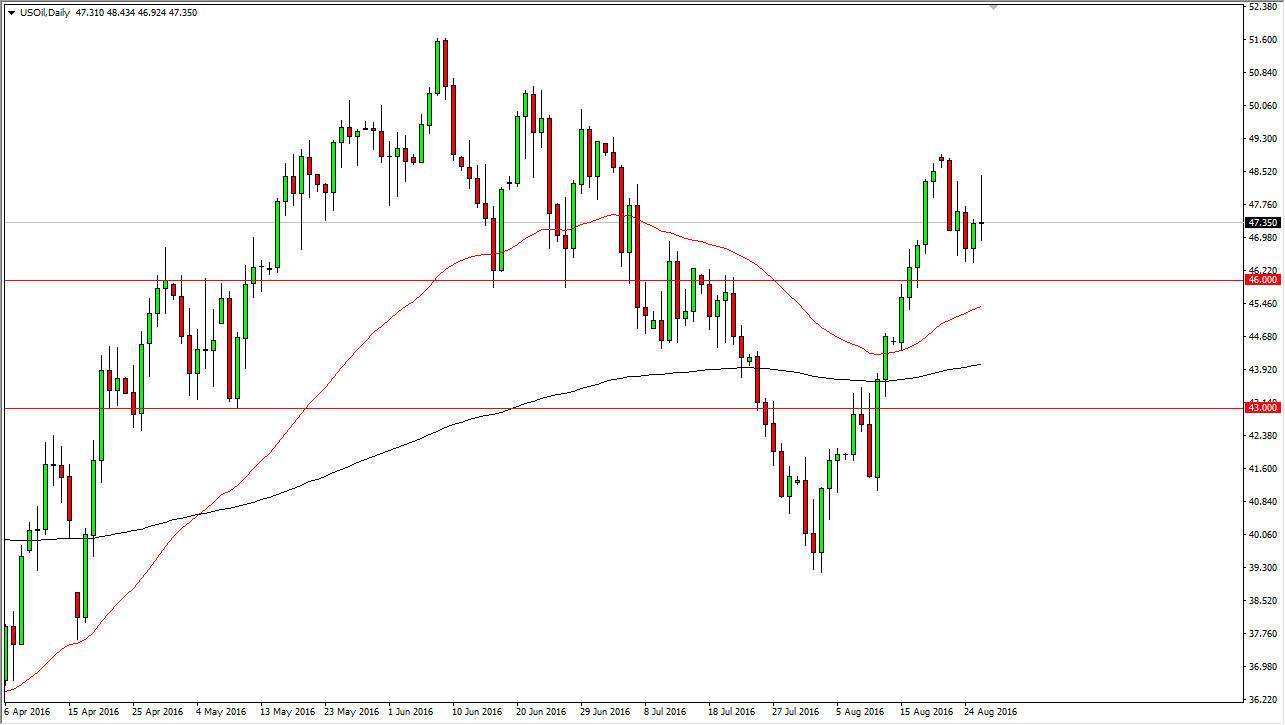

WTI Crude Oil

The WTI Crude Oil market initially tried to rally on Friday, but turned right back around to form a massive shooting star. Because of this I think we are going to fall backwards and try to test the $46 level for support. Once we do, I think that the buyers will more than likely come back in. However, we break back down below the $46 level, we could continue to fall from there. Obviously, if we break the top of the shooting star that’s a very bullish sign in changes everything. In the meantime, the one thing I think you can count on is quite a bit of choppiness in this general vicinity.

Natural Gas

This is a market that’s bit overextended for a few days, and the fact that we did up forming a neutral candle doesn’t overly surprise me. I believe that the market will continue to be volatile in general so therefore I’m looking for sideways action. However, if we can break back below the $2.75 level, I would be a seller that point as it should continue to go lower from there. On the other hand, if we can break above the top of the range, from the session on Friday, we could reach towards the $3 level at that point in time. I believe that the natural gas markets will continue to be volatile in general, as the volume just isn’t that strong right now due to the end of the holiday season.

Regardless, I wouldn’t be hanging on to trade for any real length of time at this point, it’s just not going to be stable enough to do so. With that being the case, expect short-term moves at best, and use short-term charts to make any type of trading decision. For myself, I’m actually perfectly fine on the sidelines.