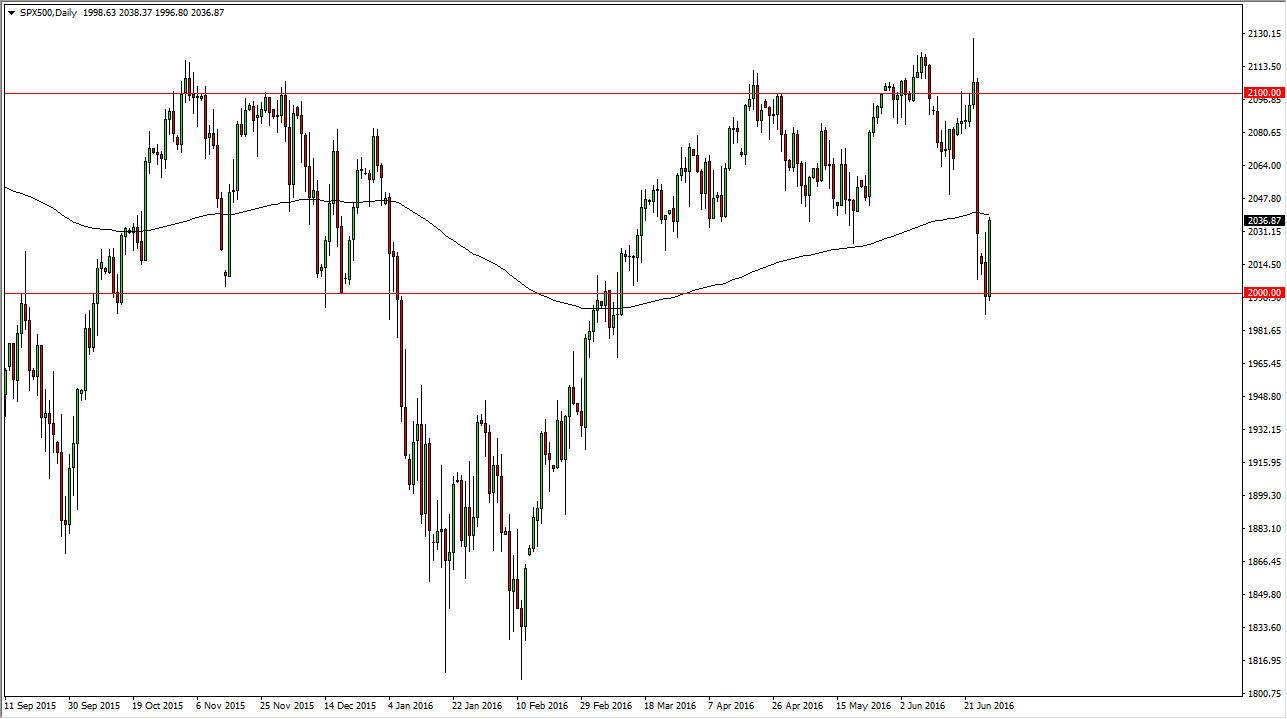

S&P 500

The S&P 500 rallied it during the day on Tuesday, bouncing off of the 2000 level and slamming into the 200 day exponential moving average. That sets today as a very important session, because the 200 day exponential moving average is of course followed by quite a few traders out there for the longer-term trend. I believe that the best thing you can do in this market at the moment is to simply sit on the sidelines and wait to see how the day shakes out. On a positive daily candle, I’m willing to start buying again, but if we get signs of exhaustion or even a negative candle, I’m certainly going to sell and aim for the 2000 level below. The markets will continue to be volatile, but the 200 day exponential moving average does carry some significant weight with it.

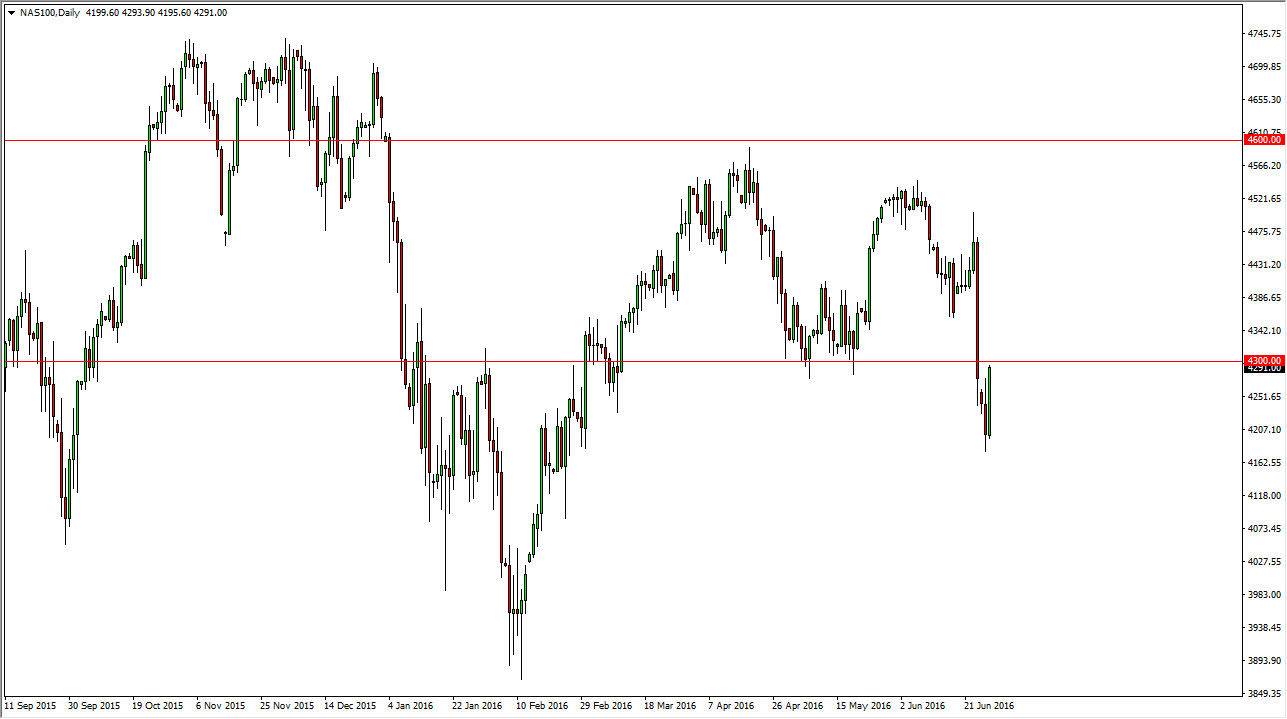

NASDAQ 100

The 4300 level was the source of real resistance during the day that was so explosive to the upside in this market. That’s an area that had been resistive and supportive in the past, so it makes sense that “market memory” came back into play. We closed at the top of the candle, and generally that means that we are starting to see real strength, but it would only take one wrong headline to turn this market back around. Because of this, I am a bit hesitant to put money at work right away. If we can stay above the 4300 level for at least 4 hours, at that point in time I might consider taking out a small position to the upside.

An exhaustive candle could be a reason to sell though, and as a result I would be willing to short at that point. I have to say that there is still quite a bit of risk out there, so be interesting to see how this shakes out.