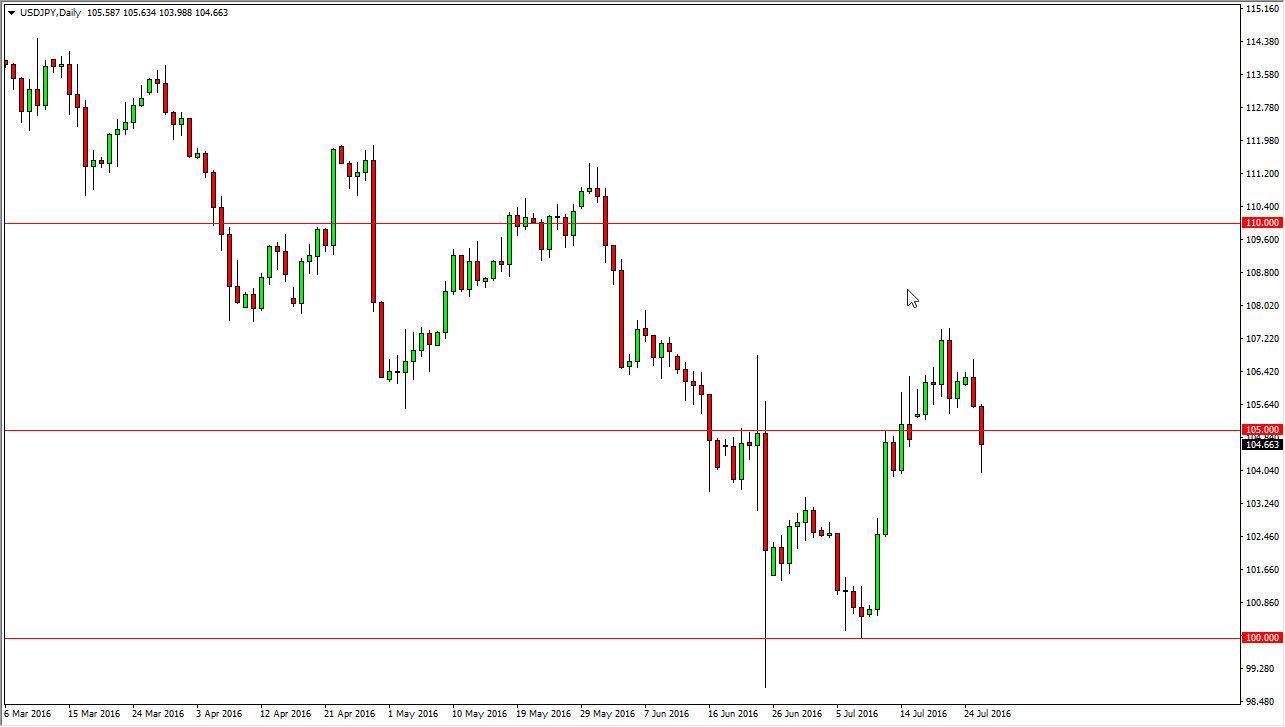

USD/JPY

The US dollar fell against the Japanese yen during the trading session on Tuesday, breaking through the 105 support level at one point during the day. However, we turned around to bounce and form a somewhat supportive looking market, so it’s very possible that the buyers may reenter. This will be especially true after the FOMC Statement, because we may get something to move the markets out of that meeting. On top of that, the Bank of Japan will work against the value of the Yen given enough time, so quite frankly I think it’s only a matter of time before the buyers return. We would need a sustained move above 105 for me to be comfortable buying though.

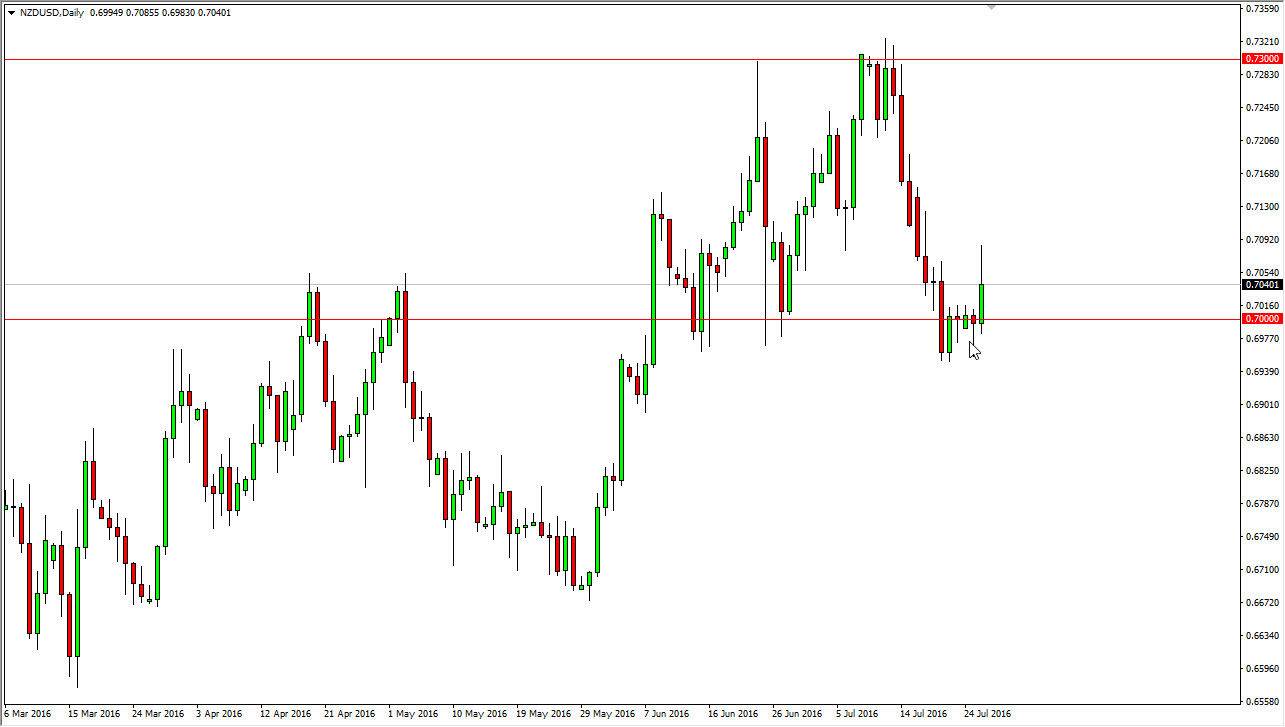

NZD/USD

I believe that the New Zealand dollar showed quite a bit of strength during the course of the day on Tuesday, but we do get back about half of the gains. Because of this, I think that simply shows that there is going to be a significant amount of volatility on the move higher. However, I do think that we continue to grind higher, and that would more than likely be the key word here: grind.

With this, it’s very likely that short-term pullbacks will offer buying opportunities going forward as the New Zealand dollar strengthens. I have no interest in selling this market until we break below the 0.69 level, which at this point in time doesn’t look very likely as we have fallen far too quickly for the bearish pressure to continue. With this, I do believe that we could continue the general uptrend that we had seen recently, before the shock to the markets a couple of weeks ago. The Reserve Bank of New Zealand wants to have a lower valued Kiwi dollar, but quite frankly if the FOMC suggests that rates are going to be on hold for some time in the United States, they can’t do a thing to fight the Federal Reserve.