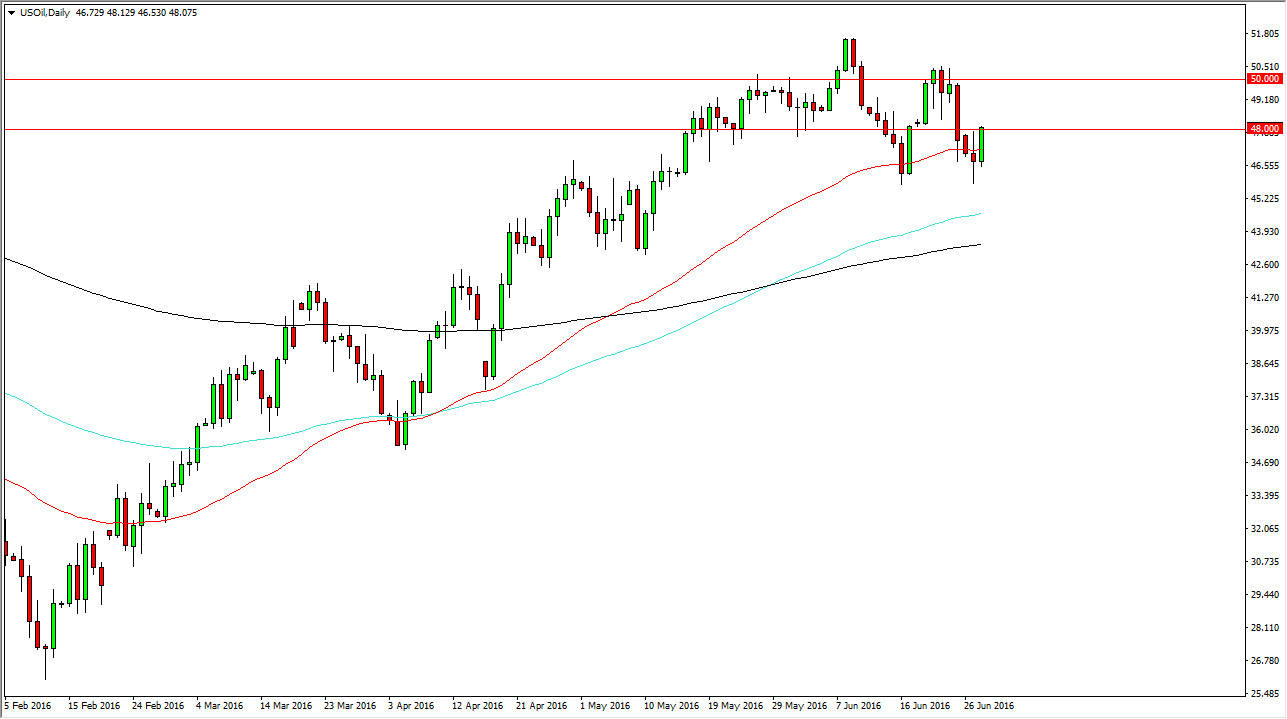

WTI Crude Oil

The WTI Crude Oil market rose during the day on Tuesday, as most risk assets got a bit of a boost during the day. With this, it’ll be interesting to see how things play out today with the inventory numbers coming out but it has to be noted that we did break above the highs from the previous session. That’s a fairly bullish sign and the fact that we cleared the $48 level also show signs of strength. The 50 day exponential moving average, pictured in red on this chart, seems to have offered bullish pressure. At this point in time, I think it will be fairly choppy but it looks as if the buyers are starting to step in and assert their will again. A move below the $46 level would be very negative.

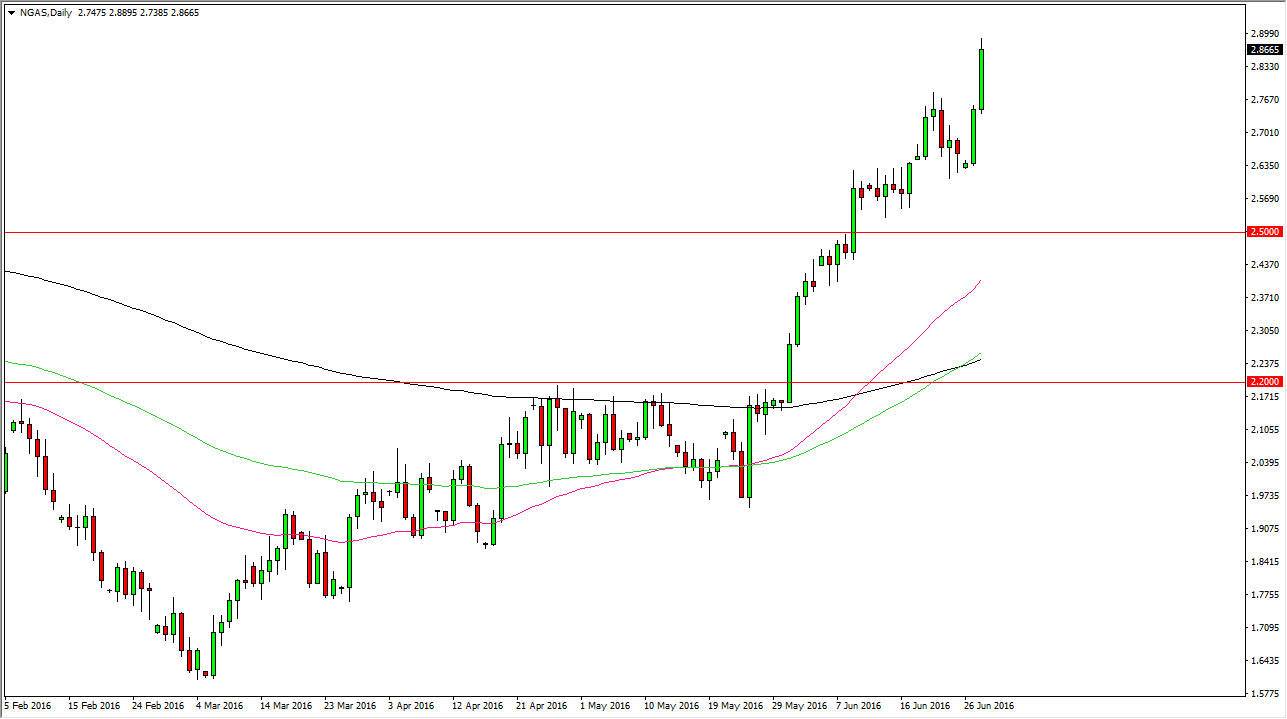

Natural Gas

In a market that seems to be defying gravity, we have seen quite a bit of bullish pressure of the last couple of days. It now appears that we are going to make a serious attempt to reach the $3.00 level, but at the end of the day I think that we might be a little bit overextended fairly soon and will have to pullback in order to look for support. I have no interest in shorting this market yet, although I do think that there are some serious long-term problems that we have to deal with down the road.

Ultimately, I think that it is not a market that the easy to deal with, so you will more than likely have to take either small positions or perhaps play the options markets to protect yourself. Obviously, the buyers are in full control rain now so even though I think we will turn around eventually, there’s no real sign of it at this point, at least not for any significant move.