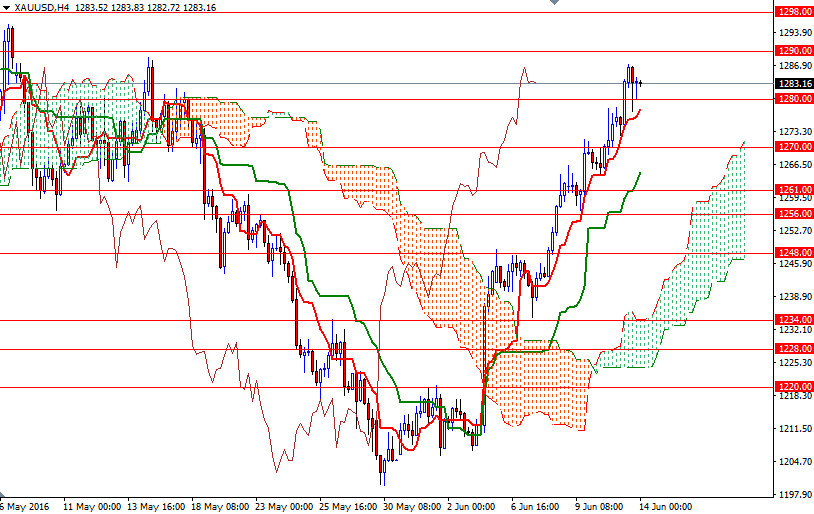

Gold prices advanced $8.22 an ounce yesterday, up for the fourth straight session to $1283.16, as investors retreated to safe-haven assets amid worries over central bank meetings in the U.S. and Japan and UK's historic referendum on European Union membership. The XAU/USD pair initially grinded lower but the previous resistance now flipped to support in the 1272.70-1270 zone kicked in and pushed the market higher. Not surprisingly, breaking through the 1280/77 zone triggered a fresh round of buying and as a result we ended up testing the next barrier in the 1290/87 area as expected.

The U.S. Federal Reserve's two-day meeting begins later in the day. The longer the Fed waits to tighten monetary policy, the better for gold. The Federal Open Market Committee is widely expected to leave rates unchanged. However, the central bank could use the meeting to clarify the outlook on interest rates, whether in the official statement or in Chair Janet Yellen's press conference. The most recent surveys shows British voters are evenly split. Three of the six major polls give Remain a lead, while three give Leave a lead.

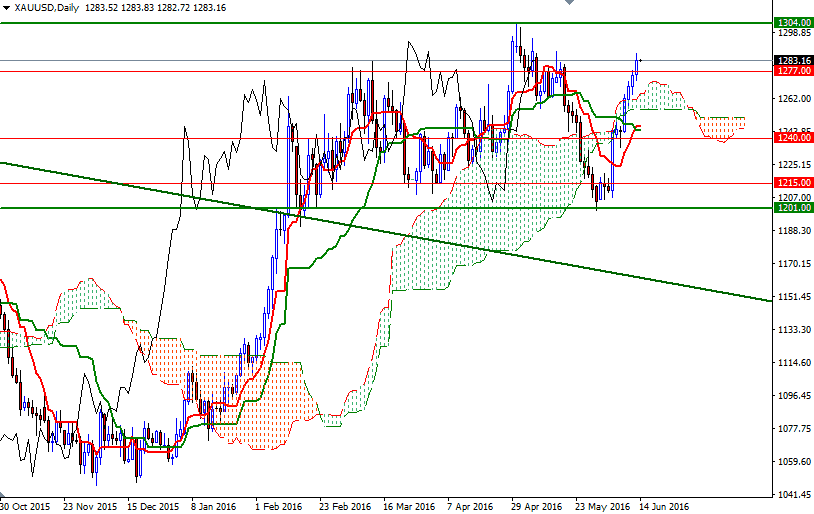

Gold's technical picture remains bullish, with the market trading above the Ichimoku clouds on the weekly, daily and 4-hourly charts - plus we have positively aligned Tenkan-Sen (nine-period moving average, red line) and Kijun-Sen (twenty six-period moving average, green line) lines on all three charts. However, there are some tough barriers ahead such as 1298/5 and 1304/2. Therefore, the market may tend toward consolidation between the 1290 and 1270 levels. The bears will have to push prices back below 1272.70-1270 if they intend to put extra pressure on the market and make an assault on the 1264 and 1261 levels.