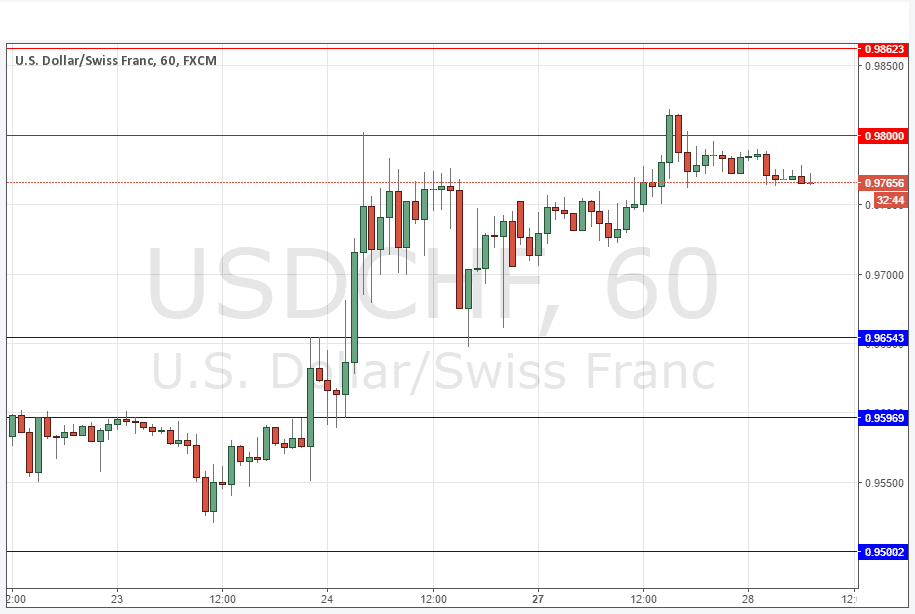

USD/CHF Signal Update

Yesterday’s signals were not triggered as the price action at the key resistance level of 0.9800 involved an hourly close some way above that level.

Today’s USD/CHF Signals

Risk 0.75% per trade.

Trades may only be taken between 8am and 5pm London time today.

Long Trades

Long entry after bullish price action on the H1 time frame following the next touch of 0.9654 or 0.9597.

Put the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trades

Short entry after bearish price action on the H1 time frame following the next touch of 0.9862, or 0.9894.

Put the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

USD/CHF Analysis

As expected, the round number at 0.9800 acted as resistance yesterday, although unfortunately it was exceeded by too much to be a good short trade entry trigger. That level is likely to remain as good resistance for the time being.

We may see minor support now at around 0.9760, although the next truly key level is all the way down at 0.9654, which we are very unlikely to reach today.

There is nothing due concerning the CHF. Regarding the USD, there will be a release of Final GDP data at 1:30pm London time, followed later by CB Consumer Confidence at 3pm.