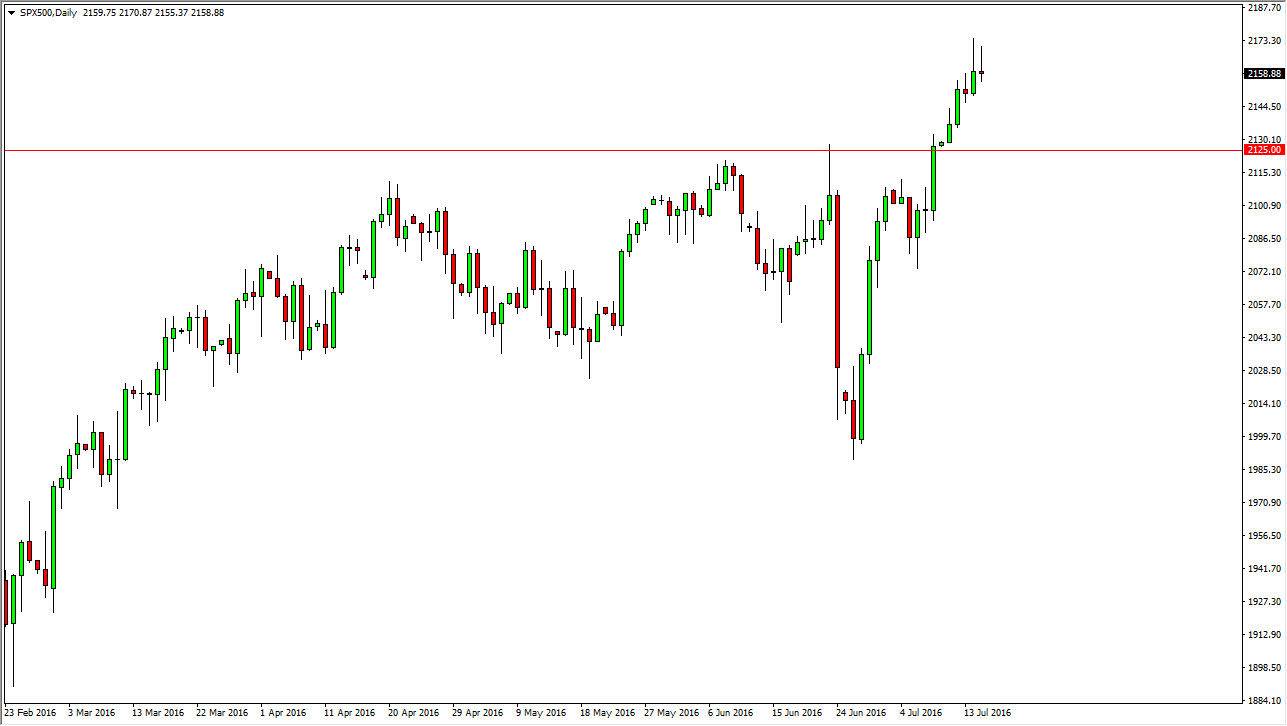

S&P 500

The S&P 500 rallied during the course of the session on Friday, but just like on Thursday ended up falling and forming a bit of a shooting star. The shooting star of course is a negative candle but I believe that this will simply be a short-term pullback more than anything else. The 2125 level below should be the “floor”, and I believe that there will be a lot of buying pressure in that area. Quite frankly, we may be a little overextended at this point and it makes a lot of sense that perhaps people will relax a bit and there will be plenty of people down near the “floor” that will be looking to take advantage of what has been an obvious breakout. On the other hand, we could break above the highs on Thursday, and that would be reason enough for me to go long as well.

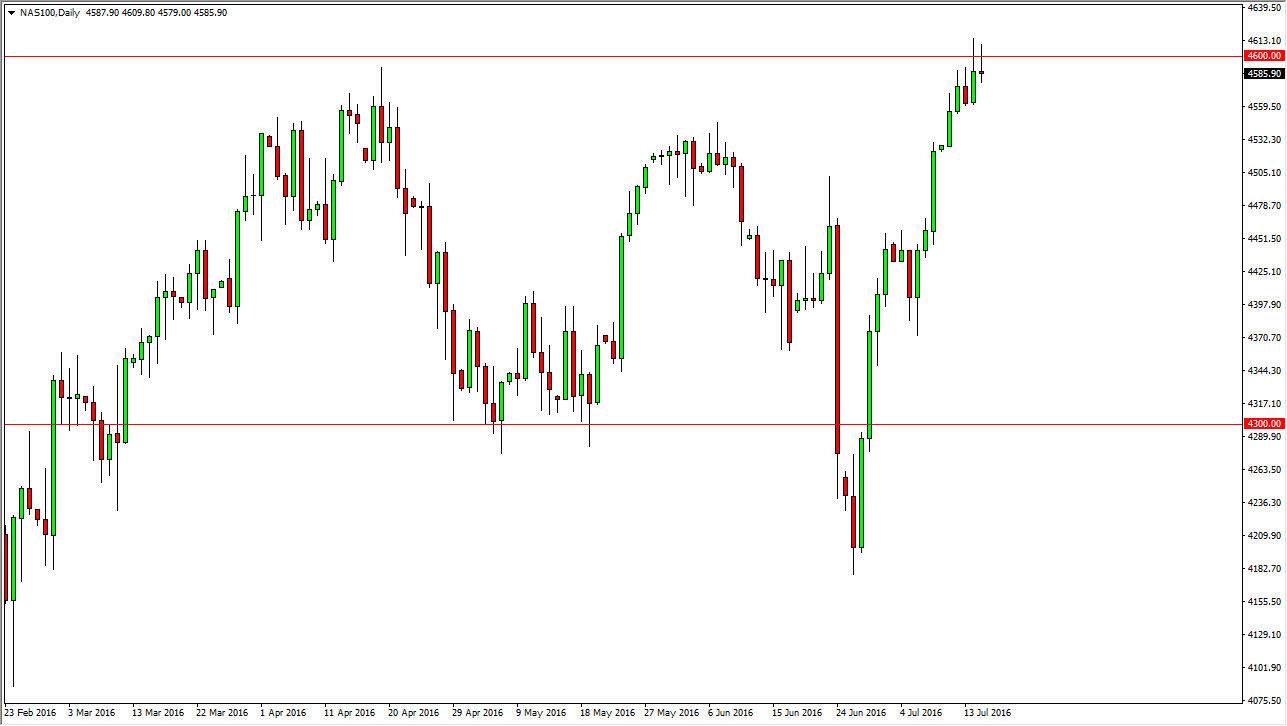

NASDAQ 100

The NASDAQ 100 broke higher during the day again on Friday, but just like on Thursday we ended up struggling above the 4600 level. We formed a shooting star during the day on Friday just as we did on Thursday, so quite frankly I feel that this market needs to pullback in order to build up enough momentum to continue going higher. The 4500 level below should be very supportive and I feel that it’s only a matter of time before the buyers step in and push this market higher from that level. Alternately, just as in the S&P 500, we could go higher than the Thursday candle and break out to the upside from here. Quite frankly, even though this market is a little bit overextended, it’s not as overextended of the S&P 500. It should follow the S&P 500 of the longer-term, because it has a tendency to do so historically. At this point though, it’s very likely that we will play “catch-up” over in this market.