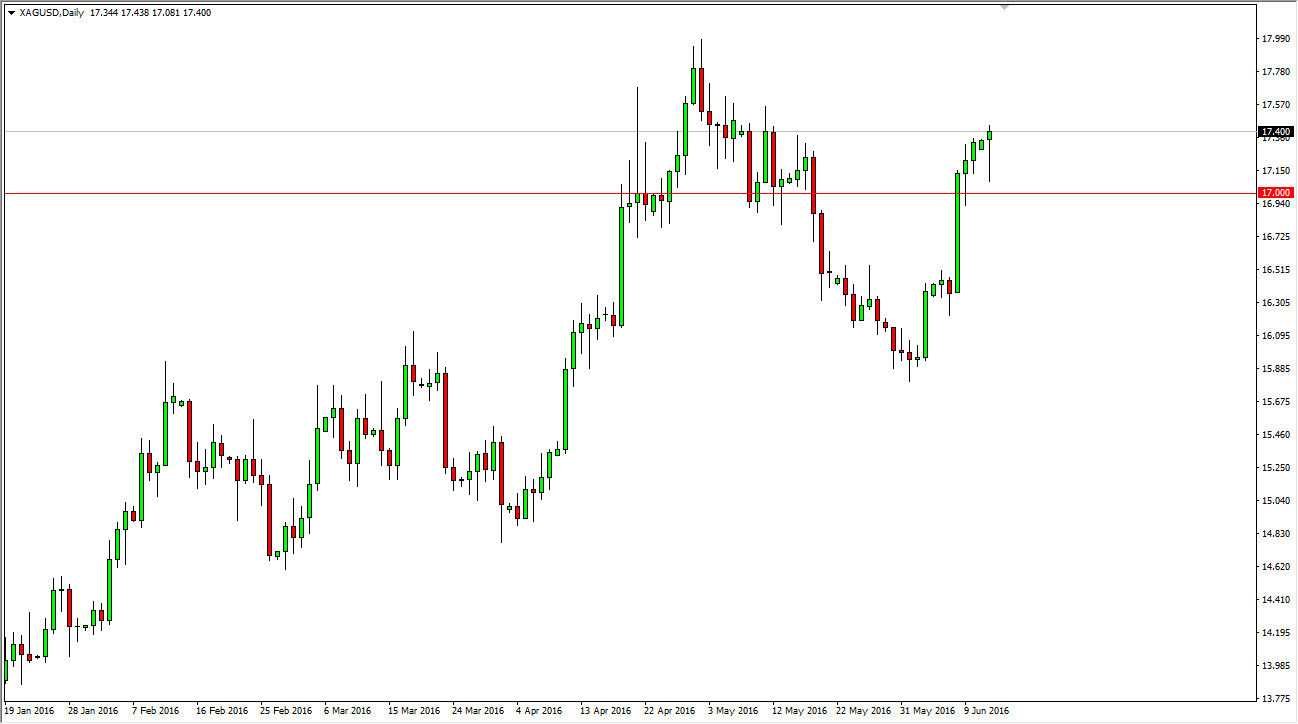

Silver markets initially fell during the day on Monday, but found enough support at the $17 level to turn things back around and form a nice-looking hammer. While most people look for hammers of the bottom of a long move lower, as it represents a nice trend reversal, the reality is that a hammer at the top of the move higher shows a very similar situation, in the sense that the buyers are taking over. Think about it this way: if the sellers cannot push a dollar market that looks obviously overbought, it shows just how tenuous their position is. With this being the case, I believe that the silver markets will continue to go higher and it now appears that the $17 level is going to offer a bit of support.

US dollar and interest rates

Keep in mind that the US dollar will of course the fact that the value of precious metals markets in general, as the Federal Reserve is still reeling from the horrible jobs numbers that came out last week for the month of May. Because of this, it looks like some of the interest-rate hikes that we had anticipated will not happen, and that of course drives down the value of the US dollar overall, meaning that it takes more than that currency to purchase an ounce of silver.

With this, I believe that precious metals in general will continue to do fairly well, and I think given enough time we will see fresh, new highs and not only silver but also gold markets. Silver tends to be dismissed by a lot of traders as they will typically run to gold first, but when gold looks so strong, silver tends to play “catch-up” when it comes to the move. Ultimately, I think that silver markets will break above the $18 level, an area that was extraordinarily strong resistance previously. With this, I remain very bullish.