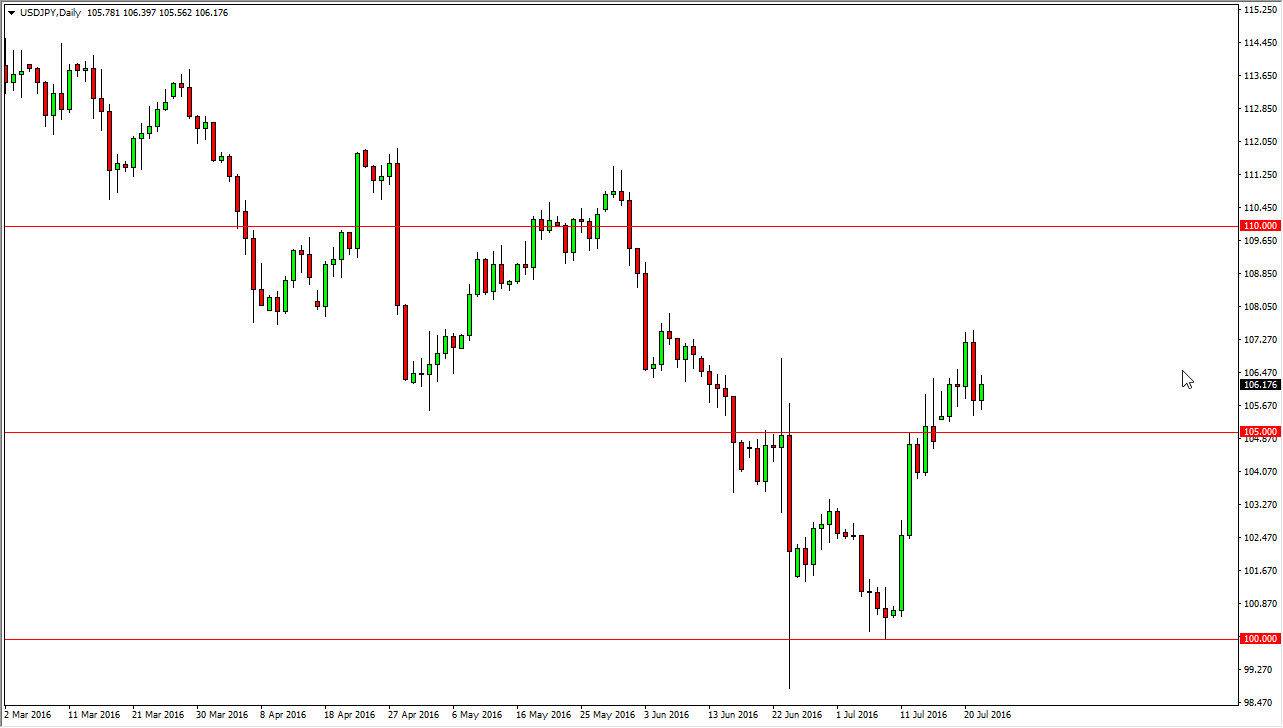

USD/JPY

The US dollar rose against the Japanese yen slightly during the session on Friday. This is a market that continues to have a little bit of a boost underneath it due to the Bank of Japan looking very likely to get involved if we fall. Because of this, I feel that every time we pullback, you have to start thinking about value and possibly going long due to the fact that the Bank of Japan’s interest in the Japanese yen losing value is probably one of the worst kept secrets in the Forex world right now. I believe that we will eventually grind our way back to the 110 level.

AUD/USD

The Australian dollar is a real mess at the moment, as we continue to bounce around in general, hanging about the 0.75 handle. This is a market that does have an upward bias to it, but it is noisy and choppy to say the least. Gold markets have been showing signs of resiliency again, so that could bring money back into the Australian dollar, but recently we have seen the Reserve Bank of New Zealand suggest that perhaps they will have to cut interest rates. This of course has a bit of a “knock on effect” in the Australian dollar itself.

Ultimately, I don’t really like this pair at the moment they do recognize that it could offer a long-term buying opportunity as more of an investment and less of a trade. Because of this, it is possible in my estimation to take long positions in small increments, but quite frankly I think there are much easier pairs to trade at the moment, as there so much going on as far as the safety bit for the US dollar is concerned. However, if gold releasers to take off again, I suspect it’s only a matter of time before the Australian dollar benefits.