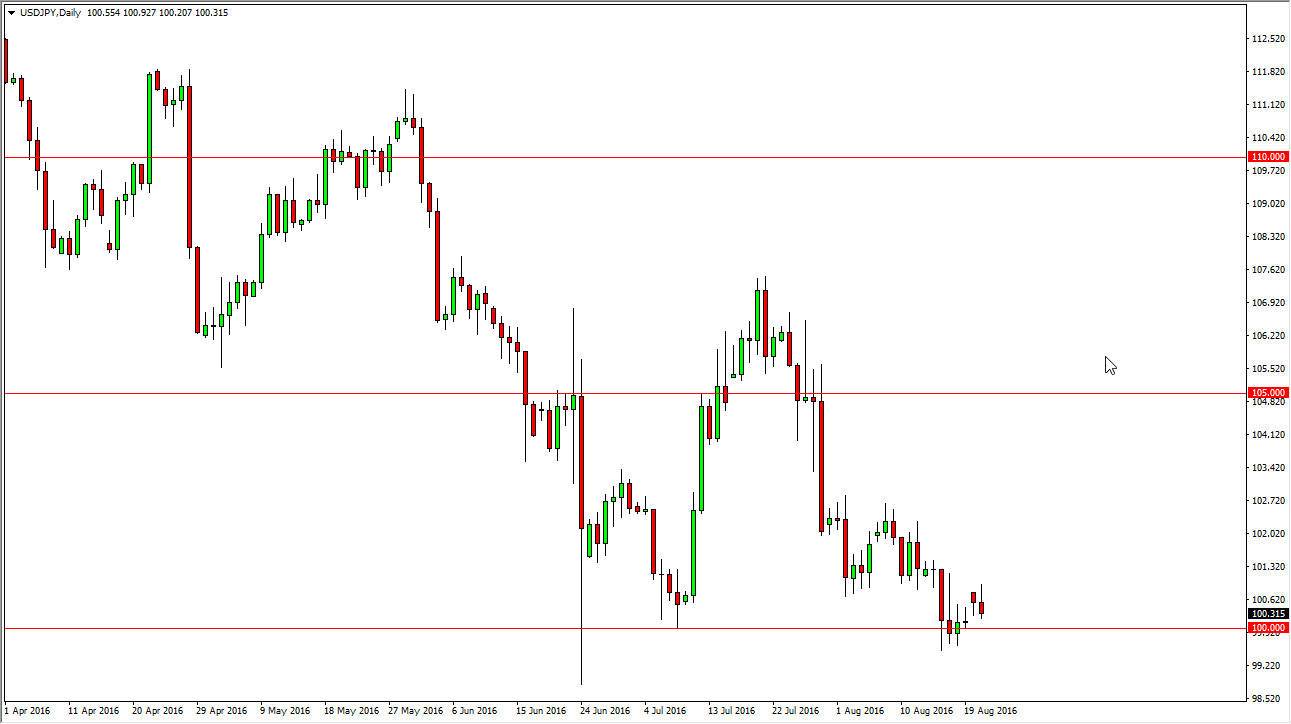

USD/JPY

The US dollar did gap higher against the Japanese yen initially during the day on Monday, but as you can see we turn right back around to form a slightly negative candle. What I find more important in this market is the 100 level below, which should be a psychologically significant number. The 100 level below is essentially the “line in the sand” when it comes to the Bank of Japan. I think that if we break down significantly below that level, the Bank of Japan will either intervene, or perhaps maybe do more quantitative easing. We also could see this market turned back around due to verbal intervention as well, so this point in time I’m waiting to see either a supportive candle or a break above the top of the Monday session in order to start buying and aiming for the 102.50 level.

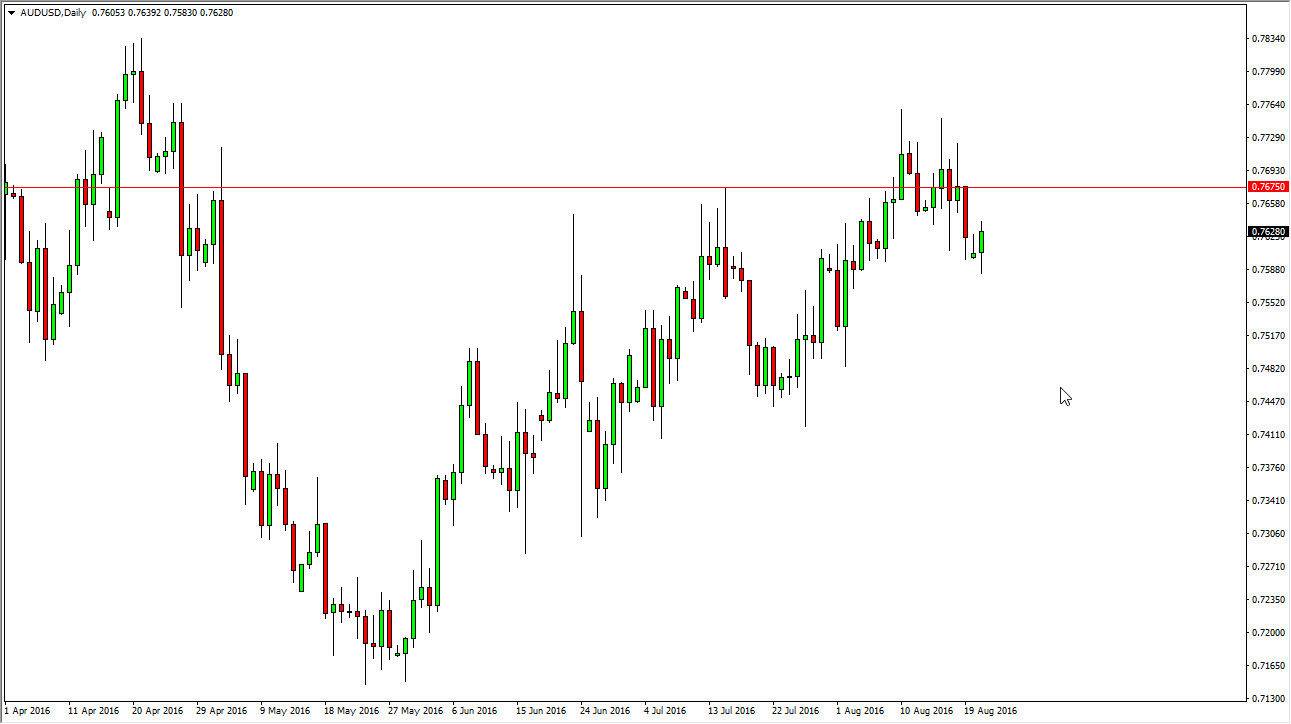

AUD/USD

The AUD/USD pair initially fell during the course of the day on Monday, but bounced off of the 0.7550 level. The market formed a fairly positive looking candle, but I think we are going to have to continue to grind against the resistance above at the 0.7675 level. Sooner or later though, we will break above there and we will continue to reach towards the 0.80 level given enough time.

Pay attention to the gold markets, because they tend to influence the Australian dollar quite a bit. If they start rallying again, that should push the value of the Aussie higher incongruence. I have no interest is in selling this market, because quite frankly there is more than enough support below at various levels that could turn things back around. Don’t get me wrong, I don’t think that this is a market that is going to go straight up, just that I think the overall bias is going to be to the upside. Regardless of what happens, one thing you can probably count on is volatility.