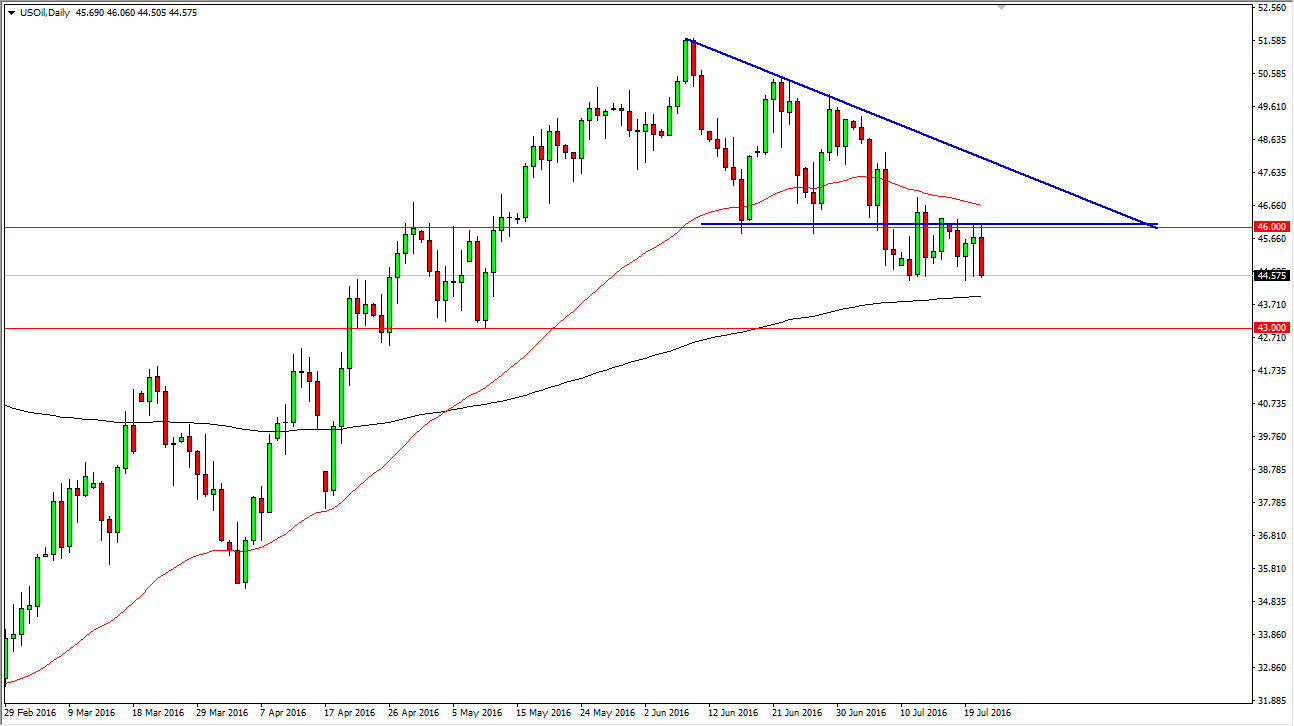

WTI Crude Oil

The WTI Crude Oil market initially trying to rally on Thursday, but continues to find the $46 level resistive enough to turn things back around. In fact, during the Thursday session we closed at the absolute lows, so it appears that we are trying to break down from here. I suspect that the next target is $43, but we do have the 200-day exponential moving average just below. Quite frankly, I would not be surprised at all if it is relatively ignored at this point in time. After all, there are serious demand concerned, and of course the US dollar continues to strengthen overall which works against the value of this market. As far as buying is concerned, and have absolutely no interest in doing so at the moment.

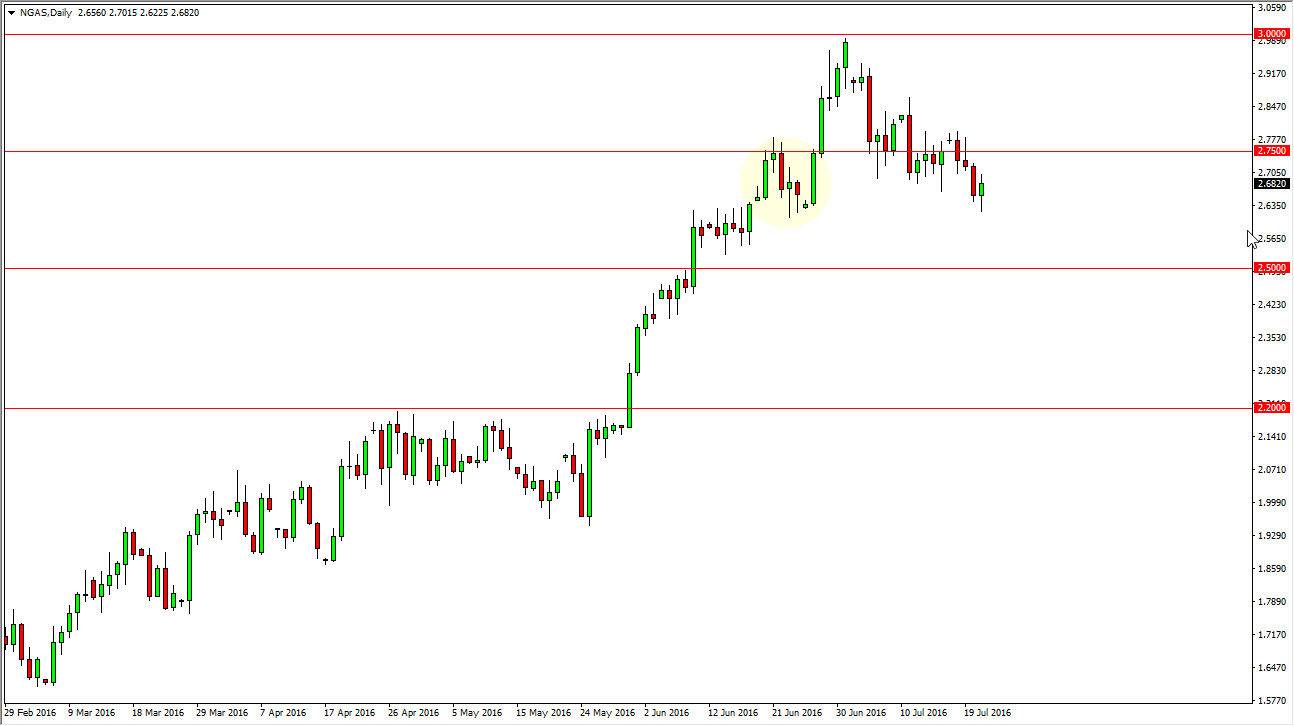

Natural Gas

The natural gas markets initially fell during the course of the day on Thursday, but turned right back around to form a bit of a hammer. If we can break above the top is hammer, it’s very likely that we trying to reach towards the $2.80 level above. If we can break above there, I think we continue to grind our way towards the $3.00 level. With this, the market should continue to be bullish as it has been for quite some time, and as a result should continue. However, we could possibly continue to fall but I’m not willing to sell this market until we break below the $2.50 level which would have us reaching towards the $2.20 level below there. With this, I believe that the market will more than likely trying to reach towards the $3.00 level above, which of course is a large, round, psychologically significant number and quite often those need to be tested several times before the market is satisfied. With this, I anticipate the buyers will return fairly soon.