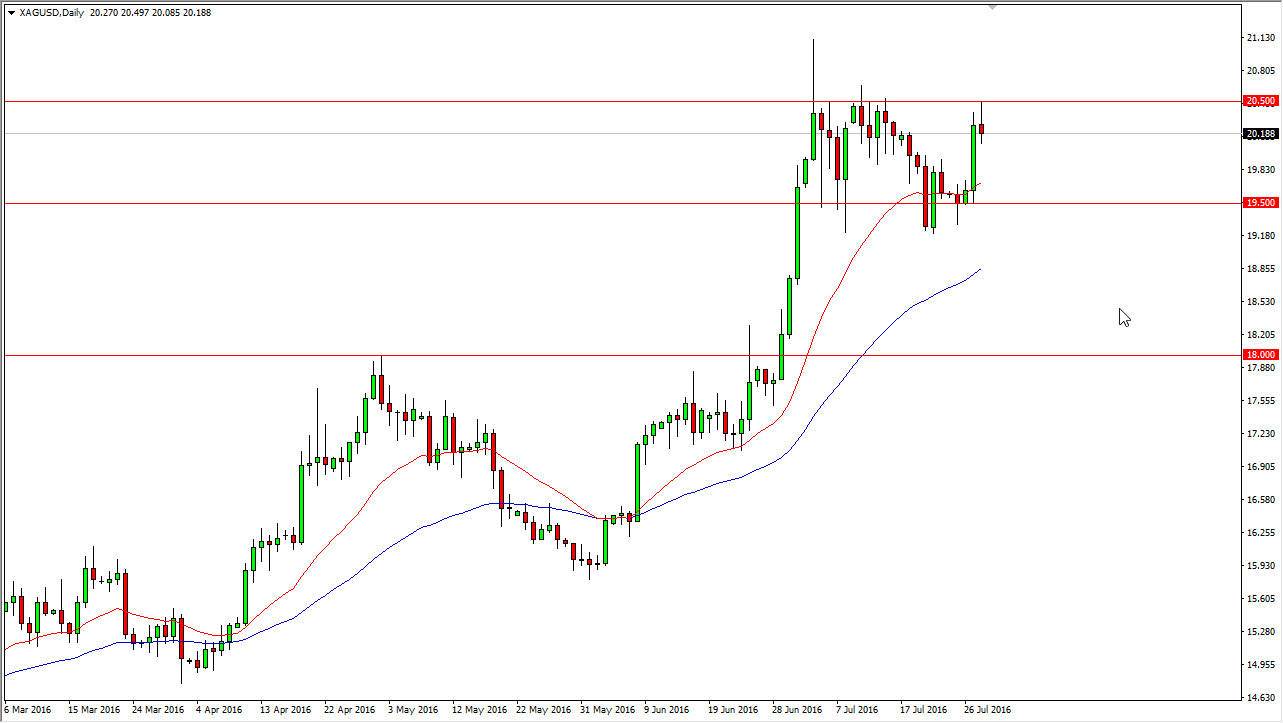

Silver markets continue to look as if they are one of the more interesting markets right now, and during the day on Thursday we tried to break out above the $20.50 handle, which was the top of the recent consolidation area. Below there, the $19.50 level is supportive, and as a result it is likely that this market will continue to go back and forth, but I believe that there is a lot of bullish pressure underneath. The 20-day exponential moving average is on the chart, and the color red, and as you can see it is just below the recent impulsive candle that shot higher during the day on Wednesday.

With this, I believe that the shooting star suggests that we are going to go lower, perhaps possibly looking for support below. I think that this is a perfect example of the old adage “consolidation means continuation”, which means that typically as we rally we will have to take breaks from time to time. With this, it looks as if the market is trying to find buyers below in order to continue the massive move higher.

Silver continues higher longer-term

I believe the longer-term silver continues higher mainly because of the concerns in the European Union and the United Kingdom. After all, people are running from those areas as far as money is concerned, with perhaps the lone exception being the stock markets. But quite frankly that is just due to softening currencies, so having said that it makes sense that this is one of the markets of people go to in order to store value when it comes to currency.

Given enough time we will break out and I believe we will target the $22.50 level above, and then eventually the $25 level. I have no interest in selling, but I do recognize that if we broke down below the $19.50 level, that would be very negative, especially if we can do for any real length of time. I believe that the absolute “floor” is at the $18 handle below.