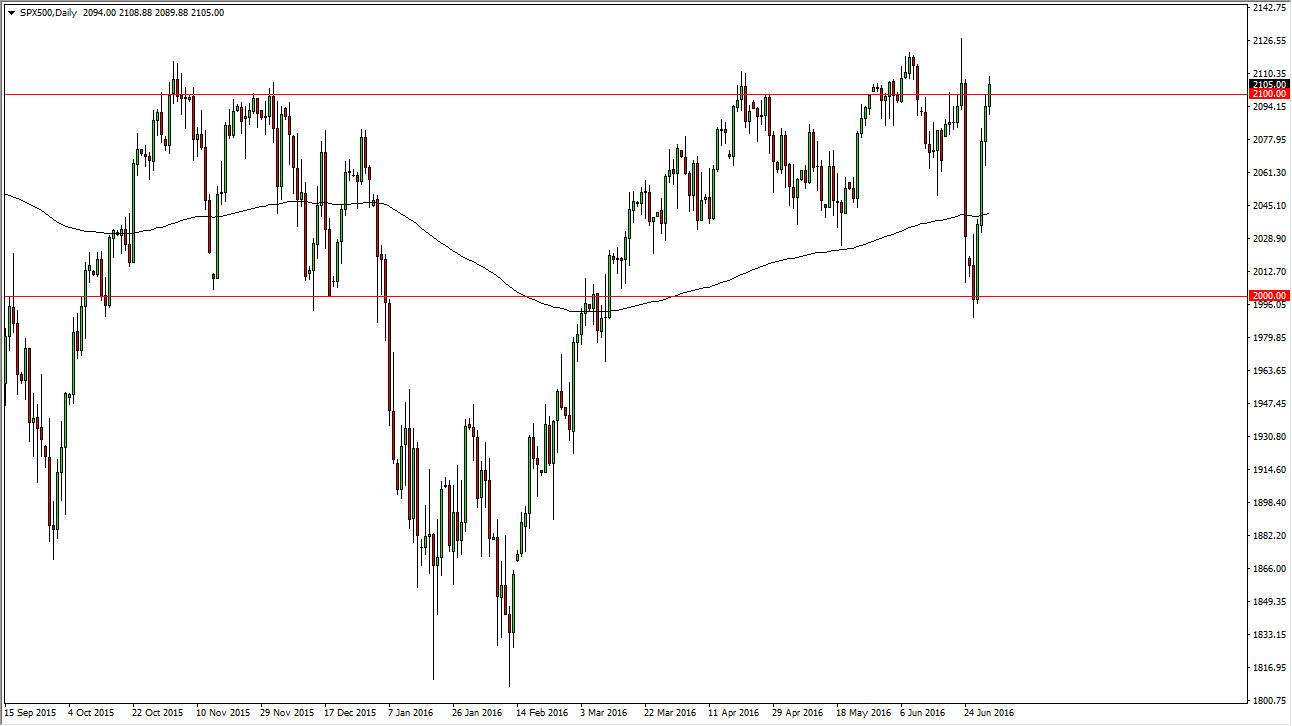

S&P 500

The S&P 500 of course had a positive session on Friday and will be closed today, but at the end of the day I think you need to look at this market from a longer-term perspective. The recent rally tells me one specific thing: that there is still a lot of underlying demand for the S&P 500. I believe that it’s only a matter of time before buyers get involved when we pullback, and that will more than likely continue to be the case. We are bit overextended at this point so we go back to work on Tuesday, I believe that we will see buyers jump into the market and take advantage of perceived “value.” After all, there are a lot of stock traders out there that are looking to avoid the European indices, so that should continue to help the American indices.

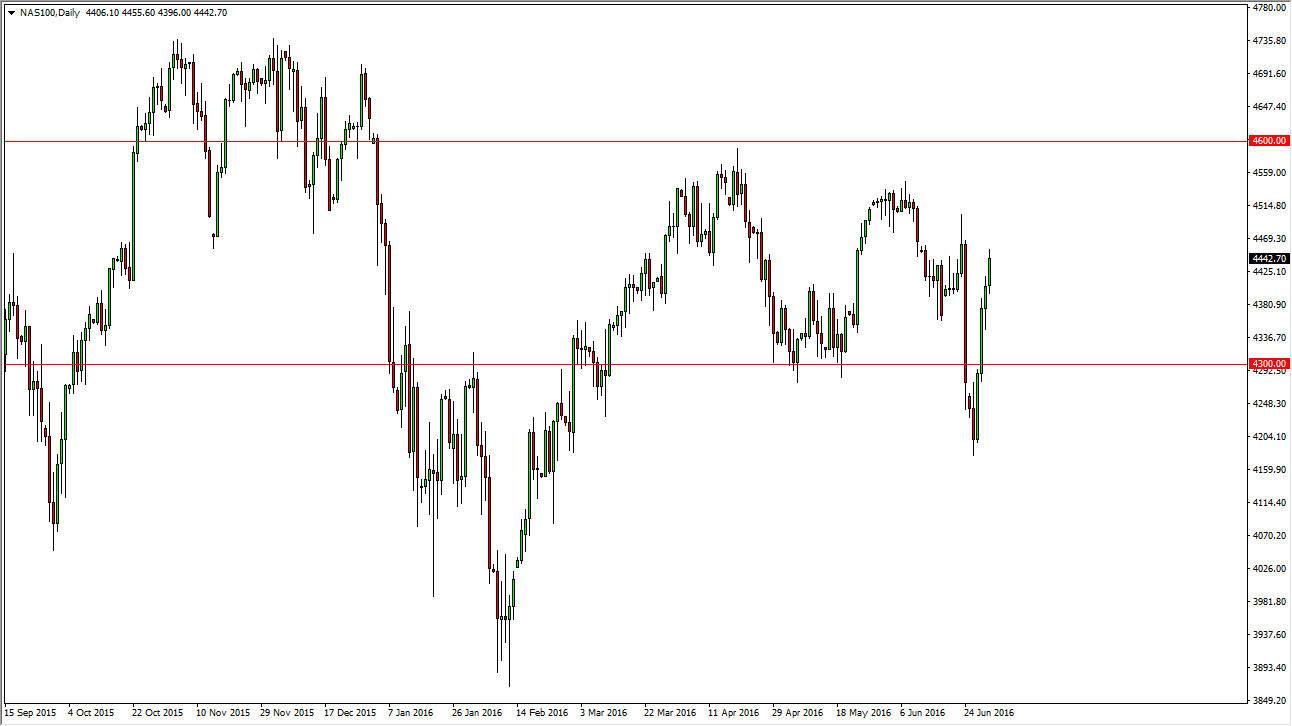

NASDAQ 100

The NASDAQ 100 had a positive session as well, and looks set to continue going higher over the longer term but just like the S&P 500, we are bit overbought at this point. I believe that short-term pullbacks will more than likely offer value though, and it just like in the S&P 500, I would be looking for short-term candles that show signs of support, as it should show that there is still plenty of demand.

I believe that the 4300 level below is essentially going to be the “floor” in this index, as the built-in installation of not being European helped. However, you should keep in mind that the NASDAQ 100 has been a bit of a laggard lately, so with that being said I think that I will be paying more attention to the S&P 500 or even the Dow Jones Industrial Average than the NASDAQ 100 of the next few days. Either way though, the 3 do tend to move in tandem, so there should be a trade.