EUR/USD

The EUR/USD pair initially tried to rally during the course of the session on Thursday, but found the previous uptrend line to be a bit resistive so then we fell rather significantly. Ultimately though, we bounced again so we ended up forming a bit of a hammer. Because of this, I am more convinced than ever that the previous uptrend line should now be the biggest barrier to overcome in the short-term. If we can get above that line, I believe that the market will probably try to reach towards the 1.1350 handle. On the other hand, we could end up breaking down from here and as a result I would be interested in shorting exhaustive looking candles as it would continue the negative attitude that we have seen in this market. After all, there is going to be a considerable amount of uncertainty when it comes to the European Union.

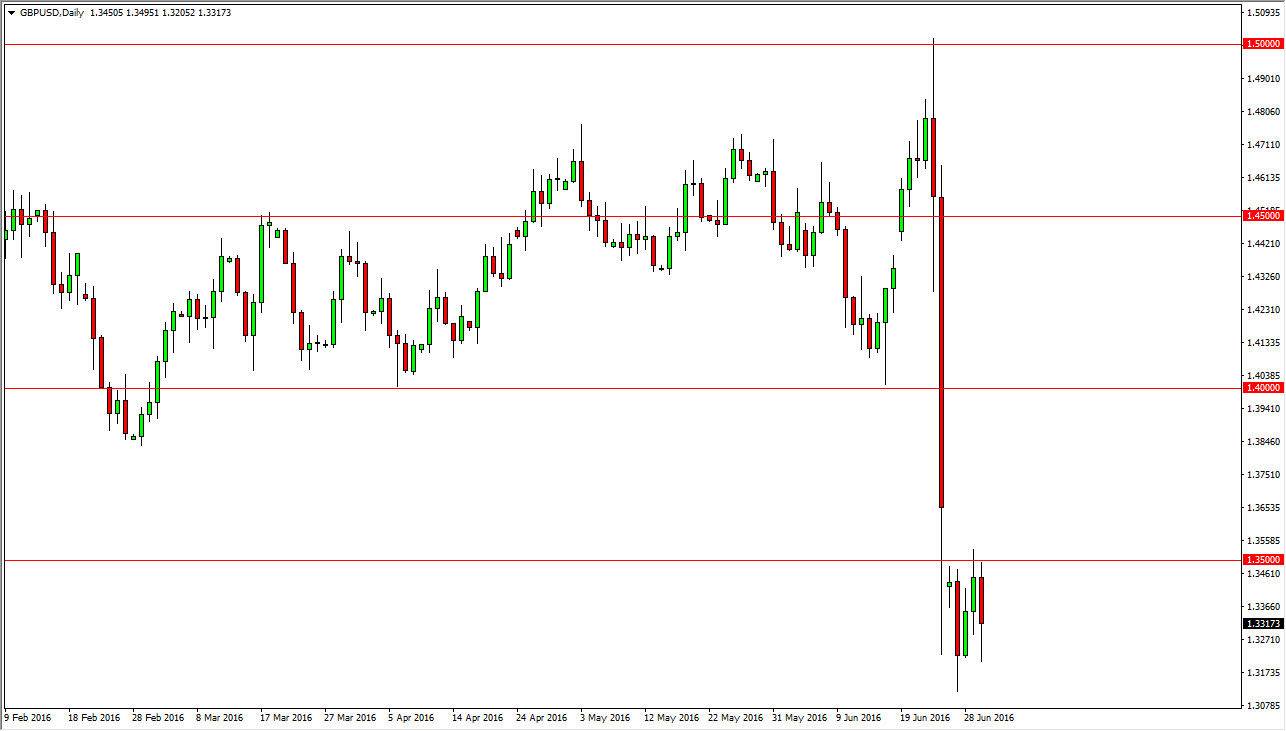

GBP/USD

The GBP/USD pair fell significantly during the course of the day on Thursday, but did bounce a little bit towards the end of the day. At this point in time, looks as if we are going to continue to see this market consolidate in this general vicinity. The 1.35 level above it seems to be rather resistive, and we also have a gap above that should continue to keep the selling pressure on the British pound. After voting to leave the European Union, there is a lot of negativity when it comes to the British pound, and as a result it looks very likely that we will sell off every time we try to rally and show signs of exhaustion.

On the other hand, if we break down below the bottom of the range for the session on Thursday, I believe at that point in time that the British pound will drive down to the 1.30 level, a natural round number.