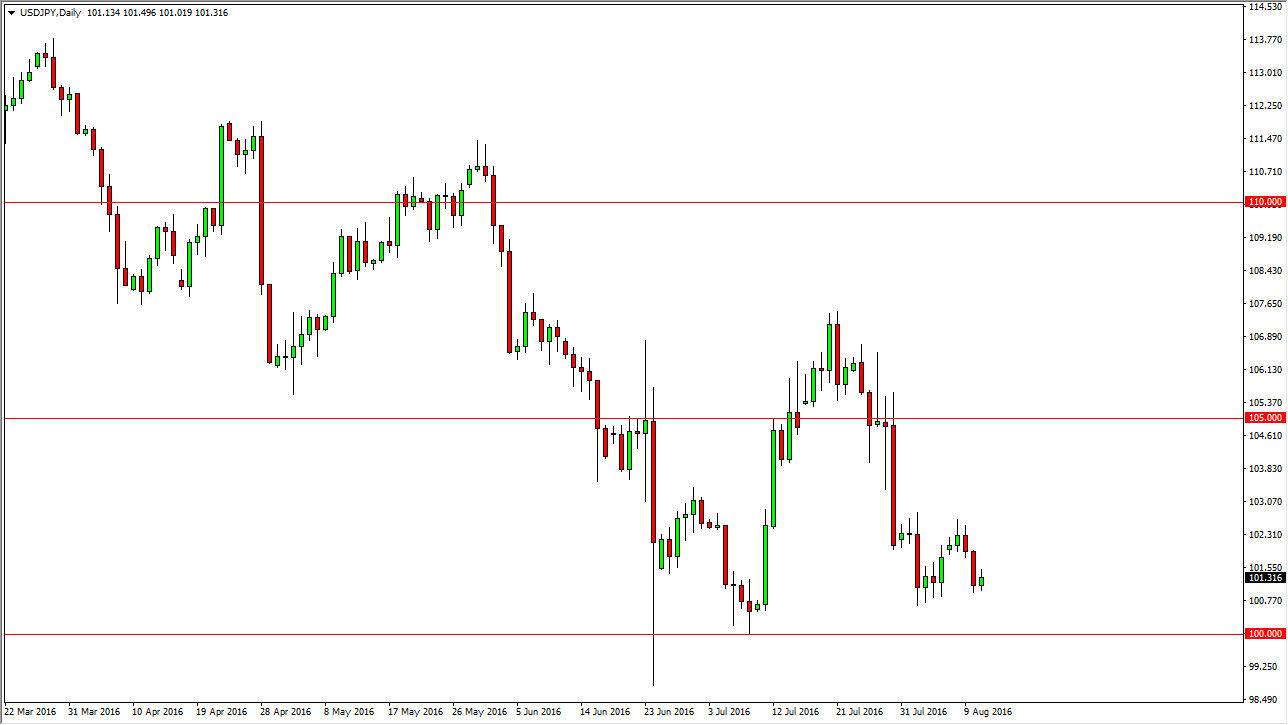

USD/JPY

The USD/JPY pair had a slightly positive session during the day on Thursday, but at this point in time I believe that the real story is going to be closer to the 100 level. After all, this is a “line in the sand” as far as I can see, as the Bank of Japan has no interest in seeing the Japanese yen appreciate far from here. With that being the case, quantitative easing is probably coming, and as a result we could see the Japanese yen fall in value over the longer term. Ultimately, I believe that if we break down below the 100 level, so having said that, I believe that the market will continue to find buyers in this area, and therefore short-term bounces can be played.

AUD/USD

The AUD/USD pair initially fell during the course of the day, but as you can see the 0.7675 level has offered quite a bit of support. Ultimately, this is a market that should continue to go higher due to the interest-rate differential and of course the fact that gold tends to pull the Australian dollar right along with it. I believe that this market continues to go much higher, but it will very likely be a choppy affair. The 0.80 level above will be the target going forward, and therefore I have no interest in shorting this market. On top of that, I expect that the 0.7675 level below will begin to show quite a bit of support over the longer term and may very well be the “floor” in this market going forward.

Unless there is some type of systemic shock, I believe that the Australian dollar will continue to go higher, as there is simply no interest rate rich market at the moment. The interest-rate differential place more of a factor in currency markets than many of you recognize, as on the real interbank market, people tend to get better swap rates.