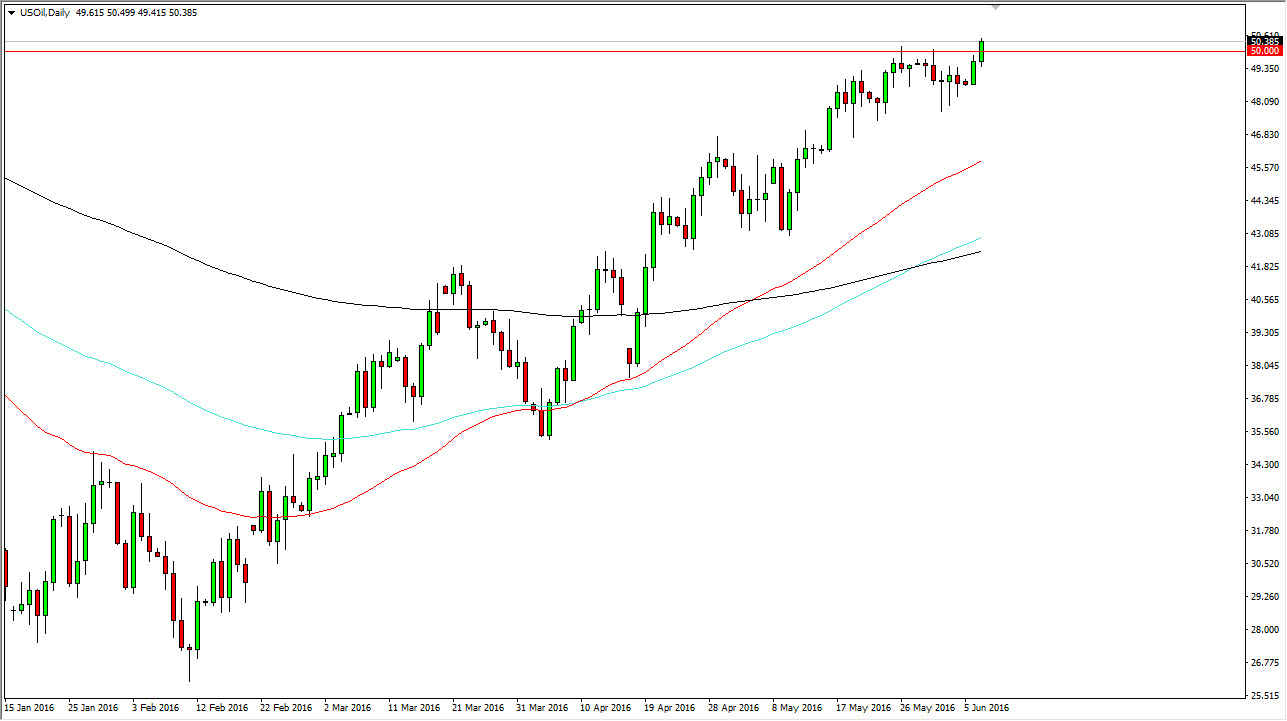

WTI Crude Oil

The WTI Crude Oil market broke higher during the course of the session on Tuesday, clearing the $50 level. By closing at the top of the range, it looks like the market should continue to go higher. After all, the $50 level is of course a large, round, psychologically significant barrier. Also, is an area that we have been fighting with for some time, and with that being the case I believe that it’s a sign we will continue to go much higher.

Looking at this chart, you can see that the 50 and the 100 EMAs have crossed above the 200 EMA, which of course is a very bullish sign. It now appears to me that the longer-term move is on, and we are going to go much higher. Ultimately, I believe that the “floor” in the market is somewhere near the $48 handle.

Natural Gas

Natural gas markets initially fell during the day on Tuesday, but turned right back around to explode to the upside. We closed at the $2.48 level, just below the vital $2.50 level. If we can break above there, I believe that this market is going to start the next leg higher. However, we are bit overextended so a bit of a sideways grind might be just what the doctor ordered. Pullbacks at this point in time should more than likely find plenty of support, at least down to the $2.40 level.

If we break down below there, we could drop back down to the $2.20 handle but at this point in time it looks like natural gas certainly has quite a bit of buying interest in it. So, with this being said I believe that eventually we will go higher but at this point in time it’s likely that it’s going to be very volatile over the next several days.