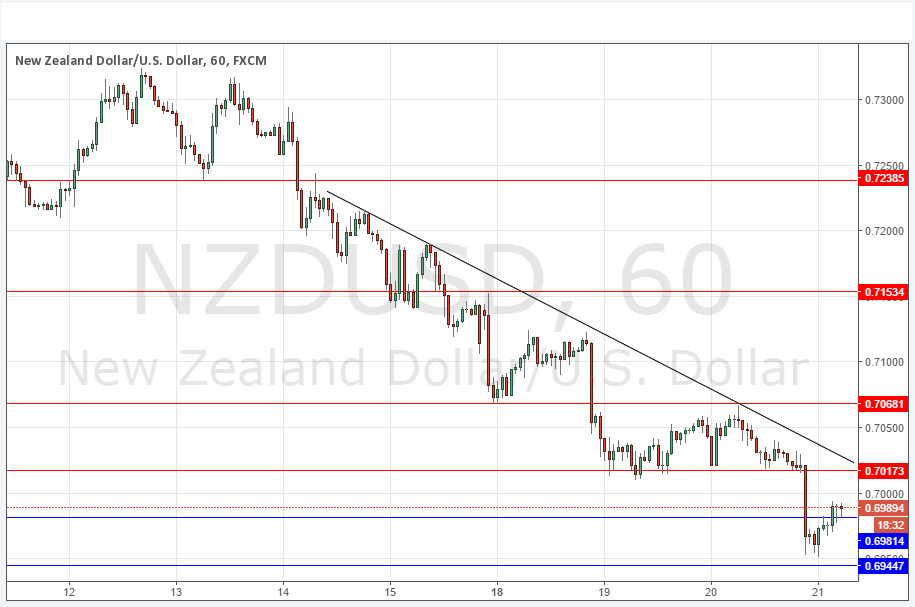

NZD/USD Signal Update

Yesterday’s signals were not triggered as there was no bullish price action at either 0.7017 or 0.6981.

Today’s NZD/USD Signals

Risk 0.75%

Trades may only be taken between 8am New York time and 5pm Tokyo time during the next 24 hours.

Long Trade 1

Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 0.6945.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trades

Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 0.7017 or 0.7068.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

NZD/USD Analysis

I was wrong yesterday in being too keen to look for a bullish reversal off support just above the big round number at 0.7000. What we got instead was more bearishness and a continuation of this strong short-term downwards trend. This pair had been quite well established bullishly but now that has been completely called into question.

However at the time of writing we have seen some solid buying between 0.6950 which is driving the price back up to about 0.7000 and a bullish reversal in this area would not be a surprise as this area has been a key floor over recent weeks.

A sustained break below 0.6980 would be a very bearish sign.

Concerning the NZD, there is nothing due. Regarding the USD, there will be a release of Unemployment Claims data at 1:30pm London time.