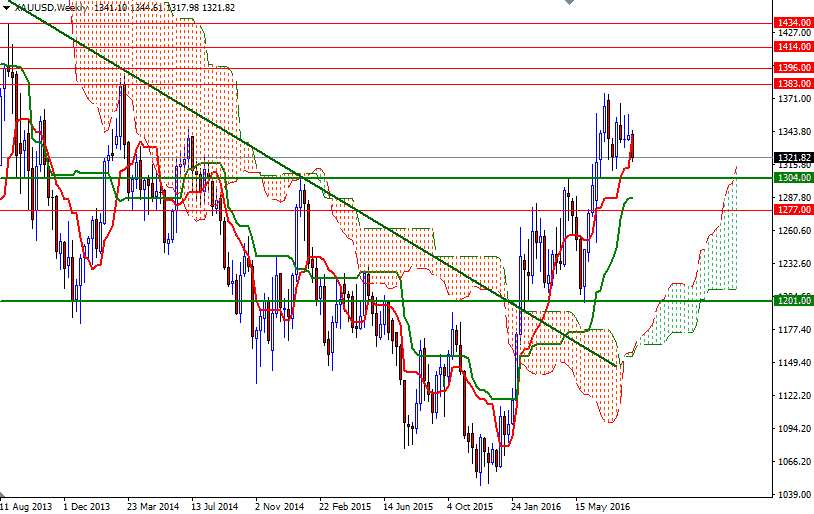

Gold ended the week down by 1.44% at $1321.82 an ounce, weighed down by a strengthening dollar and rising expectations for an interest rate increase this year. Federal Reserve officials signaled they could tighten monetary policy as soon as next month if the economy does well. Speaking at the Fed's annual symposium in Jackson Hole, Fed Chair Janet Yellen said "I believe the case for an increase in the federal funds rate has strengthened in recent months."

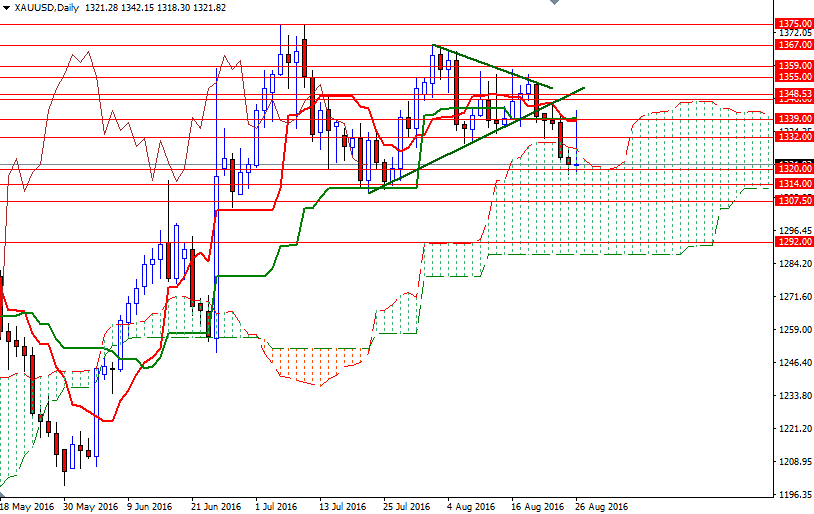

Apparently, they are trying to emphasize that the economy is strong enough to withstand higher borrowing costs, though traders put the odds of a rate increase in September at about 40%. Trading below the Ichimoku clouds on the 4-hour time frame suggests that the XAU/USD pair is likely to remain under selling pressure over the short term. The daily candle, which left a long upper shadow, also supports this view as it argues for rejection of higher prices.

In my previous analysis, I had pointed out the possibility of a move towards 1300 on a break below the ascending trend line (the lower line of the triangle shown on the daily chart). If prices can't climb back above the 1332/0 zone, the market will probably visit the 1314 and 1307.50-1304 support. In that case, the outcome of the next test of 1307.50-1304 should confirm what will happen next. While a failed assault on this support could be a good place to seek a long trade (for a rebound to the 1320 level), a successful drop would make me think that the bears will be aiming for 1292 and 1287.40, which happens to be the bottom of the daily cloud. Closing beyond 1332/0 might see a push up to the 1340/39 region, where the daily Tenkan-sen (nine-period moving average, red line) and Kijun-sen (twenty six-period moving average, green line) lines converge. If XAU/USD breaks up above 1340, it would be a sign of a bullish recovery and open a path to the next barrier in the 1348.53-1346.60 area.