USD/JPY

The US dollar fell against the Japanese yen during the course of the day on Tuesday, but found enough support near the 100 level to turn things back around and form a hammer. I believe that the Bank of Japan will continue to monitor this market, and a break below the 100 level would get the Japanese central bankers involved. After all, the 100 level is essentially a “line in the sand” as far as I can see, and with that being the case it’s likely that a break down below there will have some type of consequence. With this being the case, waiting to see when we get short-term bounces or supportive candles and I can start buying in order to take advantage of what I think is going to essentially be the “floor” in this particular pair.

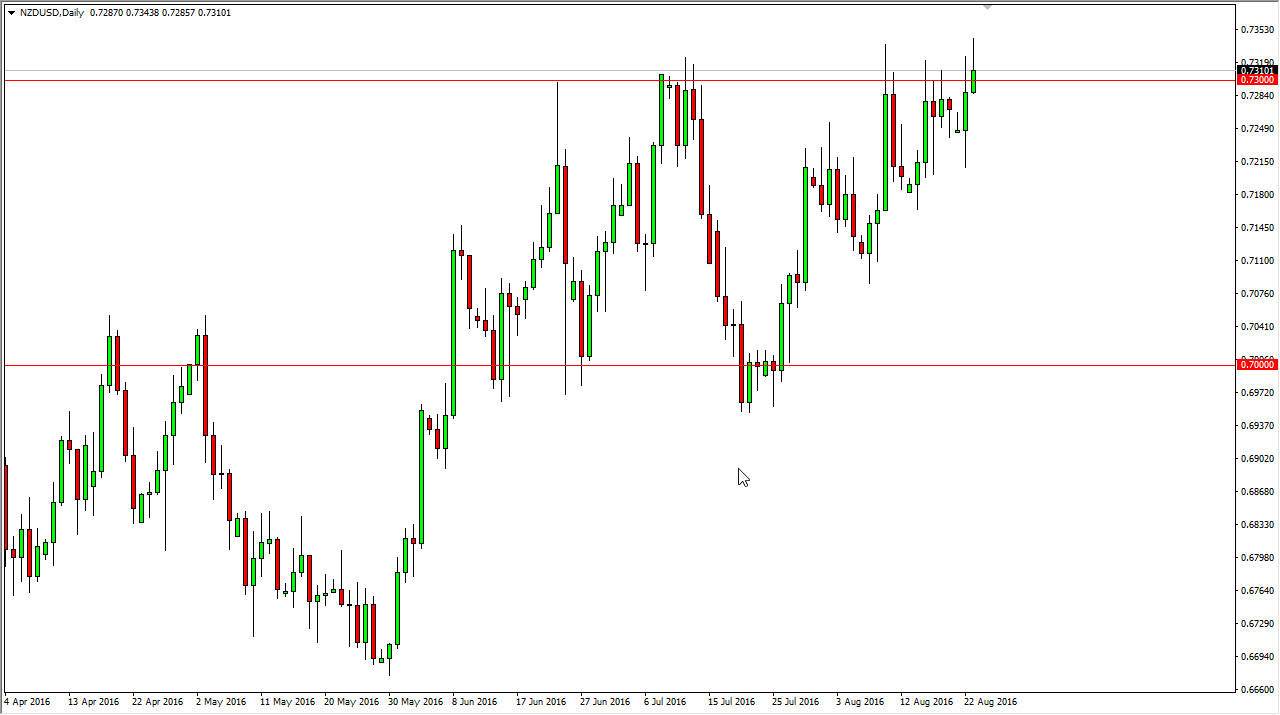

NZD/USD

The New Zealand dollar initially rallied during the course of the day on Tuesday, but turn right back around to form a bit of a shooting star. The shooting star of course is a negative sign, and the fact that it happened at the 0.73 region suggests that the resistance is going to continue to hold the market down. However, I do recognize that the lows are getting higher, so it is probably only a matter of time before the route turn of buyers happens. I believe that supportive candles below are buying opportunities, but I also recognize that it could be very choppy this time of year.

Alternately, if we can break above the top of the shooting star during the course of the day on Tuesday, I feel that the market will then go to the 0.75 level which is my longer-term target anyway. I think we can go above there, because quite frankly we have no interest out there to be picked up other than the higher swap currency pairs such as this one.