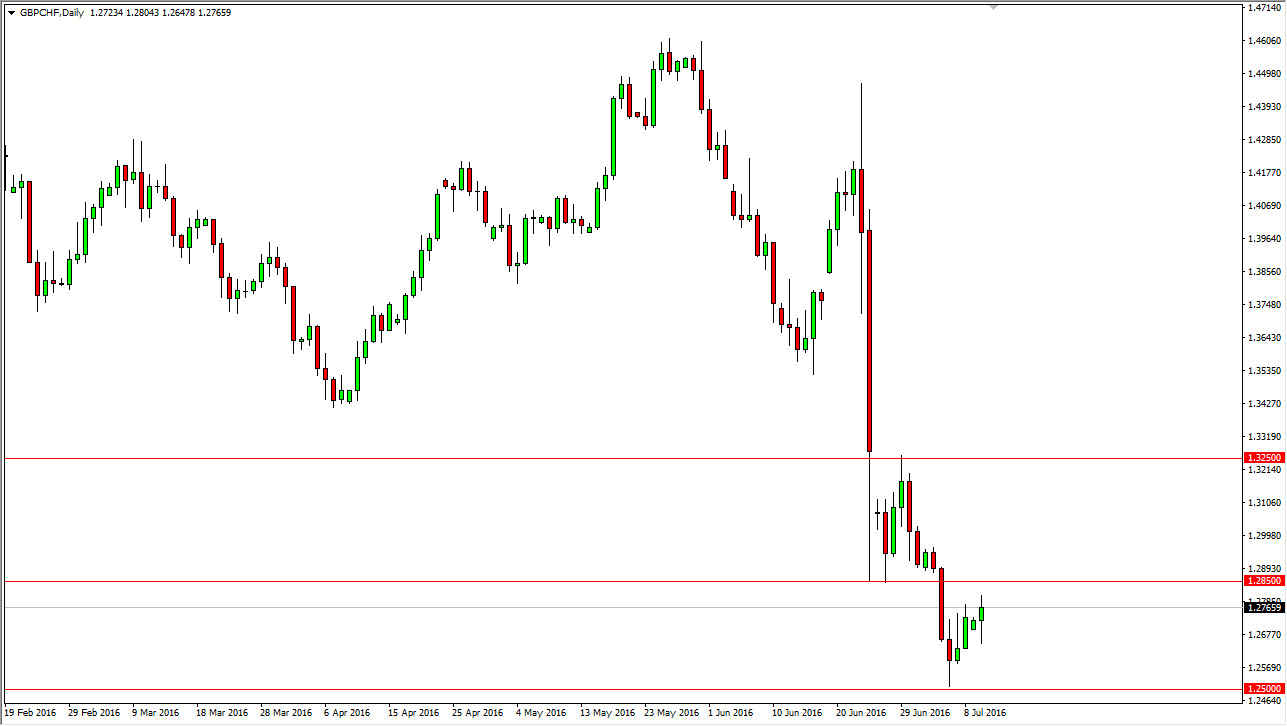

During the day on Monday, the GBP/CHF pair initially fell during the course of the session but as you can see we turn right back around to form a bit of a hammer. That of course is a very bullish sign, and the 1.2850 level above could now offer resistance to this hammer. If we can break above the top of the hammer and more and poorly the 1.2850 level, the market could continue to rally and perhaps even reach towards the 1.3250 level. However, expect a lot of volatility and it is a market that’s going to be easier to sell than buying, so at this point in time we may be getting ready to see the beginning of a “relief rally” as this market has sold off so drastically that sooner or later somebody has to be out there willing to take profit.

British pound longer-term downtrend

At this point in time, the British pound is most certainly in a longer-term downtrend, and of course you have the Swiss franc on the other side of this equation which of course has been very bullish for years. With this, it makes sense that this pair will continue to go lower over the longer term, but at this point in time we have certainly seen such a strong selloff that sooner or later people have to pullback in order to build up enough momentum to go even lower.

At this point in time, the Bank of England of course prefers a lower British pound, so I believe that this market will continue to go lower over the longer term. There is the concern of the Swiss National Bank getting involved, but I don’t think that will anywhere near there yet, as they normally will warn the markets had a time where they are starting to feel a little less than comfortable with curried exchange rates. With this, I’m just simply waiting for an exhaustive candle above so I can start selling.