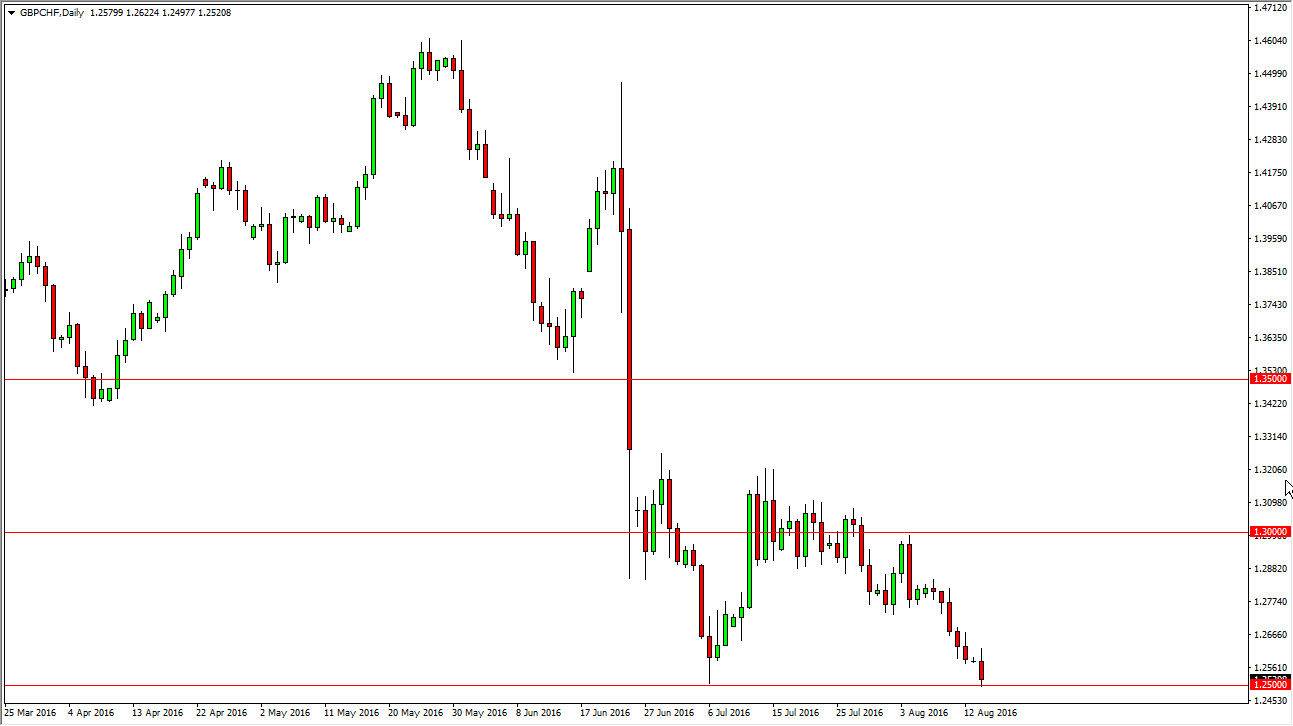

The GBP/CHF pair initially tried to rally during the course of the session on Monday, but turned right back around to slam into the 1.25 handle. This is an area that has quite a bit of support involved in it though, simply because the psychological significance of this number. Ultimately, this is a market that I do believe breaks down from here, and that once we clear the 1.25 level for any real length of time, the market should continue to work its way down to the 1.20 level given enough time. I believe that rallies continue to offer selling opportunities as well, especially based upon exhaustion as the British pound continues to get absolutely hammered.

Looking to sell rallies

I’m looking to sell rallies going forward, as the exhaustion above will offer “value” in the Swiss franc, and should build up enough momentum to finally break down below the aforementioned 1.25 handle. A break down below there is of course a very bullish sign for the Swiss franc, and therefore a negative sign for this particular currency pair. I have no scenario in which I’m willing to start buying this market, and therefore this is “sell only” as far as I can see.

I believe that the 1.2250 level will be the next major support level, but the 1.20 level will more than likely be a longer-term target that traders will be attracted to due to its large, round, psychologically significant target. I do believe that eventually we break down, but you will have to be able to deal with the volatility that is going to come with this particular market. While the British pound will continue to fall significantly, the “easy money” selling the British pound in buying the Swiss franc has already been made.

The Swiss franc of course offers a bit of a safety trade, and in a scenario in which we see a lot of trouble in both the United Kingdom and the European Union due to the vote by the British to leave the European Union, it makes sense that we continue to favor the Franc.