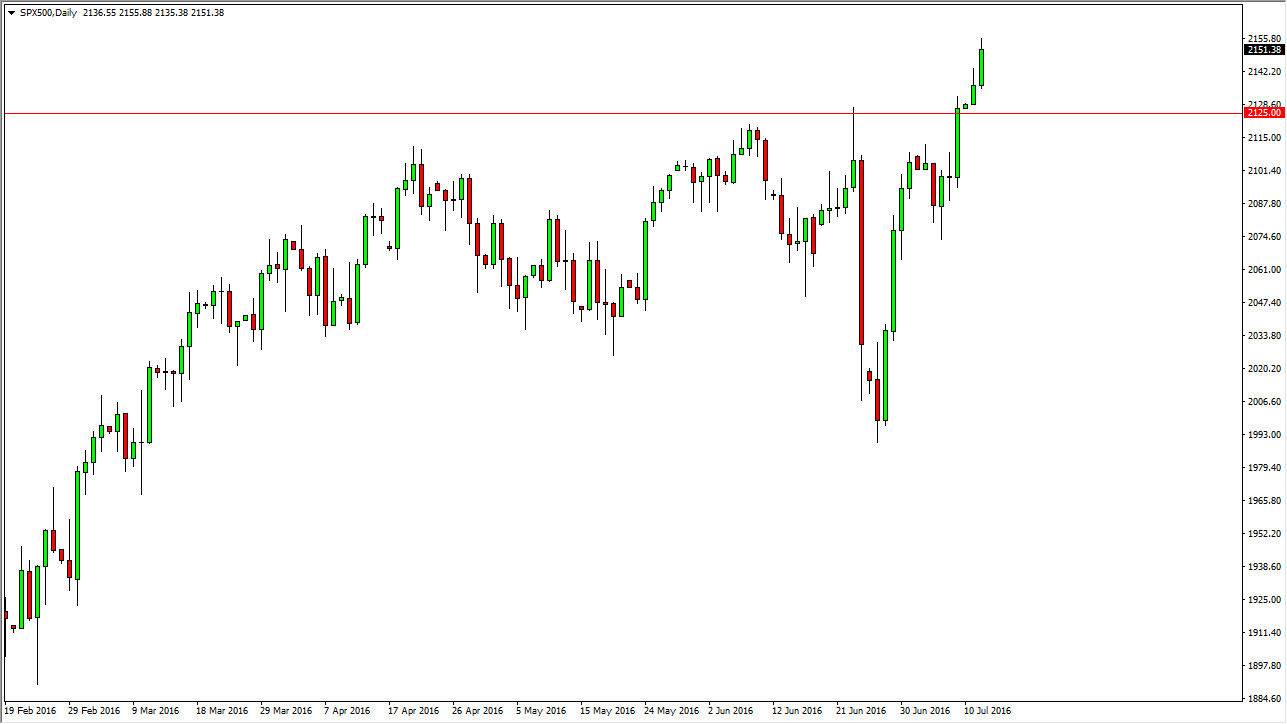

S&P 500

The S&P 500 broke higher during the course of the day on Tuesday, clearing the top of the shooting star from the Monday session so therefore it looks as if we are going to go higher as the market will has broken above a pretty significant resistance barrier. With this, I feel that the 2125 level now is going to act as a bit of a “spongy floor”, as it could extend somewhere down towards the 2100 level. This being the case, I feel that the market will reach towards the 2250 level given enough time, and that being the case I feel that this is a market that you can only go long and. I have no interest in selling this market, and believe that this market will continue to benefit from a lack of interest-rate hikes coming.

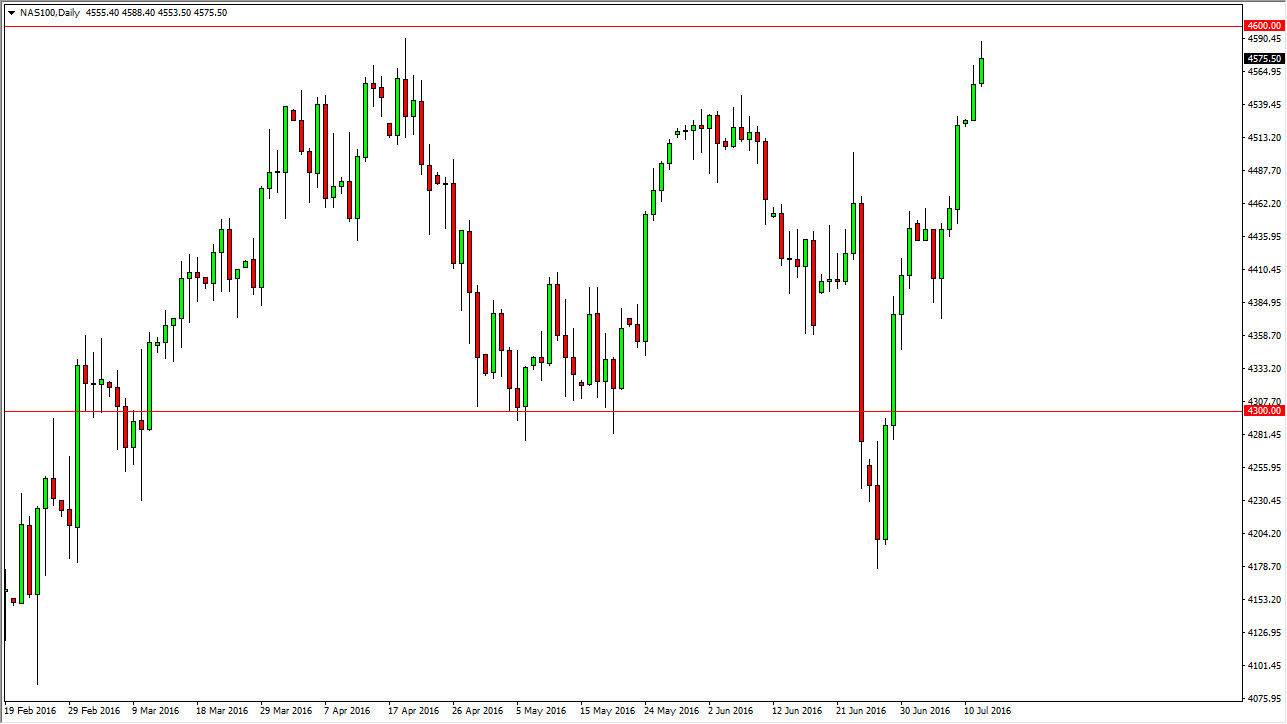

NASDAQ 100

The NASDAQ 100 rose during the course of the day but we are starting to reach towards the 4600 level, as we have continued to see buying pressure. If we can break above the 4600 level, the market should continue to go much higher, but at this point in time I feel that the market is a little bit overextended, so we may struggle to break above 4600 right away. A pullback should offer buying opportunities below on signs of support, and that’s exactly how I plan on approaching this particular marketplace.

I have no interest in selling, the explosive move to the upside has been far too strong lately, so with that being the case I feel that it is a “buy only” market, and perhaps even needs to catch up to the other markets as although it’s been stronger over the last couple of sessions, it has lagged behind the S&P 500 or the Dow Jones Initial Average. With this being the case, I believe that the market will continue to go higher over the longer term either way. I am a buyer only in this market, but recognize that we are a little bit overextended.