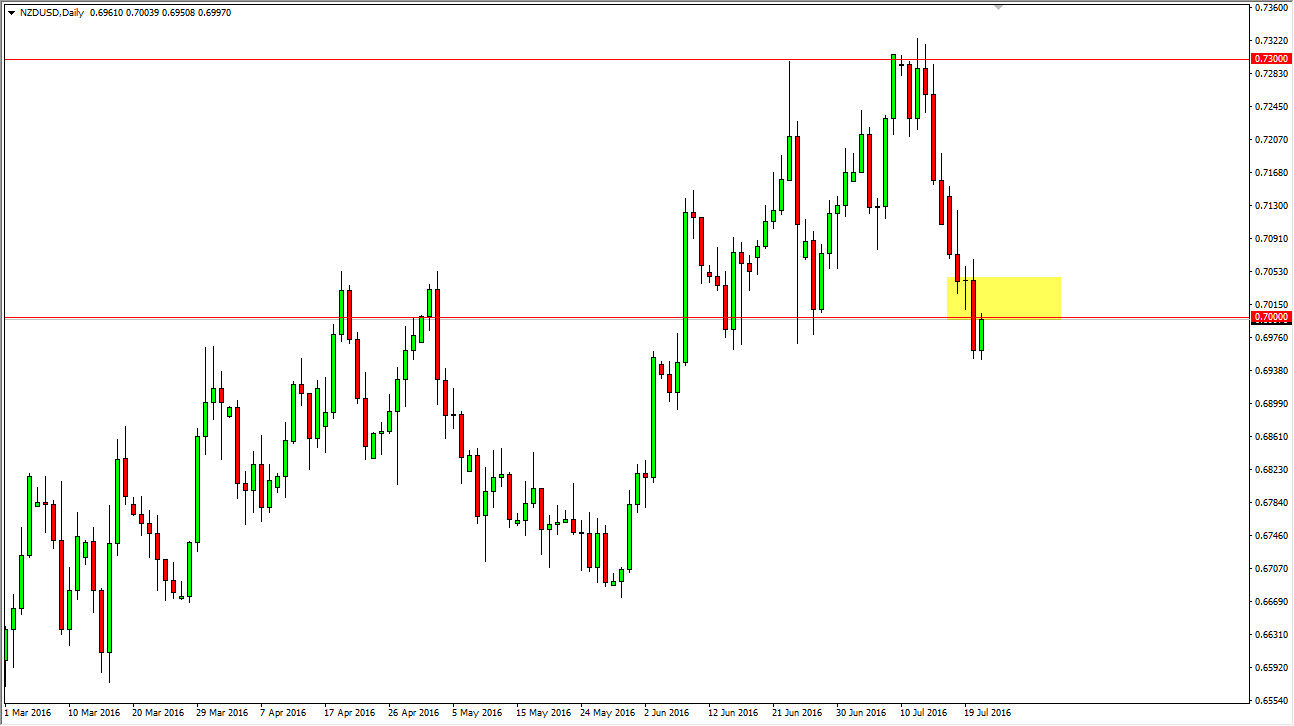

During the course of the day on Thursday, the New Zealand dollar did get a bit of a bounce after falling significantly on Wednesday. Of course, you have to keep in mind that the Reserve Bank of New Zealand recently suggested that we could perhaps he rates if the value of the New Zealand dollar continues to strengthen, so having that in the background makes sense that we saw sellers come into the marketplace. At this point though, on the attached chart I have a yellow box. I believe that we can break above that yellow box, extensively the 0.7050 level, we could very well continue to go higher. We are at the extremes of support in the consolidation area that we have been in for some time, so I believe that a bounce is not only reasonable from here, but almost expected.

Commodity markets

Remember the commodity markets can have an influence on the New Zealand dollar, and as a result you have to pay attention to the overall “mood” of the futures markets during the session today. I think that this market will be very sensitive to them as per usual, and with that will have to wait to see what happens. I think that the US dollar continues to strengthen against most currencies, the New Zealand dollar until the last several sessions has essentially been a bit of an outlier.

If we do break down, I believe that we could reach as low as 0.67 over the next couple of weeks. However, the selloff up until this point has been rather brutal so it almost demands that we get a little bit of a rally at this point in time due to the fact that no market moves in one direction forever. There is a lot of noise below though 2, so keep in mind that if we start selling, it’s going to be choppy all the way down to the target.