The difference between success and failure in Forex trading is very likely to depend upon which currency pairs you choose to trade each week, and not on the exact trading methods you might use to determine trade entries and exits. Each week I am going to analyze fundamentals, sentiment and technical positions in order to determine which currency pairs are most likely to produce the easiest and most profitable trading opportunities over the next week. In some cases it will be trading the trend. In other cases it will be trading support and resistance levels during more ranging markets.

Big Picture 3rd July 2016

Last week I predicted that the best trades for this week were likely to be short GBP against USD and long Gold and JPY against USD. The results of these trades over the week saw Gold up 2.02%, the Yen down 0.26%, and the Pound down 3.03. Overall each trade was a winner by an average of 1.60%, which is a very good result.

The focus of the market is still on the aftermath of the Brexit vote, although global equity markets have been recovering. The wider British equity market represented by the FTSE 250 Index and the British Pound however both remain down significantly on their levels from before the vote. It is not really a clear-cut “risk off” picture however as we do see some resilience in risky assets. To complicate matters, this week will see a release of FOMC Meeting Minutes, which will shift the market’s attention back to the USD.

For this week it looks attractive to stick with short GBP and long Gold. In fact, Silver has been performing even better than Gold, and might be a better precious metal to be long of.

Fundamental Analysis & Market Sentiment

Fundamental analysis will probably be of very limited use this week.

Gold and Silver look very strong and the nervous market environment is boosting money flowing into these traditional safe havens. Silver looks especially strong and is trading in blue sky, unlike Gold which is not making any real new highs. However both of these metals might find strong resistance: Silver at the psychologically key level of $20, and Gold is already at $1340.

The British Pound is down sharply, and continues to fall. There is some uncertainty as to whether a Brexit will actually happen, as the vote was not legally binding. The more likely a Brexit is to be implemented, the greater the chance that the GBP will fall further, so there is a strong element of political uncertainty that will affect sentiment on this currency, as well as any poor economic data that gets released which can be blamed upon an economic shock caused by the Brexit vote.

The Japanese Yen has been acting as a safe haven, so if the global equity market’s recovery rally runs out of steam, we can expect to see the currency strengthen.

Technical Analysis

USDX

The U.S. Dollar rose last week, printing a bullish candle albeit one with a prominent upper wick. The interesting development here is that the short-term fall in the USD seems to have been halted, and the price has closed above its level of 13 weeks ago, suggesting that the downwards trend is over. However the action is suggestive of a resistant cap at 12000.

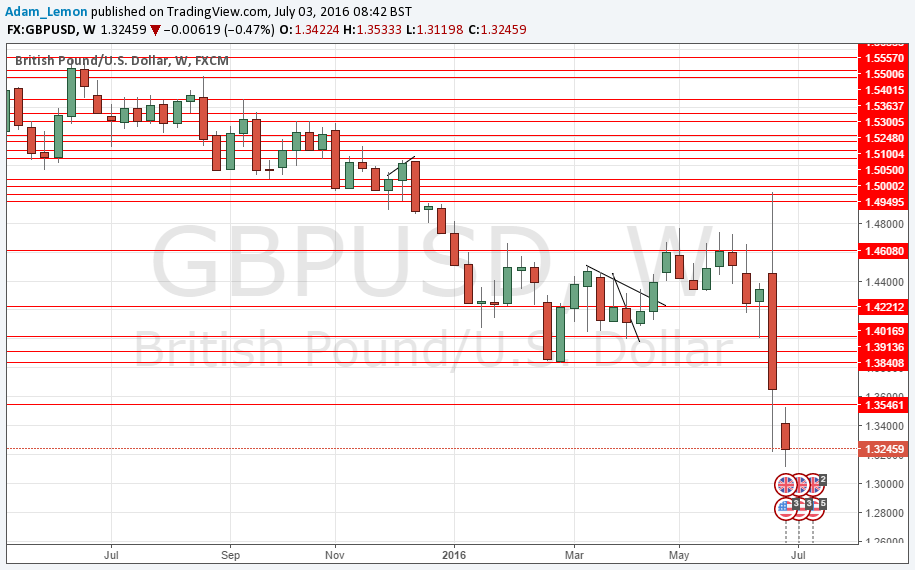

GBP/USD

The aftermath of the Brexit vote saw this pair print a new 31-year low price at 1.3120, and close quite solidly down for the week. The sheer momentum of the move suggests that the price is quite likely to reach new lows and perhaps finally find some support at a key psychological level such as 1.3000 or 1.2750, at least over the short term.

Everything will depend upon political developments in the U.K. making an eventual Brexit more or less likely, but in any case, the pound looks very vulnerable to further sharp falls.

SILVER

Silver saw its strongest weekly move for several years, and is very close to making a new 2 year high. It is above its level from 1, 3 and 6 months ago, showing strong buying momentum and a bullish trend. The question is whether there will need to be a pause at $20.

GOLD

Gold also looks very bullish for all the same reasons as Silver although it has not made a new high this week, and is also right on a key resistance level at $1340. However if this resistance is overcome, there should be little to stop it reaching $1391, which would be the next key resistant level.

Conclusion

Bullish on the JPY and spot Gold and Silver, bearish on the GBP.