EUR/USD

The EUR/USD pair initially rallied during the course of the day on Tuesday, but found the previous uptrend line resistive as I had anticipated. Because of this, the market ended up falling significantly and broke down below the 1.11 handle. Ultimately, I believe that this market continues to go lower, as the European Union is now an area where people were going to be concerned. The US dollar is a bit of a safety currency anyway, so having said that it’s likely that the pair will continue to go lower over the longer term. Because of this, it’s probably only a matter of time before any rally sees resistance, and an opportunity to short. I believe that the market will then reach down to the 1.09 level, and then possibly lower than that. I don’t really have a scenario in which I’m comfortable buying at this point in time.

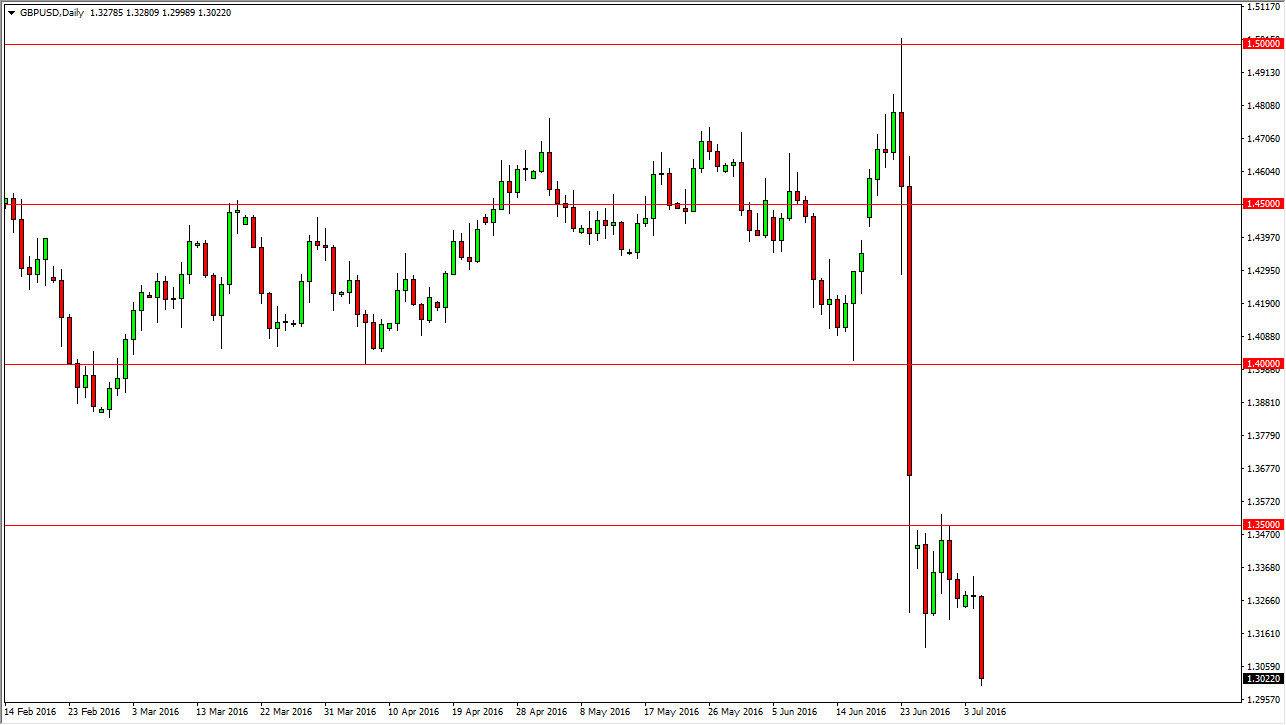

GBP/USD

The GBP/USD pair broke down significantly during the course of the session on Tuesday, as we continue to see negative attitudes prevail in this market. The British pound of course is fairly negative, so having said that it’s likely that every time we rally there should be selling pressure appearing shortly afterwards. The market will more than likely continue to punish the British pound as the United Kingdom leaving the European Union of course is a bit of a shock. At this point in time, I believe that the 1.35 level will be a significant barrier above that can keep the market down, especially considering the gap that formed is fairly significant. With this, I believe that any rally will sooner or later form a nice negative candle that we can take advantage of. If we break down from here, we could also sell as it would be a break down below the 1.3 level which of course is a large, round, psychologically significant number. Ultimately, there is no way to go long of this market anytime soon.