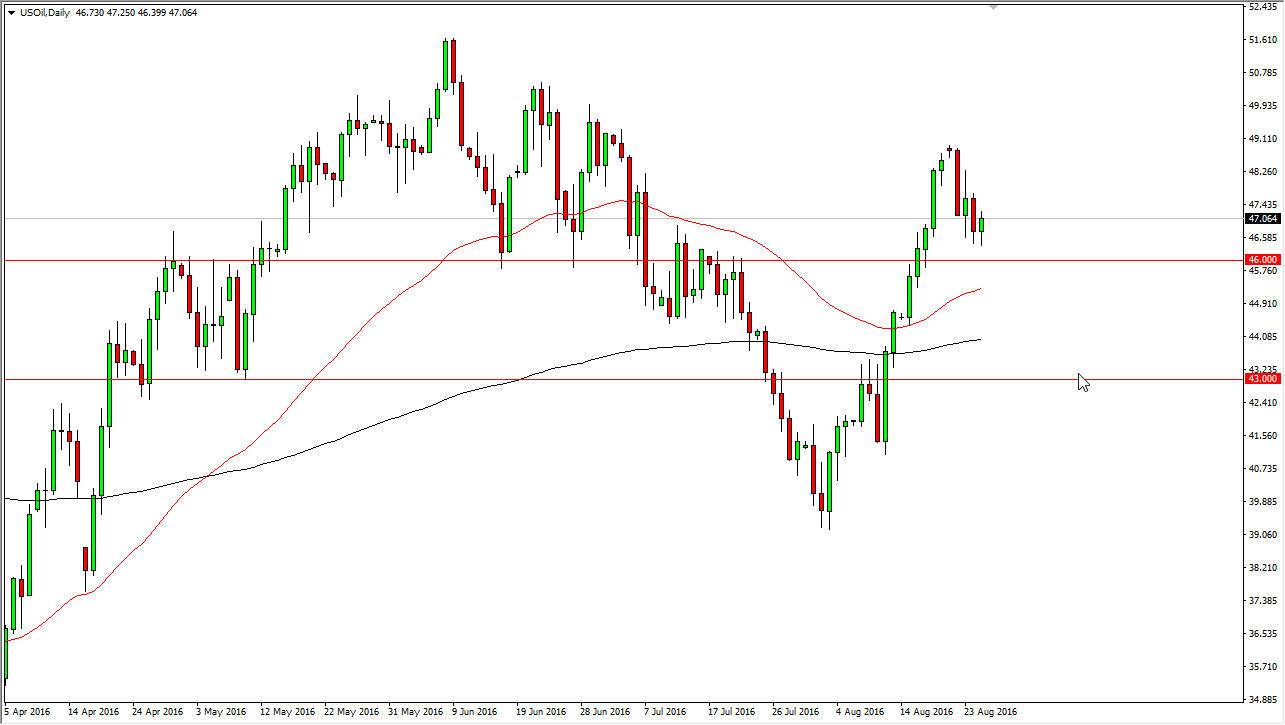

WTI Crude Oil

The WTI market rose during the course of the day on Thursday, but as you can see we ran into quite a bit of volatility. I think we are trying to find some type of floor in the $46 region, and as a result I think a bounce could be coming. However, I believe that longer-term this is a negative market just waiting to happen. After all, we did rally far too strong based upon the idea of less drilling next year. However, nobody is questioning whether or not there is going to be more demand. The meantime though, I believe that a break above the top of this candle is a buying opportunity, at least until we get to the $49 level.

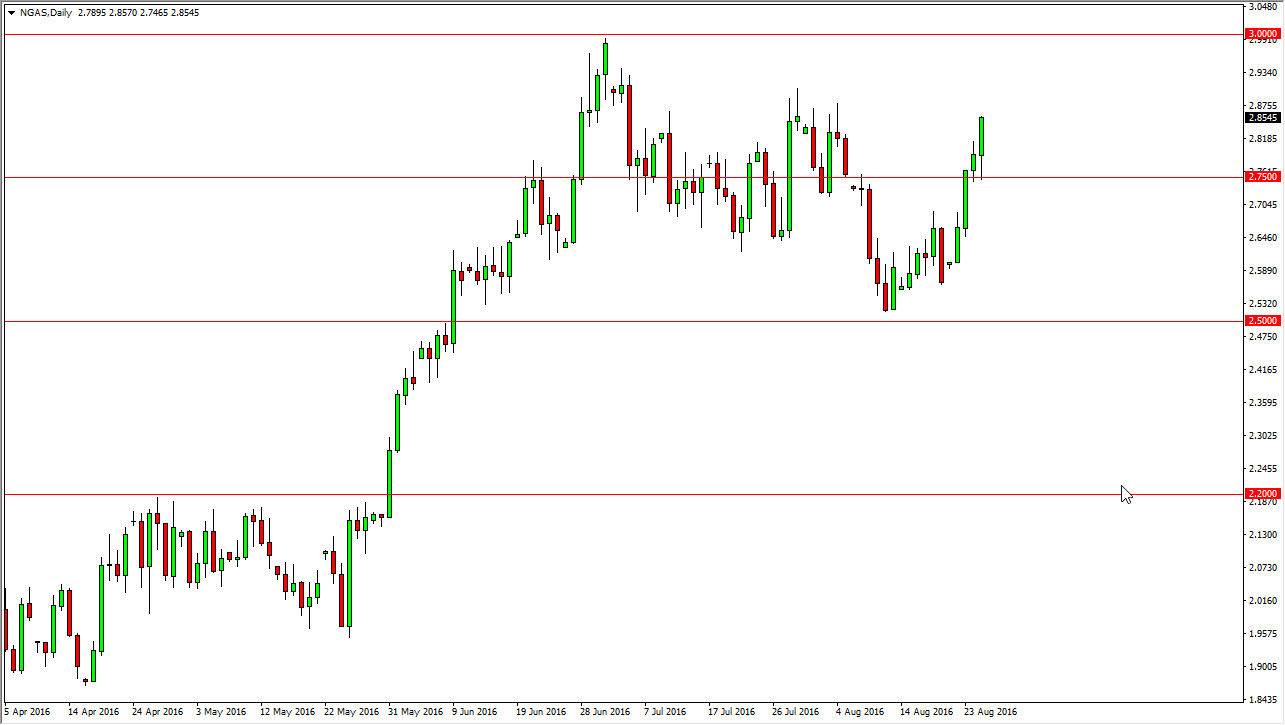

Natural Gas

Natural gas markets initially fell during the day on Thursday but found the $2.75 level to be supportive enough to turn things back around and throw the market towards the $2.85 level. The natural gas markets have been explosive lately, and as a result it’s not a surprise that this has happened. However, we are getting a bit overextended see did have the question that as well, and as a result I think you have to be out of this market at the first signs of exhaustion. I expect of the $2.90 level should cause a bit of trouble, and as a result it’s only a matter of time before the sellers returned, but quite frankly I would need to see some type of daily candle confirmation to even consider doing that as the move has been so violent.

I still believe that the $3 level above will offer quite a bit of resistance, and I don’t think that we get above it anytime soon. With this being the case, it’s likely that sooner or later we will get sellers into this market but again, I would jump on that bandwagon quite yet.