S&P 500

The S&P 500 initially tried to rally during the course of the session here on Tuesday, but turned back around to form a shooting star. We also have the exacting candle form during the course of the day on Monday, so having said that I believe that there is a significant amount of resistance just above that we are going to struggle with. The fact that we have formed what is essentially “double hammers”, I feel that this market is ready to pull back. I don’t think that the pullback is going to be some type of meltdown though, and I believe that there is a massive amount of support at the 2150 level. With this, the pullback should offer value that people will take advantage of, but having said that we could break above the top of the 2 shooting stars, and that of course would be a very bullish sign as well.

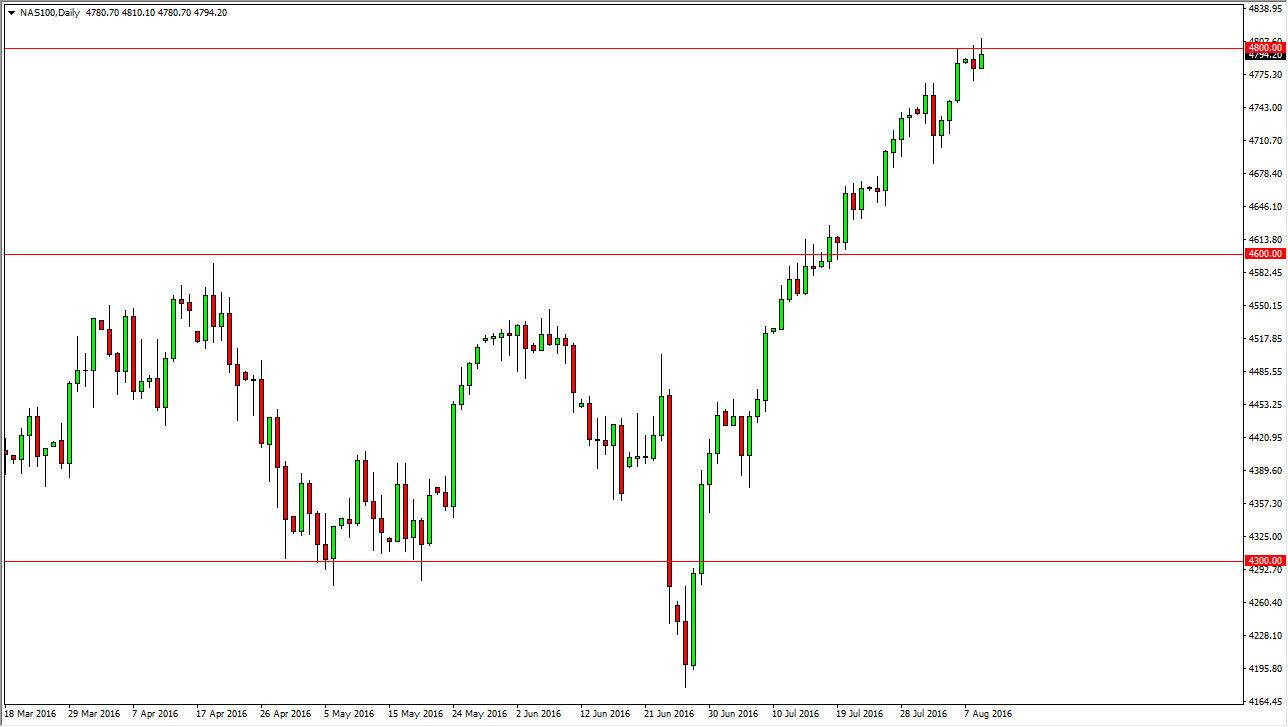

NASDAQ 100

The NASDAQ 100 tried to break out above the 4800 level during the course of the day on Tuesday, but pulled back to form a shooting star. This is a market that has been very strong for quite some time, and with that being the case I feel it’s only a matter of time before we not only continue climbing, but eventually make a fresh new high. Any pullback at this point in time should be a supportive candle just waiting to happen, and once we break above the top of the candle the market will more than likely try to reach towards the 5000 level given enough time.

I don’t think it’s going to happen right away, but it does seem to be the next major area that we would anticipate seeing over the longer term. Because of this, I recognize that the buyers are in control, and therefore have no interest whatsoever in selling.