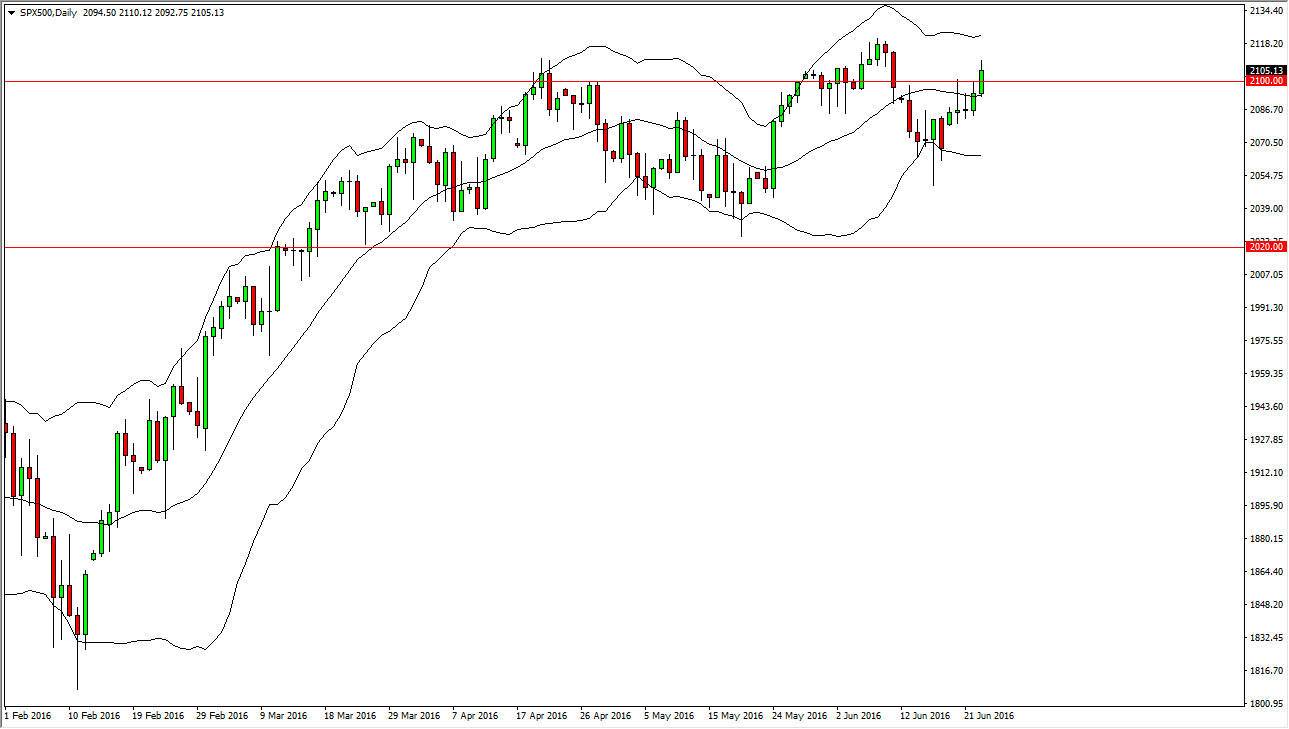

S&P 500

The S&P 500 had a positive session on Thursday as we not only broke above the median range of the Bollinger Bands, but we also broke above the 2100 level. Because of this, the market looks as if it is ready to go higher but at this point in time it’s difficult to imagine that it’s going to be easy. A lot of this would’ve been due to speculation that the United Kingdom will stay within the European Union. Having said that, the overall attitude of the market has been higher for some time, and a break out to a fresh, new high is of course a very bullish sign. Pullbacks will be supported as far as I can tell, so this is essentially a “buy only” market right now.

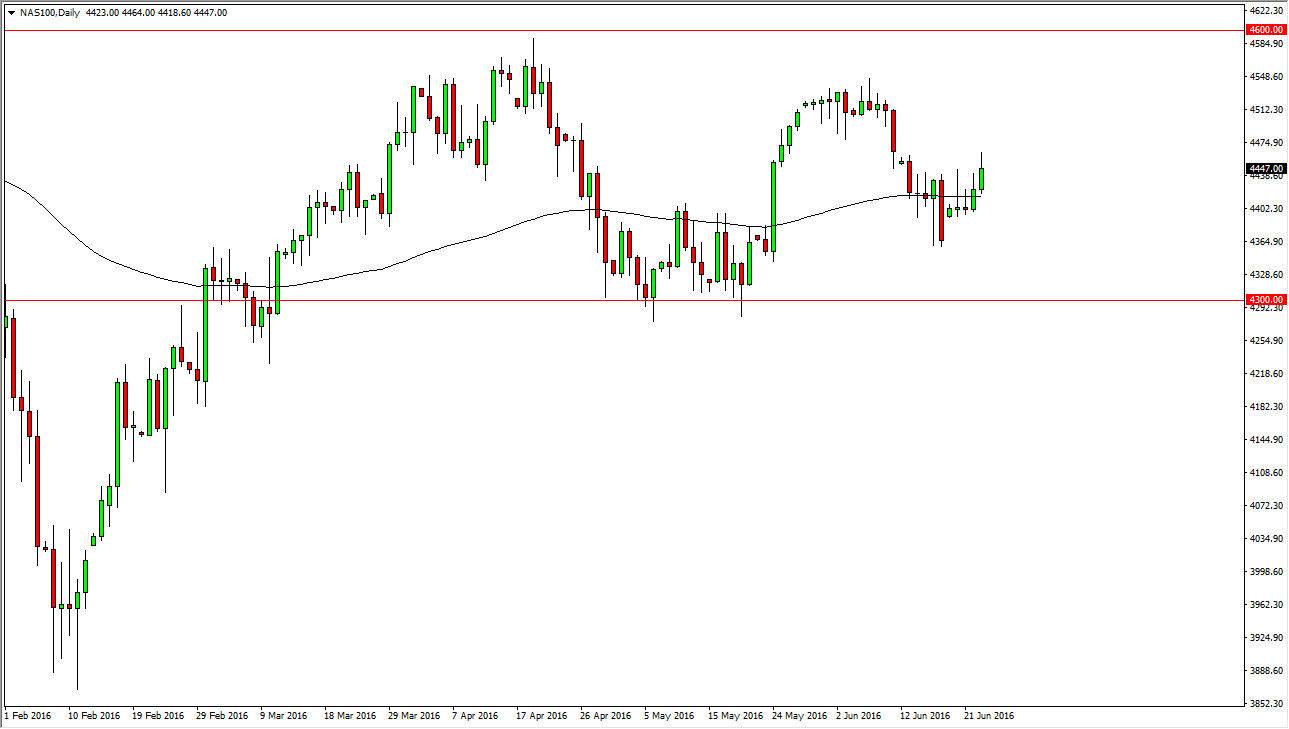

NASDAQ 100

The NASDAQ 100 broke higher during the course of the day as well, clearing the 4440 handle and continued to go higher at one point in time. By the end of the day though we did give back some of the gains, and as a result it looks like we are still waiting for the EU referendum vote. If we can break above the top of the range during the course of the day on Thursday, we should continue to go towards the 4500 level. I have no interest in selling this market right now because I believe that there is more than enough support below to keep this market afloat and of course even if the EU referendum does fail and the UK leaves, it could very well bring in a rush to American assets as people will avoid the European Union.

Ultimately, this market has been consolidating between the 4300 level on the bottom and the 4600 level on the top, so having said that even if we get a move, I believe that we will probably stay within that range at least for the time being.