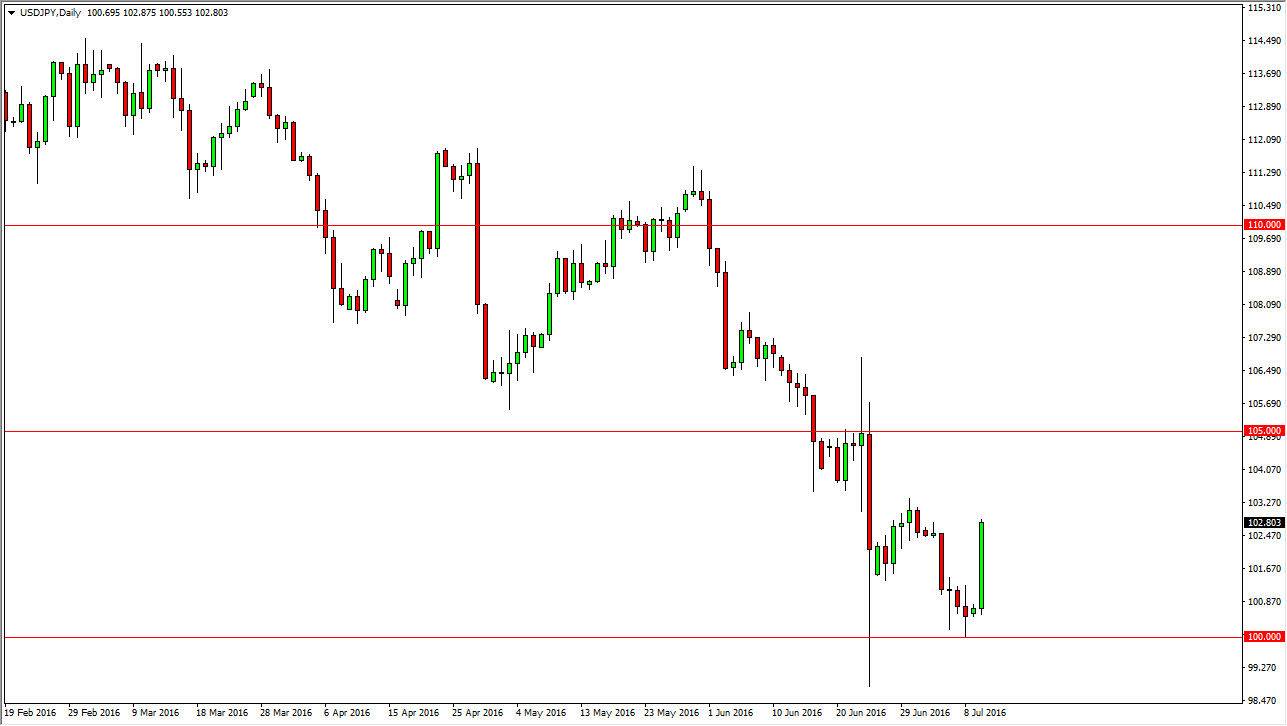

USD/JPY

The USD/JPY pair rallied during the course of the session on Monday, as the Japanese can’t the chance to react to the very strong jobs number on Friday. Because of this, the market looks as if it is ready to continue going higher, but the 103 level could offer a bit of resistance. If we break above there, the market should then go to the 105 level. The market itself looks like one that’s ready to reach towards the 105 level and try to break out above there, but it is going to be a difficult hurdle to overcome. If we do break above the 105 level, the market should continue to go to the 107 level. An exhaustive candle near the 105 level should offer selling opportunities in an already long term downtrend. Ultimately, this is a market that will be very choppy if we trying to change the trend, which I think we are indeed starting to do.

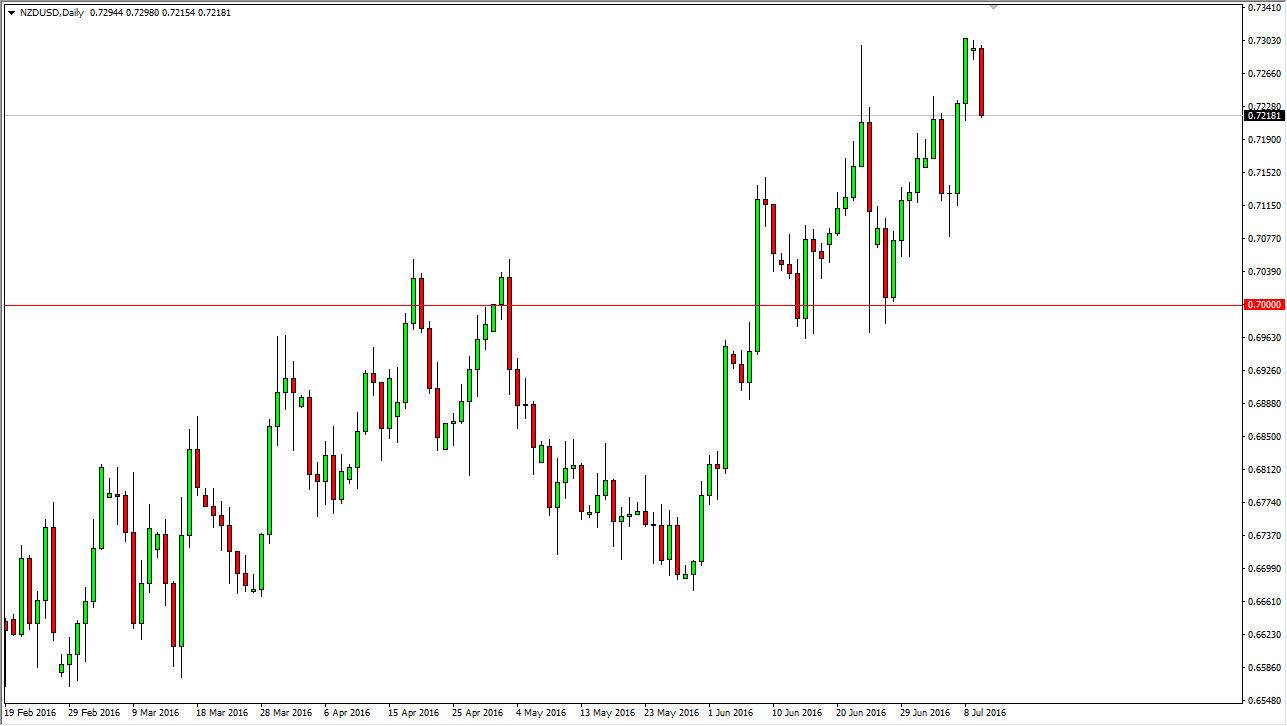

NZD/USD

The New Zealand dollar fell significantly during the course of the session on Monday, testing the 0.72 level. This is an area that has shown resistance in the past, so it should show a significant amount of support now. Ultimately, this is a market that should continue to find buyers below, and a supportive candle would be reason enough to go long as the New Zealand dollar has been very strong lately. Ultimately, I have no interest in selling this market until we break down below the 0.70 level, which seems very unlikely at this point in time. I believe that area is essentially the “floor” in this market, and with this being the case I think that the buyers will continue to come back into the market every time we drop and offer value, as the interest-rate differential still continues to be relatively wide when taken into account and compared to the rest the Forex market.