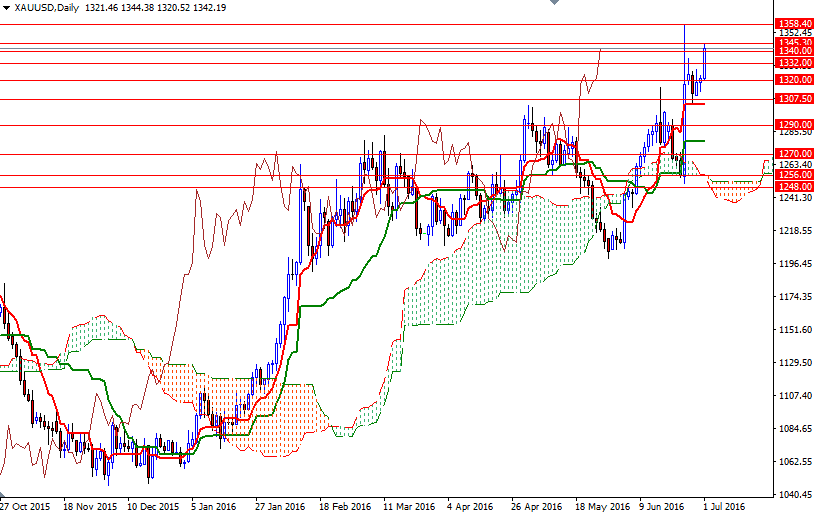

Gold prices settled at $1342.19 an ounce on Friday, rising 8.8% on the month and 7.25% over the quarter. The XAU/USD pair swung between the $1300 and $1200 levels until late June as market players speculated on the timing and speed of an interest rate hike by the U.S. Federal Reserve and the outcome of the referendum in the UK. While May’s disappointing jobs report raised the possibility that the Fed will hold off hiking interest rates until September or December and provided the oxygen for the gold to sprint, the precious metal’s recent gains were mainly driven by the risk-off sentiment in the global markets. Investors poured money into the safe-haven metal in order to diversify their assets in the wake of the UK’s decision to leave the European Union.

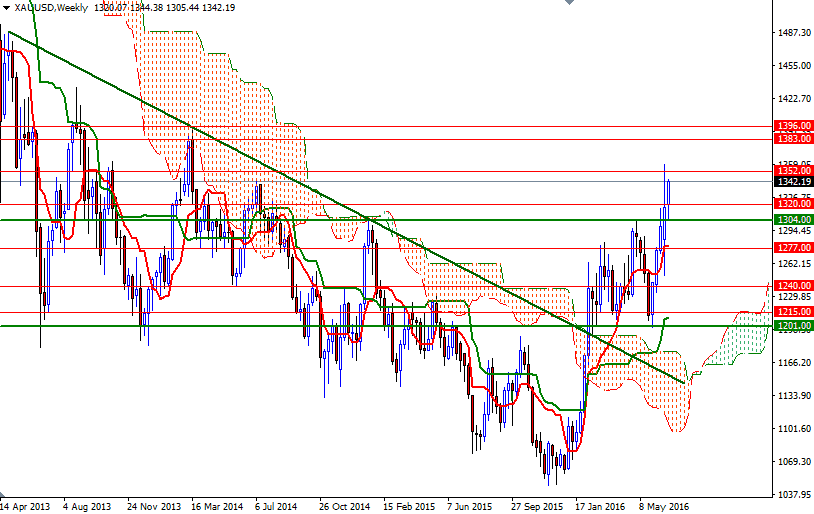

The shock of the Britain’s exit vote will wear off in the market but concerns about the political and economic aftermath will probably continue to dominate the headlines. Meanwhile many will focus on the Fed’s Open Market Committee meeting late July for clues on policymakers’ opinion on the economy and when they could raise rates. The technical picture for gold significantly improved since February when the market penetrated the weekly Ichimoku cloud and broke above the descending trend line originating in 2013.

Holding above the $1304 level is also a bullish sign and suggests that this recent rally has the potential to run further to the upside. If the XAU/USD pair passes through $1358.40-1352, the next major resistance level would be around $1392, reached in March 2014. A retracement downwards from there is highly likely, though we would see XAU/USD trading as high as $1434 in this quarter. To the downside, the $1320 and $1304 levels should offer support. If the market drops back below $1304 then we could return to the $1277 area. Invalidating this support on a weekly basis would open up the risk of a move towards the $1250/40 area.