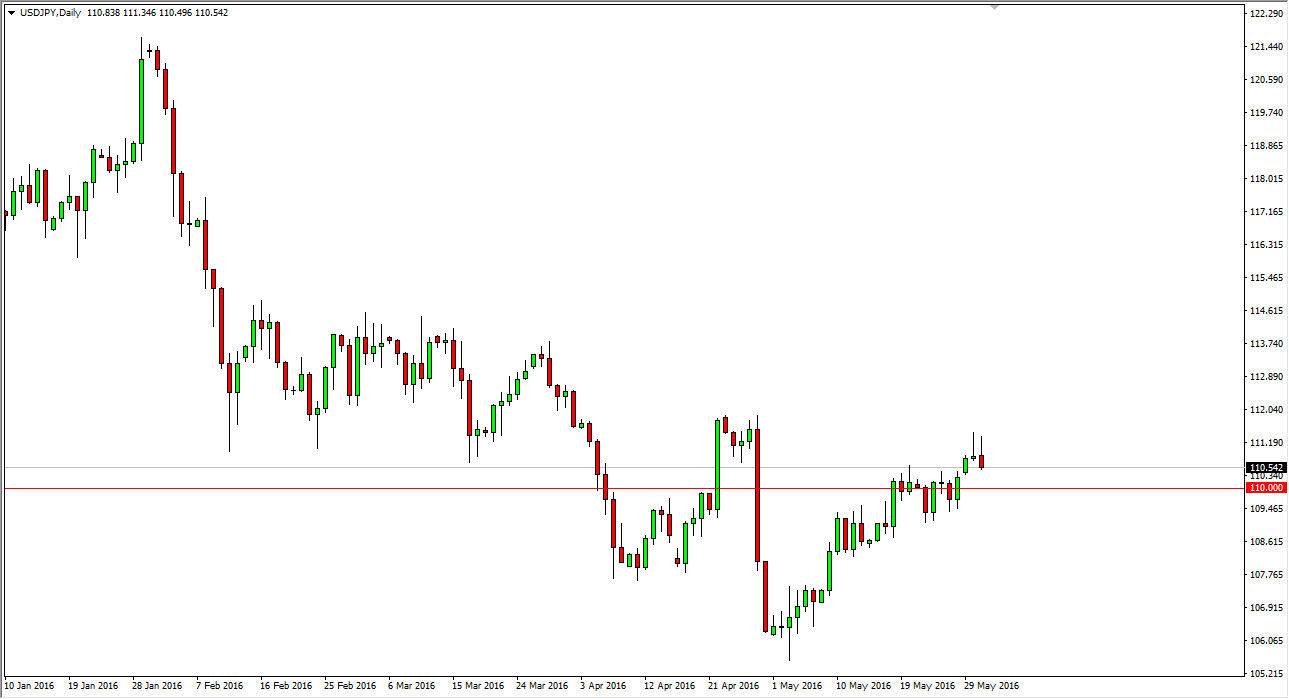

USD/JPY

The USD/JPY pair initially tried to rally during the course of the session on Tuesday, but turned right back around to form a shooting star just as we did during the Monday session. This of course is a very bearish sign, and as a result it’s likely that we will try to fall from here. However, I see quite a bit of noise between here and the 109 handle, so I believe it’s only a matter of time before we get a supportive candle or a bounce that we can start buying. I have no interest in selling at this point in time, and would also consider buying this pair if we can break above the top of the Monday shooting star.

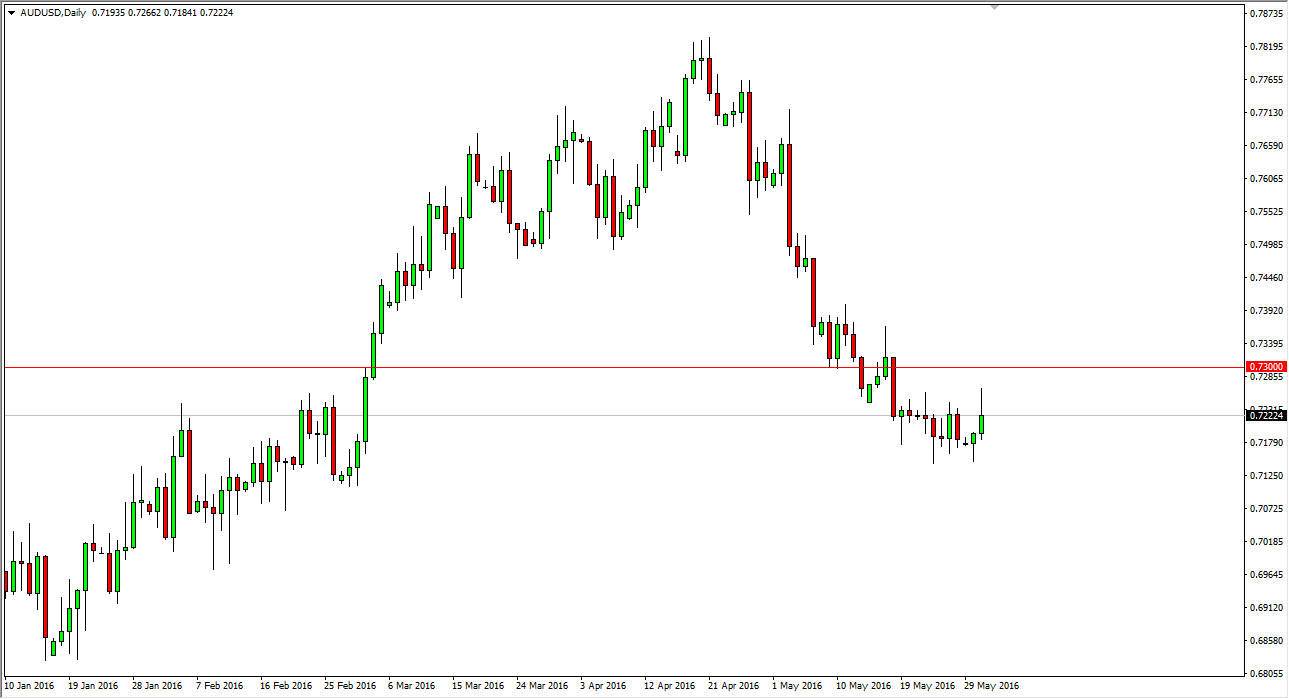

AUD/USD

The AUD/USD pair also formed a shooting star after initially trying to rally, but as you can see there’s quite a bit of resistance above. Because of this, I think it’s only matter time before this pair falls but we have a lot of noise just below so a bounce from time to time would make sense as it would be a momentum builder. The 0.73 level of course could be resistance, so it’s not really until we break above that resistance barrier, which I see extending all the way to the 0.74 level, that I would actually think about buying this pair.

Having said that, the gold markets did bounce during the day, but the fact that the Australian dollar couldn’t continue the move higher tells me that the currency is very soft at the moment, and therefore I think we are going to go lower over the longer term but there is a lot to work through on our way down to the 0.70 level. If we did break above the 0.74 level, I believe the pair would go much higher over the longer term.