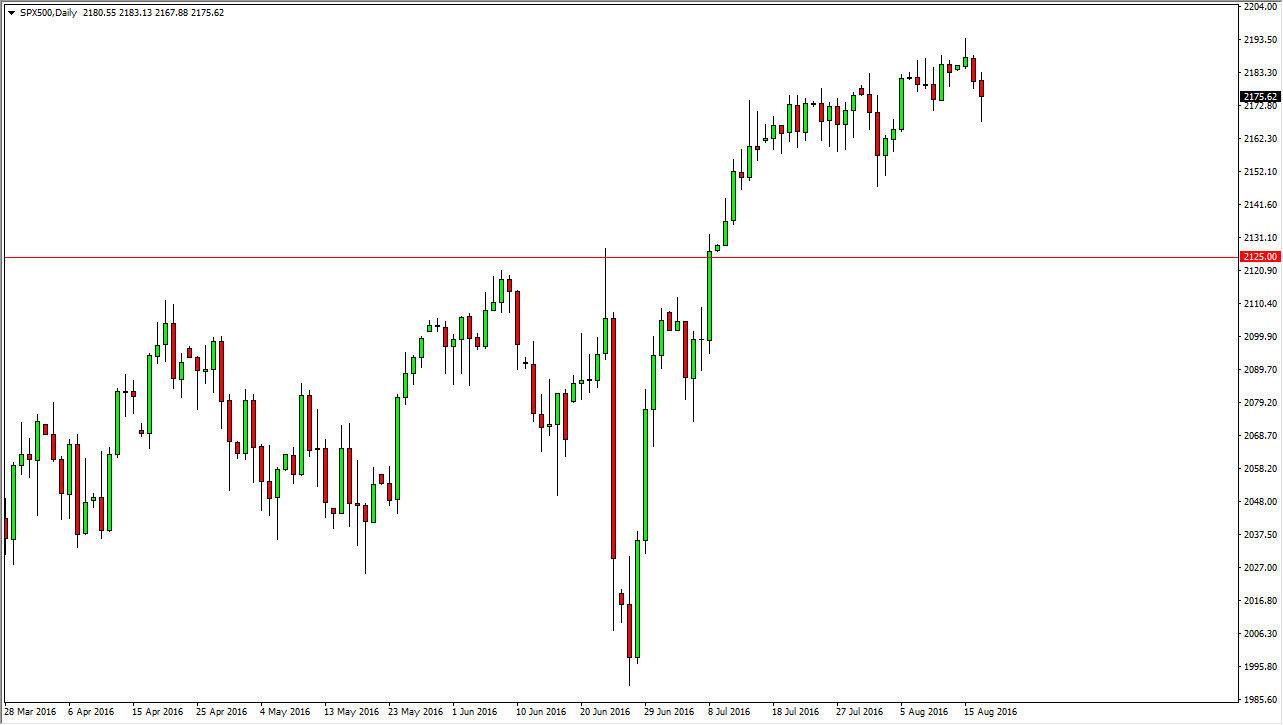

S&P 500

The S&P 500 initially fell during the course of the session on Tuesday, but found enough support to turn things back around and form a hammer. By doing so, the market looks as if it is likely that the buyers are going to come back in and continue to push this market higher. With this, it’s likely that the buyers will eventually break above the recent high, and could very well reach towards the 2250 handle. The hammer is of course a very bullish sign, and since we are in a bullish move, it makes sense that we will continue to see buyers jump back into this market. I have no interest in selling, and I believe that the 2150 level below is massively supportive. At this point in time, this is a market that although bullish, will be very choppy, see you have to be well aware of that.

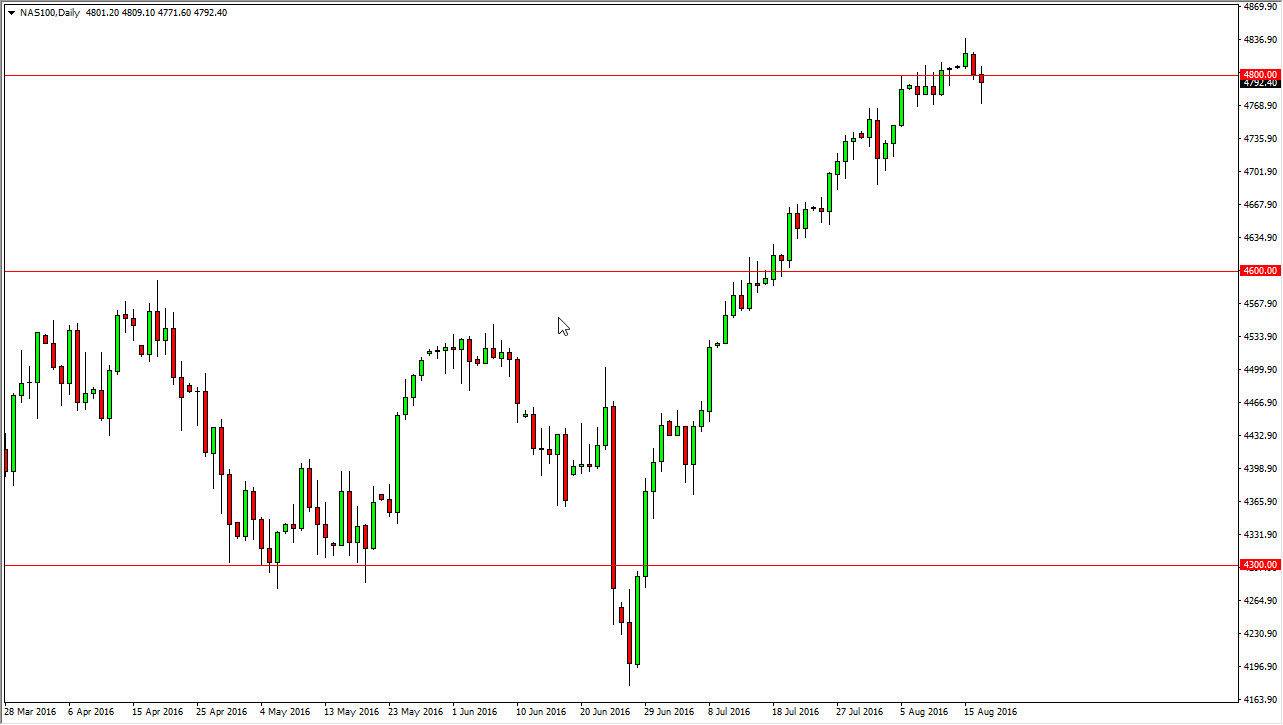

NASDAQ 100

The NASDAQ 100 initially fell during the course of the session on Tuesday, but turned right back around to form a bit of a hammer. The hammer of course is a very bullish sign, and as a result if we can break above the top of the hammer, we could very well go higher from that point in time. Pullbacks should very well offer buying opportunities in an area that has offered quite a bit of support in the past. I believe that a break above the top of the hammer, the market should then reach towards the 4850 level, and then eventually the 5000 level given enough time. I have no interest in selling this market, and even if we broke down below the bottom of the hammer from the session on Tuesday, I think there is more than enough support just below that will more than likely turn the market back around again.