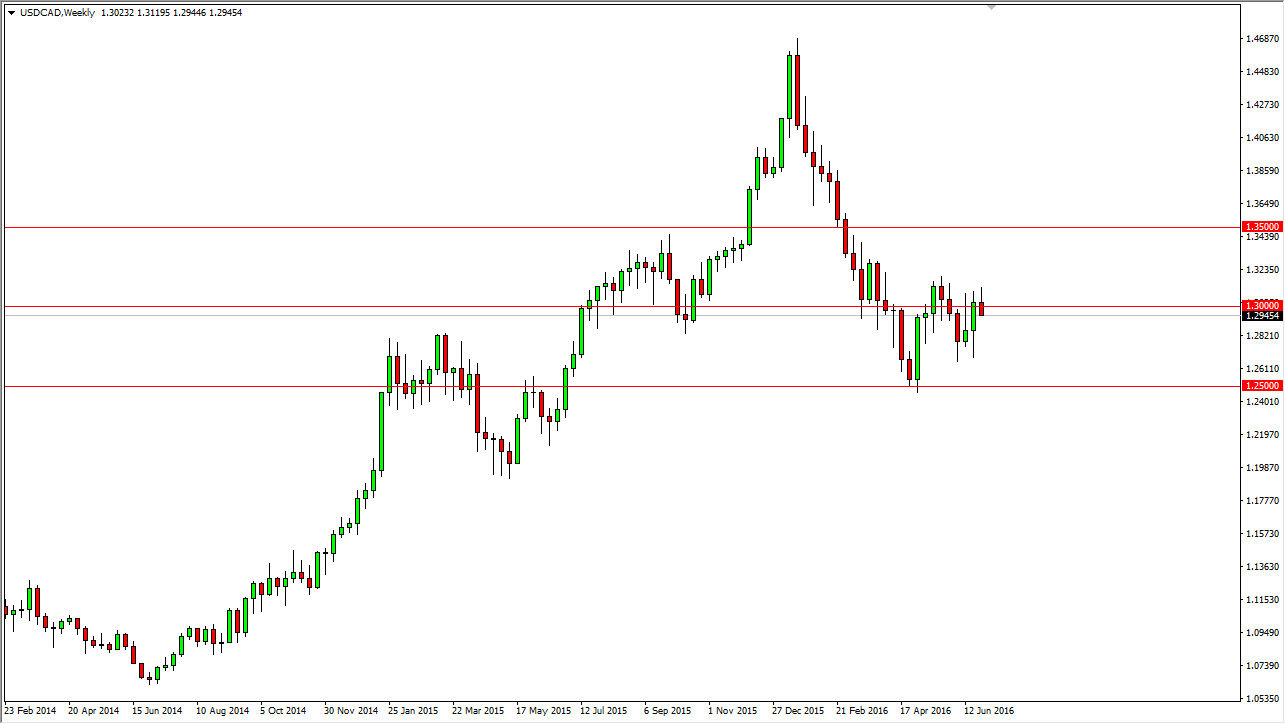

The USD/CAD pair has been very choppy over the last month or so, so having said that it’s likely that the markets could very well find themselves doing more of the same. On the chart, I have the 1.25 level below shown, as well as the 1.30 level. I believe that back and forth trading will be the staple of trading in this particular pair, especially considering that there is so much uncertainty around the world at this point in time. I believe that the pair will be somewhat sideways as in general as the market will focus on the European Union and the United Kingdom, and as a result this particular pair might be somewhat lost on most traders. Quite frankly, and with your trading the oil markets or at least the attitude of those markets, you will more than likely will find yourself ignoring this pair.

Oil

Obviously, oil has quite a bit of influence on the Canadian dollar, and the higher that oil prices go, the lower this market will typically go. I believe that we will probably have a slightly negative bias to this pair, just simply because we are bouncing around in this area and at the top of the most recent consolidation. I think that you have to look at this range as what we are going to deal with, so short-term trades in a back-and-forth manner might be possible. As far as longer-term trading is concerned, I don’t necessarily see an opportunity to do so.

One outlier could be some type of massive shock to the financial system, which would have people buying the US dollar in general. However, that would probably be coming out of the situation in the European Union, and of course the US dollar should strengthen even more against other currencies, and that would probably lead to the “knock on effect” in this market.