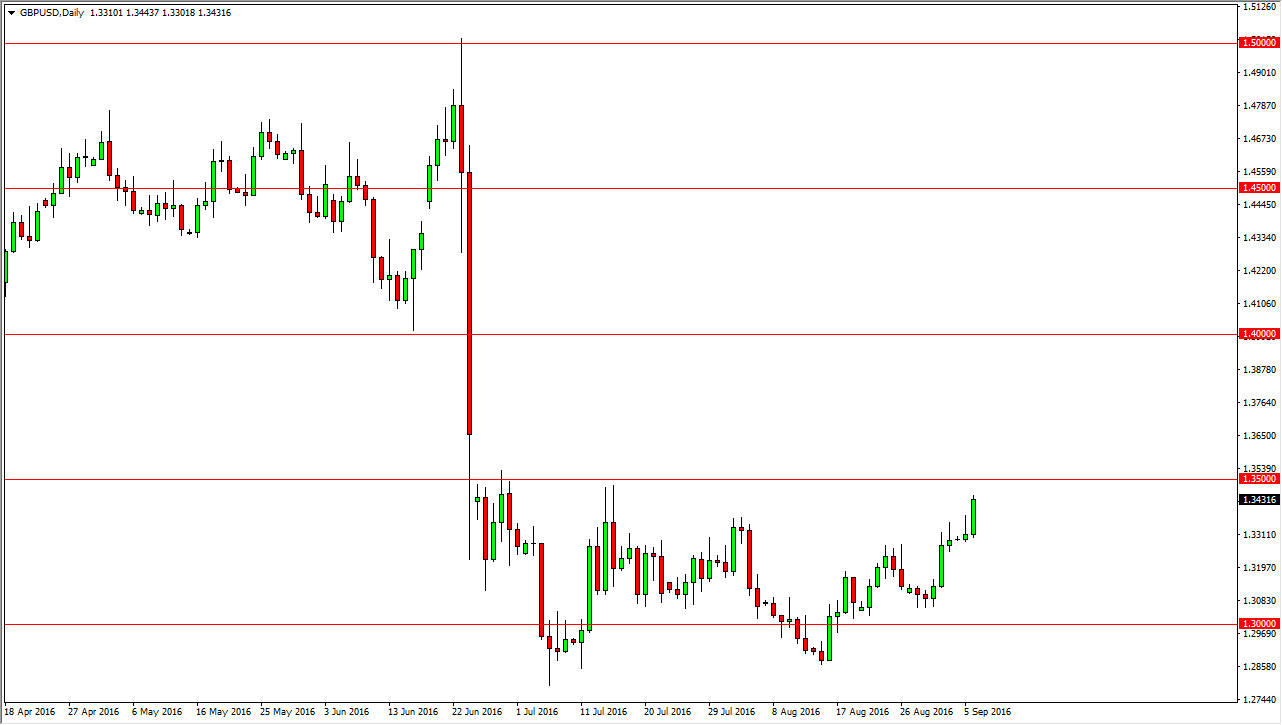

GBP/USD

The British pound rose during the session as well, breaking the top of the shooting star from the previous Monday session. With this being the case, it looks as if we are ready to grind our way towards the 1.35 handle above, which of course is a massive barrier not only due to the fact that it is a large, round, psychologically significant number, but we also have the gap that formed back during the month of June. With this being the case, the market will have a lot to deal with when it comes to selling pressure, so at this point in time I believe that the market will more than likely turn things back around and on signs of exhaustion I have absolutely no concerns whatsoever in selling. In fact, that’s my base case, that we are simply continuing to consolidate in the longer-term charts. However, if we do break above the top of the gap, the market could then very well find itself going much higher, perhaps all the way to the 1.40 level. Now that volume is picking back up after the summer break, we could get signs of where we are going for the next few months over the next couple of sessions.