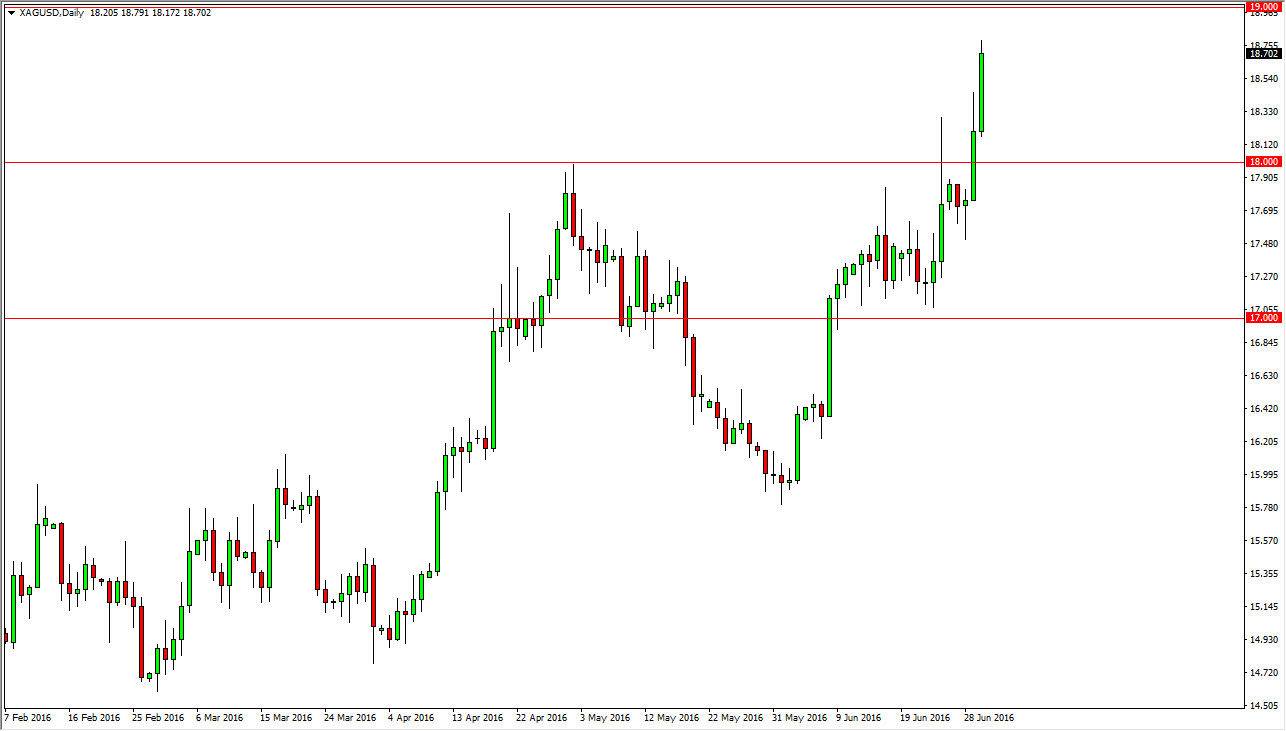

Lately, I’ve been speaking about silver quite a bit. After all, it is one of the better performing markets that I follow, and we have finally broken above the $18 level which was a massive resistance barrier. With this, it’s likely that the market will continue to go much higher, as this area should now be essentially a “floor” in this market going forward. I believe that we will aim for the $20 handle now, and perhaps even go higher than that. However, there won’t necessarily be a straight shot to that level, so I think that we will pull back from time to time and offer buying opportunities.

With this being the case, I believe that the silver market is simply showing that there is a complete distrust of most currencies around the world right now, as the fallout from the so-called “Brexit” will continue to weigh upon the Euro and the Pound. While I know this particular contract is priced in US dollars, the reality is that there is a bit of an “knock on effect” in this market as silver price in this currency shows a massive amount of demand.

Buy only

At this point in time, I have no interest in selling and I believe that the support at the $18 level actually extends all the way down to the $17.70 level, meaning that it is more of a “range” and less of a line. I believe that the markets will offer quite a bit of short-term trading opportunities, and if you have the ability to be patient, you can simply buy dips again and again as this market will grind its way to the upside.

If you have the ability to buy silver in either British pounds or Euros, that’s probably going to be an even better trade, but I recognize that most of you do not. With this, I believe silver goes higher, and as a side note is probably only a matter of time before gold takes off. Ultimately, I am very bullish of the precious metals in general, but it appears silver will lead the way.