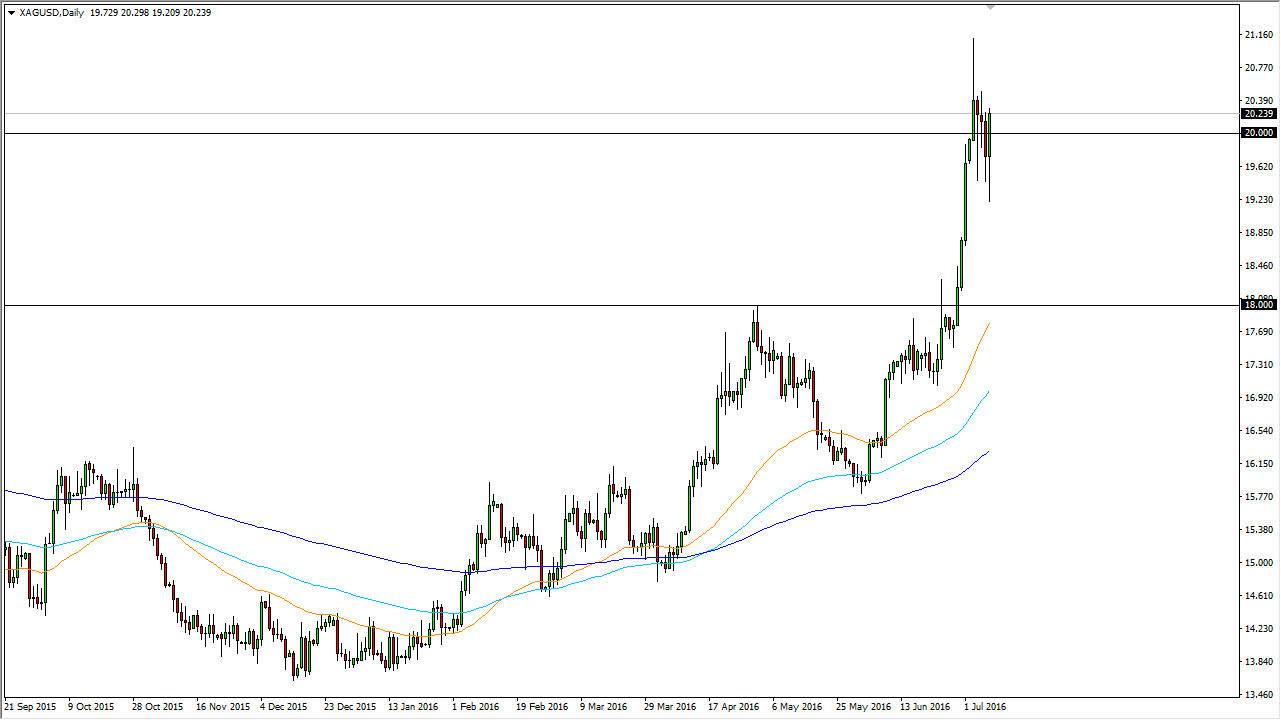

The silver markets initially fell during the day on Friday, as the jobs numbers came out much stronger than anticipated. This made the US dollar of course strengthen, which work against the value of precious metals in general initially. However, we eventually saw the gold and silver markets rally significantly during the day and in fact the silver markets formed a nice-looking hammer. The hammer is based upon the $20 handle, an area of psychological significance. Because of this, I believe that the silver markets are ready to go higher given enough time, and will eventually break out to the upside.

We have been in a very parabolic move over the course of the last several weeks, so it makes a lot of sense that we would have to sit still for a minute. I believe that the market is going to continue to go higher eventually, but we need to build up the momentum needed in order to go higher. At this point in time, I have no interest whatsoever in selling this market.

Moving averages

I have 3 moving averages plodded on the chart, the 50 day exponential moving average, the 100 day exponential moving average, and finally the 200 day exponential moving average. All of these are pointing up and are nicely spread apart which of course is a very positive sign when it comes to an uptrend. The 50 day exponential moving average, pictured in red, are just below the $18 level. With this being the case, I have no interest whatsoever in selling this market, and I look at any pullback as potential value. In fact, I have been buying silver in the physical sense for the longer-term investment type of trade. I also believe that CFD markets offer quite a bit of value as we can adjust the size of trades in this market. I don’t like futures markets only because they tend to be very expensive and volatile, but at the end of the day I believe that we go much higher and it soon becomes more or less a “buy-and-hold” market.