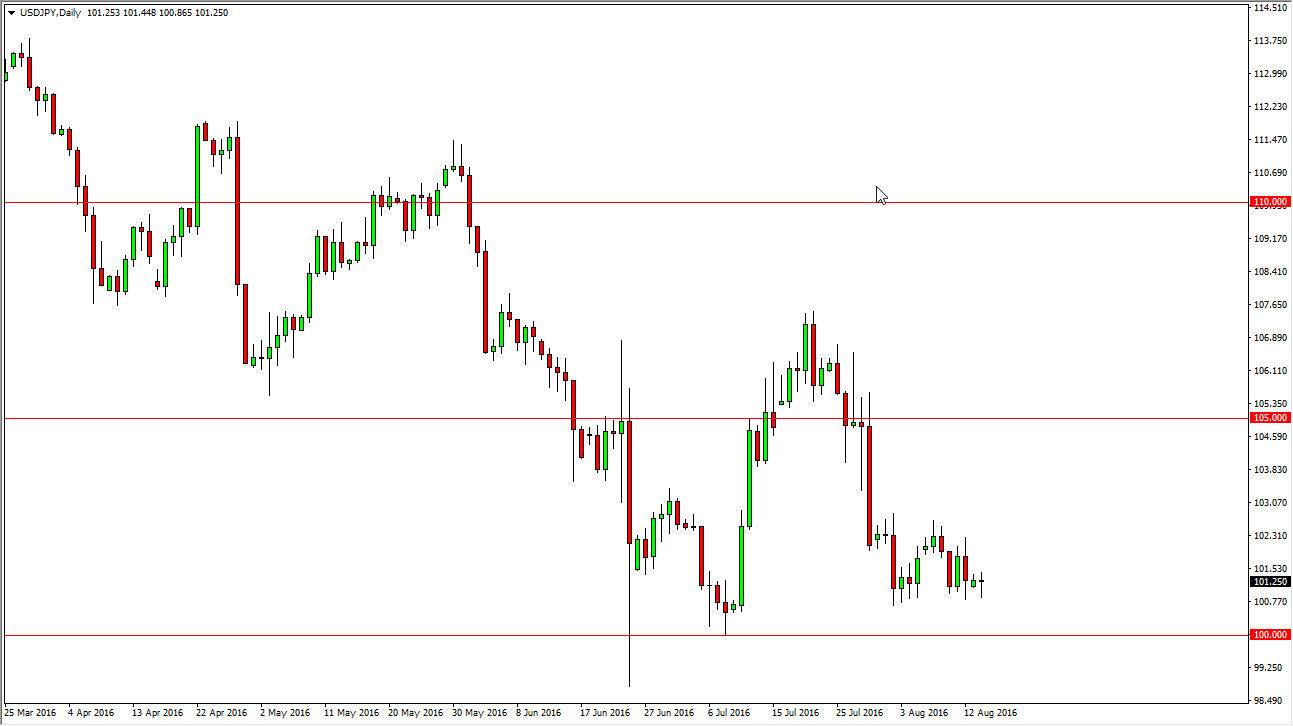

USD/JPY

The USD/JPY pair went back and forth during the course of the session on Monday. By doing so, the market looks very neutral at this point in time, and I also recognize that the 101 level seems to be very supportive. In fact, I believe that there is support all the way down to the 100 level, and with that being the case it makes sense that we would continue to see buyers enter this market again and again. In fact, the Bank of Japan should offer quite a bit of support to this market, so I think it’s only a matter of time before the buyers step back into this marketplace. I don’t necessarily think that it’s going to be easy to go higher, just that it’s the only direction that you can go at the moment.

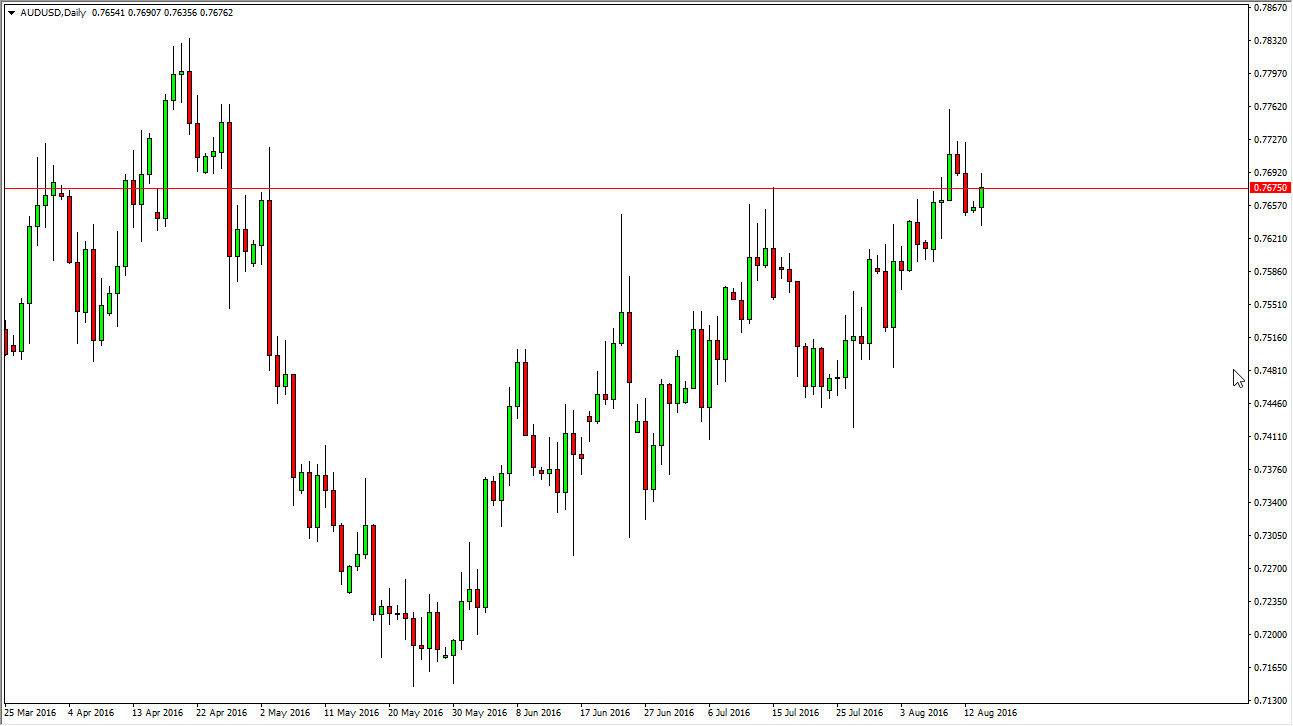

AUD/USD

The Australian dollar had a very positive day after initially falling on Monday, and even broke above the 0.7675 level at one point. By doing so, the market looks like it is ready to go higher. I recognize that there is a lot of volatility though, so it’s difficult to imagine that most people would be willing to buy and hold the Australian dollar at the moment. However, I have no interest whatsoever in shorting, so it makes sense that this market to only travel in one direction as far as I can see.

A break above the top of the range for the day will more than likely bring buyers back into this market as we continue to try to reach towards the 0.80 level above. I think that this is a market that continues to only be able to be traded in one direction, mainly because the gold markets look so healthy, and that of course is reason enough to pull the Australian dollar right up with it.