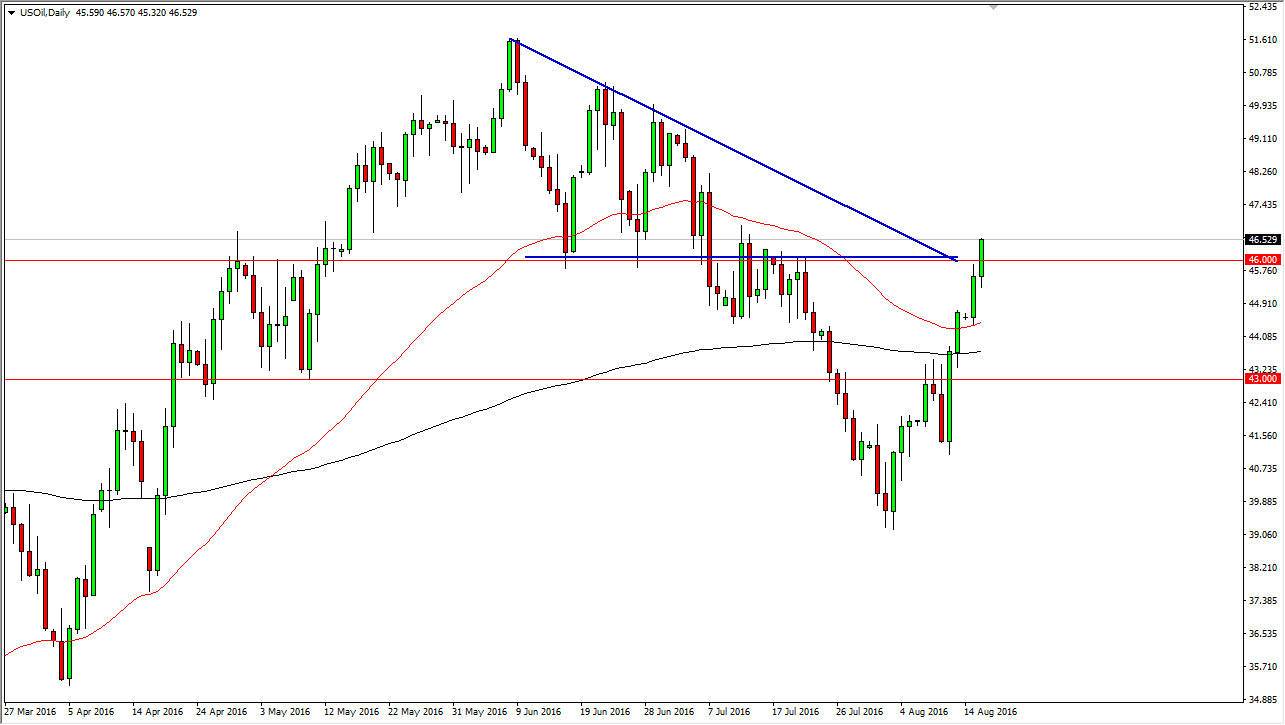

WTI Crude Oil

The WTI Crude Oil market rallied during the course of the day on Tuesday, breaking above the $46 handle. This is a very bullish move, and as a result I feel that the market will continue to go higher and less of course the inventory number comes out very bearish during the day. Recently, this has been a move predicated upon the idea that drilling will slow down during the year 2017, something that hasn’t necessarily been proven yet. Ultimately though, you cannot argue with the market and you have to simply follow. A break above the top of the range during the day is a buying opportunity but having said that if we managed to turn right back around and break below the bottom of the candle for the day on Tuesday, I would then become a seller because it would be a reaction to the inventory numbers, which of course gives us the clearest signal of demand.

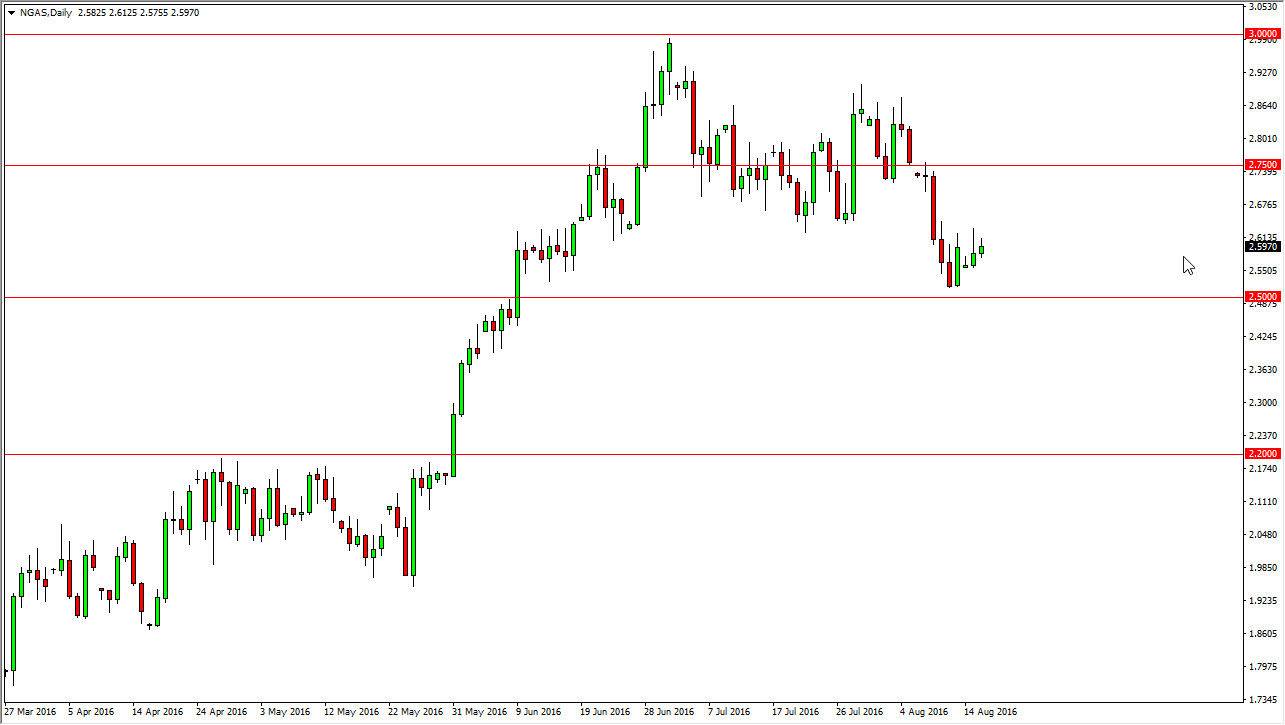

Natural Gas

Natural gas markets rose slightly during the day on Tuesday, as we continue to grind higher. The market is testing the $2.60 level again, an area that has been rather important. I believe that this market does continue to go lower given enough time though, but right now we just don’t have any price action to work with. I believe that the $2.50 level below is massively supportive, so more than likely what we are about to see is going to be quite a bit of consolidation as we simply grind back and forth. Short-term traders may be attracted to this type of market but quite frankly doesn’t have enough room for me to move in. With this, I believe that the market is probably best left alone for the short-term, but I am the first to admit that I would really like to see an exhaustive candle and a break down that I can start selling.