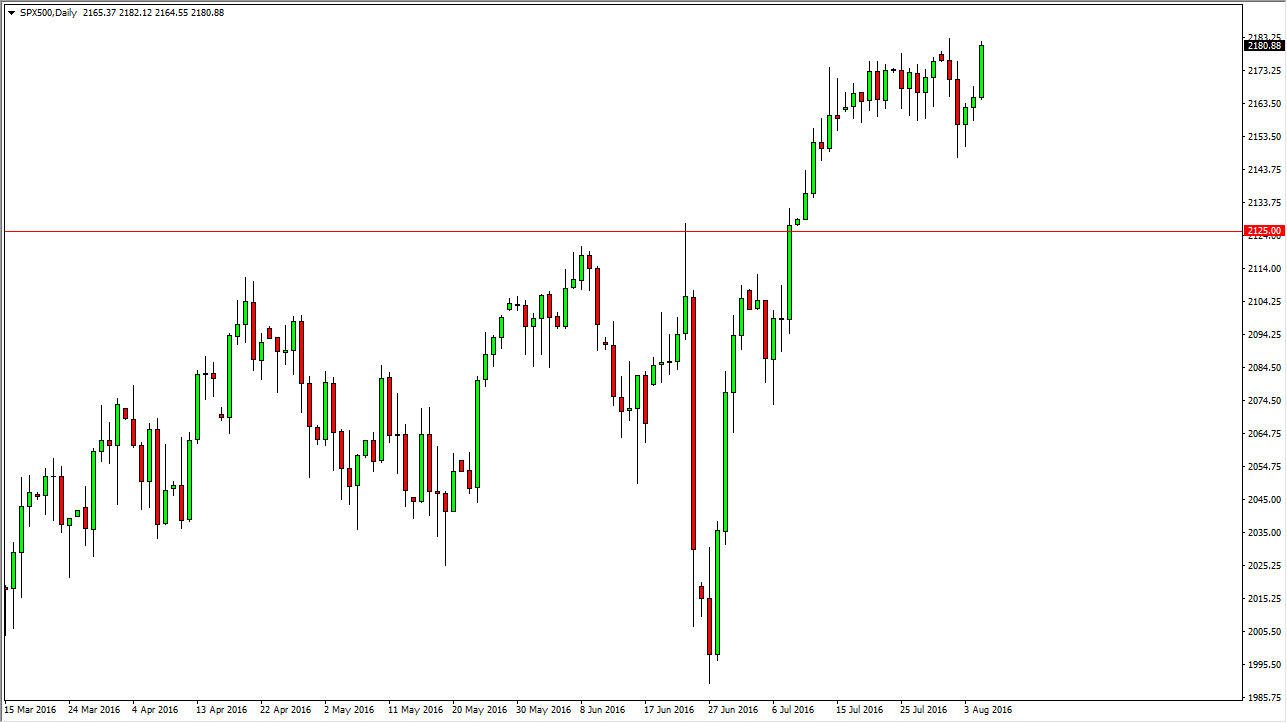

S&P 500

The S&P 500 index rally during the course of the session on Friday, breaking above the 2180 handle. This was in reaction to be stronger than anticipated jobs number, and as a result it looks like we are trying to break out to the upside and perhaps reach to much higher levels. At this point in time, I still have a target of 2250, and believe that as soon as we pullback from rallies, we will more than likely find supportive candles that we can take advantage of based upon “value.” Given enough time, we do go higher and I believe that this market has a “floor” at the 2125 level below.

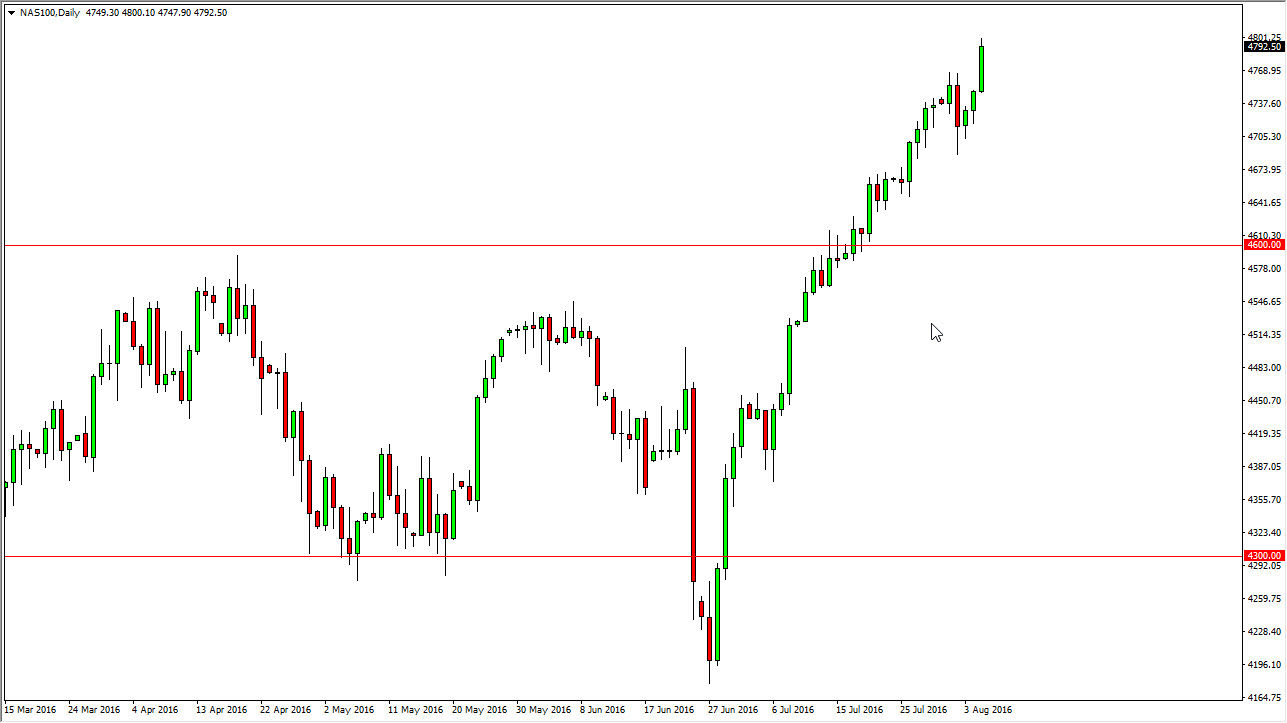

NASDAQ 100

The NASDAQ 100 broke higher during the course of the session as well, breaking out to a fresh, new high. The NASDAQ 100 had been a bit behind the other indices in the United States, but has most certainly jumped well above the other ones as far as momentum is concerned as we have shown quite a bit of strength. I still believe that the 4600 level below is massively supportive, but quite frankly I think that we are starting to see a bit of a “floor” near the 4700 level as well. This candle is very impressive, and in fact I believe that we are now reaching towards the 5000 level given enough time. With this, pullbacks will offer value the people will take advantage of, and shorting the NASDAQ 100 isn’t even a thought at this point in time.

The jobs number being stronger than previously anticipated of course is a positive sign, but we still have quite a bit of concern when it comes to global markets, so therefore the Federal Reserve will probably struggle to raise interest rates anytime soon. This is typically good for stocks, and as a result it makes sense that we continue to see bullish pressure.