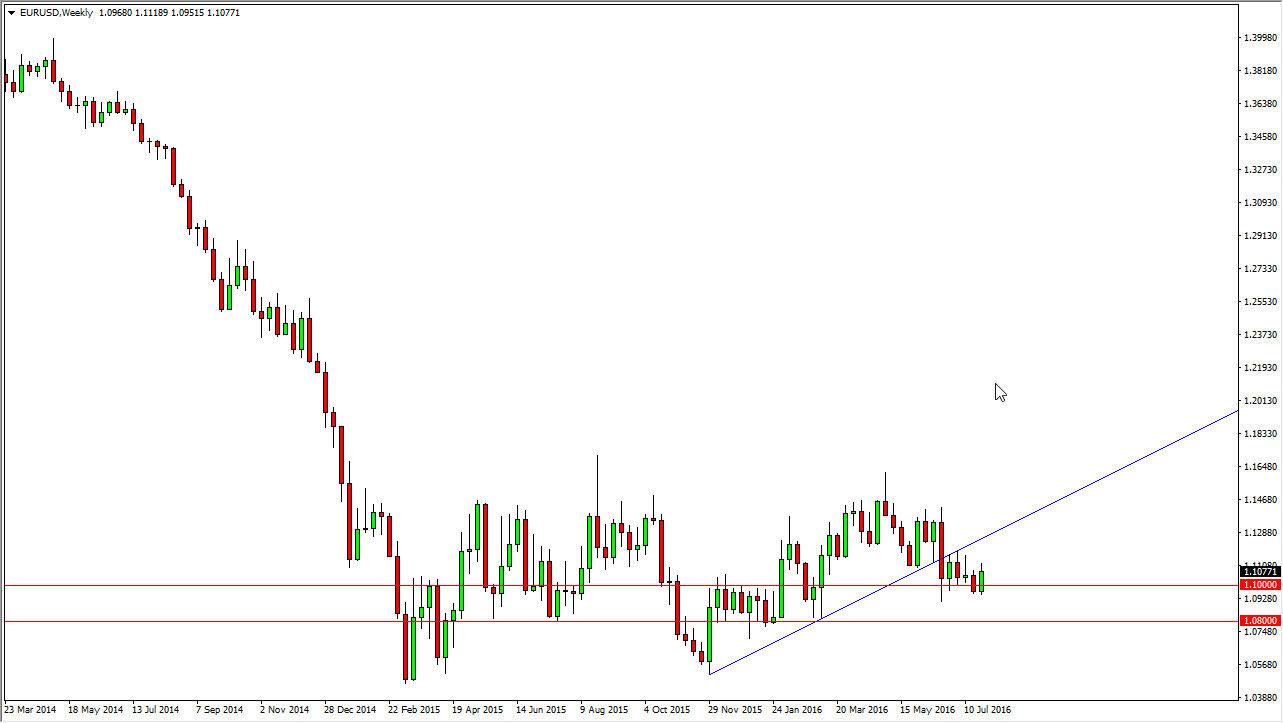

The Euro rose during the course of the final week of August, but I cannot help but notice that on the shorter-term charts it appears that the market is trying to roll over a little bit. We look at the weekly chart, which of course is attached to this article, you can see very clearly that we have been consolidating between roughly 1.05 and 1.15 levels since the end of 2014. I think we are continuing to do that, and I even have an uptrend line on the chart that shows we have in fact broken down below it.

I’m not looking for some type of massive breakout here, I just think we are going to grind down to the 1.08 level, and then eventually the 1.05 level. I don’t even know if we can get down there this month, because it is such a volatile market. However, there are a lot of things going on at one point in time that should continue to work against the value of the Euro.

European Union

The European Union of course is struggling with a lot of questions right now, not the least of which being the fact that the British have decided to leave. On top of that, we have fairly sluggish economies, and a lot of uncertainty when it comes to the future direction of the European Union. I believe at this point in time we will continue to see sellers jump into this market again and again, but it’s very likely that it will be very rocky.

Because of this, I think you will have to continue to work on short-term charts, but at the end of the day it should essentially offer only one direction, to the downside. I believe at this point in time it’s only a matter of time before we continue to see bears come back into this market and run to the safety of the US dollar as the European Union looks so messy.